Table of Contents

Japan’s financial markets are abuzz following a significant development: the Japanese Yen’s sharp appreciation against the US Dollar and other major currencies. This surge has placed the Yen carry trade under intense scrutiny. Know all about Yen Carry Trade in this article.

What is the ‘Yen Carry Trade’?

A carry trade is a financial strategy where investors borrow money in a currency with a low interest rate and use those funds to invest in assets with higher returns. In the Japanese Yen carry trade, investors take advantage of Japan’s historically low interest rates. They borrow Yen at a low cost and convert it into a higher-yielding currency to invest in assets such as bonds, stocks, or real estate.

Key Components

- Borrowing in Yen: The Japanese Yen has been associated with low interest rates for decades. Investors borrow Yen at these low rates, minimizing their borrowing costs.

- Investing in Higher-Yield Assets: The borrowed Yen is converted into a foreign currency with higher interest rates. The invested assets generate returns that exceed the cost of borrowing.

- Profit from Differential: The profit from the carry trade is derived from the difference between the high returns on the invested assets and the low cost of borrowing.

Historical Context and Popularity

The Japanese Yen carry trade gained popularity due to Japan’s extended period of low interest rates. Since the early 1990s, the Bank of Japan has kept rates low to combat deflation and stimulate economic growth. The policy of low interest rates has made Yen an attractive currency for borrowing.

Key Historical Points

- 1990s Economic Stagnation: Japan’s economic stagnation in the 1990s led to prolonged low interest rates.

- 2008 Financial Crisis: During the global financial crisis of 2008, Yen carry trades were disrupted as investors sought safe havens. The subsequent reduction in interest rates by the US Federal Reserve redirected carry trades towards other currencies like the Australian Dollar and the Brazilian Real.

- Recent Developments: In July 2024, the Bank of Japan raised interest rates for the first time in 17 years, leading to a sharp appreciation of the Yen and impacting carry trade dynamics.

Benefits of Yen Carry Trade

- High Profit Potential: The primary benefit of a Yen carry trade is the potential for high returns. By borrowing at low rates and investing in high-yield assets, investors can achieve substantial profits from the interest rate differential.

- Market Liquidity: Carry trades contribute to global market liquidity, as investors exchange currencies and invest in various assets. This increased liquidity can enhance market efficiency.

- Diversification: The strategy allows investors to diversify their portfolios by accessing higher-yielding assets in different currencies and markets.

Risks and Challenges

- Currency Risk: The primary risk associated with the Yen carry trade is currency fluctuations. If the Yen appreciates against the invested currency, the cost of repaying the debt increases, potentially erasing profits.

- Market Volatility: Economic events, geopolitical tensions, or changes in monetary policy can lead to sudden shifts in exchange rates, impacting the profitability of carry trades.

- Interest Rate Changes: A change in interest rates by the Bank of Japan or other central banks can alter the attractiveness of carry trades. For example, an increase in Japanese interest rates can diminish the profit margin of borrowing in Yen.

Recent Trends and Implications

Recent developments have drawn renewed attention to the Yen carry trade. The Bank of Japan’s decision to raise interest rates has led to a significant appreciation of the Yen, affecting global markets. The rise in Yen value has increased borrowing costs for investors engaged in Yen carry trades and prompted a reevaluation of investment strategies.

Key Implications

- Market Adjustments: Investors are adjusting their positions in response to the rate hike, leading to volatility in financial markets.

- Impact on Global Currencies: The appreciation of the Yen has affected other currencies and global asset prices, demonstrating the interconnected nature of financial markets.

Yen Carry Trade UPSC

The Japanese Yen carry trade is a significant financial strategy that exemplifies the impact of interest rate differentials on global investment decisions. For UPSC aspirants, understanding the mechanics, benefits, and risks of carry trades provides valuable insights into international finance and economic policy. As financial markets continue to evolve, monitoring developments in carry trades and their broader implications will remain crucial for grasping the complexities of global economic interactions.

India’s Road Safety Crisis: Engineerin...

India’s Road Safety Crisis: Engineerin...

A Decade of Startup India: Transforming ...

A Decade of Startup India: Transforming ...

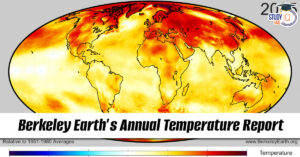

Berkeley Earth Annual Temperature Report...

Berkeley Earth Annual Temperature Report...