Table of Contents

Context: In its recent panel ruling, the WTO upheld all EU claims against India and found that India’s tariffs on certain ICT products, such as mobile phones, were not in line with its WTO commitments, and thus are illegal.

What is the Dispute?

- The dispute involves India’s tariffs on certain information and communication technology (ICT) products such as mobile phones, which the EU, Japan, and Taiwan have claimed to be inconsistent with India’s WTO obligations.

- In 2019, India imposed import duties on a variety of IT products, ranging from 7.5% to 20%. The products affected by the duties included mobile phones, components, and integrated circuits.

- The complainants argued that the duties exceeded the maximum tariff rate allowed under the ITA, (information technology agreement) which is 0%.

- The EU deemed these duties a direct breach of WTO rules and argued that India was obliged under the WTO commitments to apply a zero-duty rate to such products.

| India’s Stand | WTO Panel Ruling |

| To justify higher tariff rates, India argued that its binding tariff commitments on ICT products are contained in the WTO Ministerial Declaration on Trade in Information Technology Products (ITA Agreement), which India joined in 1997.

India also contended that its commitments under the ITA are ‘static’ and argued that its commitments under the Goods Schedule do not include products that emerged due to technological innovations after the conclusion of the ITA. India had argued that there was an error during the transposition of its Goods Schedule from the Harmonized System of Nomenclature (HSN) 2002 edition to the HSN 2007 edition, which restricted the scope of its Goods Schedule. |

The panels concluded that India has violated Article II of the General Agreement on Tariffs and Trade (GATT) because India’s tariffs breach its Goods Schedule.

The panels held that India’s Goods Schedule, not the ITA, is the source of India’s legal obligations on tariffs, including on products covered by the ITA. The panels also held that the ITA cannot override the tariff commitments given in India’s Goods Schedule. The panels accepted India’s argument on HSN transposition but held that India failed to show that this assumption formed a necessary basis for India’s consent to the Goods Schedule. |

Possible Impacts of the ruling on India

- Pressure to withdraw the tariffs: The rulings in three separate but similar disputes raised by the European Union (EU), Chinese Taipei, and Japan will put pressure on India to withdraw the tariffs at a time it is seeking to be a leader in electronics manufacturing through a production-linked incentive scheme.

- Trade relations: The ruling could strain India’s trade relations with the European Union, Japan, and Taiwan, which have filed complaints against India at the WTO.

- Economic growth: The imposition of import duties was aimed at promoting domestic manufacturing and creating jobs in the country. If the import duties are removed, it could impact India’s efforts to boost its manufacturing sector and reduce its dependence on imports.

- Revenue loss: The removal of import duties could lead to a loss of revenue for the Indian government, which has been collecting tariffs on IT products.

- Damage reputation: If the ruling goes against India, it could damage India’s reputation at the WTO and make it more difficult for India to negotiate trade agreements in the future.

What is the way ahead for the dispute?

- India is likely to appeal against the panel ruling, but the Appellate Body that hears appeals has ceased to exist since 2019 because the United States has been blocking the appointment of the body’s members.

- Thus, India’s appeal will go into the void. Legally, India will not be required to comply with the panel rulings till the time its appeal is heard.

- The EU has also approached India to resolve the matter through a multi-party interim appeal arbitration arrangement (MPIA). However, India is against MPIA as a mechanism and is in favor of the restoration of the WTO appellate body.

- Can EU retaliate?

- Under the WTO law, the EU cannot impose trade sanctions when an appeal is pending.

- Retaliatory action in the form of trade sanctions can be imposed only after the authorization of the Dispute Settlement Body, which comprises all WTO members.

Key concepts and terms involved

- General Agreement on Tariffs and Trade (GATT):

- It was an international trade agreement signed in 1947. 23 nations were signatories of this trade agreement. GATT came into effect on January 1, 1948.

- India has been a member of GATT since 8 July 1948.

- The purpose of GATT was to liberalize trade by reducing tariffs and reducing quotas among member countries. The member nations had to remove all the trade discriminations.

- The 7 rounds of negotiations from 1947 to 1993 reduced average tariffs on industrial goods from 40% to 5%. The steps taken at GATT led to economic globalization.

- MPIA (Multi-party interim appeal arbitration arrangement):

- It is an alternative system for resolving WTO disputes that are appealed by a member in the absence of a functioning and staffed WTO Appellate Body.

- The MPIA embodies the WTO appellate review rules and in a dispute between members, it will supersede the previous appeal processes and also apply to future disputes between members.

- Any member can join the MPIA by notifying the Dispute Settlement Body and a range of members have done so.

- Information Technology Products (ITA Agreement):

- Adopted in 1996, is an arrangement through which select WTO member countries agree to eliminate duties on IT products.

- India joined ITA in 1997.

- Participants are committed to eliminating tariffs on IT products covered by the agreement, including computers, telecommunication equipment, semiconductors, software, and more.

- The agreement is reviewed periodically, and new products can be added to its coverage.

- The Harmonized System of Nomenclature (HSN)

- It is an international standardized system of names and numbers to classify traded products.

- It was developed by the World Customs Organization (WCO) and is used by over 200 countries as a basis for their customs tariffs and for the collection of international trade statistics.

- The HSN contains over 5,000 product groups, organized into 21 sections, each identified by a two-digit code.

- The system provides a common language for international trade and simplifies the process of customs clearance by standardizing the classification of products.

- What is ‘transposition’ under HSN?

- Due to the continuous emergence of new products owing to technological innovations, the HSN system is regularly updated to reflect new products, also known as ‘transposition’.

- What are WTO Schedules?

- The specific commitments made by each of the WTO’s member states during the course of multilateral trade negotiations are memorialized as “schedules of concessions.”

- These are referred to informally as schedules. Schedules constitute an integral part of both the 1994 General Agreement on Tariffs and Trade (GATT 1994) and the General Agreement on Trade in Services (GATS).

- Note that schedules may be altered through subsequent formal negotiations or through technical modifications.

- Goods schedules may include maximum tariffs on specific types of goods, as well as agreements on quotas, export subsidies, and domestic supports for particular industries.

- Services schedules usually take the form of commitments to open domestic markets to services provided by firms in other member states, as well as specific exemptions from these commitments.

- About the World Trade Organization (WTO)

- WTO is an international organization established to supervise and liberalize world trade.

- The WTO is the successor to the General Agreement on Tariffs and Trade (GATT), which was created in 1947.

- Members: The WTO has 164 member countries, and its headquarters is located in Geneva, Switzerland.

- India and WTO: India has been a WTO member since 1 January 1995 and a member of GATT since 8 July 1948.

- Objectives of WTO:

- To promote free and fair trade

- To provide a forum for trade negotiations

- To administer and enforce WTO agreements

- To cooperate with other international organisations

- To Monitor National trade policies

- To Provide technical assistance and training

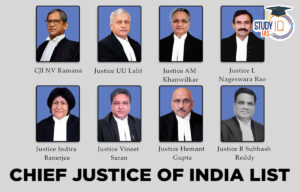

Justice BR Gavai will take oath as 52nd ...

Justice BR Gavai will take oath as 52nd ...

Harnessing Spiritual Aastha for River Re...

Harnessing Spiritual Aastha for River Re...

Daily Quiz 18 April 2025

Daily Quiz 18 April 2025