Table of Contents

About the World Economic Outlook 2022

World Economic Outlook is a half-yearly publication by the International Monetary Fund based on data obtained from its consultations with member countries’ governments.

World Economic Outlook Report, best known for its global growth forecasts, summarizes the state of the global economy and highlights the most important recent developments.

The theme of World Economic Outlook, October 2022 is ‘countering the cost-of-living crisis’.

World Economic Outlook Report Highlights

Global Scenario

- Growth projections:

- Global growth is forecast to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023.

- This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic.

- Inflation

- Global inflation is forecast to rise from 4.7 percent in 2021 to 8.8 percent in 2022 but to decline to 6.5 percent in 2023 and to 4.1 percent by 2024.

- Upside inflation surprises have been most widespread among advanced economies, with greater variability in emerging market and developing economies.

- Challenges to global economy:

- Three powerful forces: The current global economic outlook is shaped by the effects of three powerful forces, the Russian invasion of Ukraine, a cost-of-living crisis caused by persistent and broadening inflation pressures, and the slowdown in China.

- Slowdown in major economies: The largest economies of the world are facing significant slowdowns. A US GDP contraction in the first half of 2022, a Euro area contraction in the second half of 2022, and prolonged COVID-19 outbreaks and lockdowns in China with a growing property sector crisis.

- China property crisis: A worsening of China’s property sector crisis could spill over to the domestic banking sector and weigh heavily on the country’s growth, with negative cross-border effects.

World Economic Outlook India Rank

- Growth projections

- IMF has cut down its FY23 growth forecast for India by 60 basis points from its July projection of 7.4 per cent to 6.8 per cent, its steepest cut for any major economy barring the US.

- The IMF stated that the move reflects “a weaker-than-expected outturn” in the June quarter and “more subdued external demand”, indicating that exports will be hit.

- IMF’s move follows the World Bank slashing its FY23 growth projection for India to 6.5 per cent last week, from 7.5 per cent predicted earlier.

- Most other agencies, too, have been lowering their India forecast in recent weeks. The RBI also recently cut its projection modestly from 7.2 per cent to 7 per cent.

World Economic Outlook IMF

- About: IMF is a specialized agency of the United Nations to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

- Headquarters: Washington D.C.

- Establishment: The IMF was established through the Bretton Woods Conference 1944 in the aftermath of the Great Depression of the 1930s.

- Membership:

- Currently, the IMF has 190 member countries.

- India was among the 44 founding member countries of IMF.

- Any other state, whether or not a member of the UN, may become a member of the IMF in accordance with IMF Articles of Agreement and terms prescribed by the Board of Governors.

- Membership in the IMF is a prerequisite to membership in the IBRD.

- Pay a quota subscription:

- On joining the IMF, each member country contributes a certain sum of money, called a quota subscription, which is based on the country’s wealth and economic performance.

- Quotas are denominated (expressed) in SDRs (Special Drawing Rights).

- Members’ voting power is related directly to their quotas.

- Special Drawing Rights (SDRs):

- The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves.

- SDRs is the IMF’s unit of account and not a currency.

- The currency value of the SDR is determined by summing the values in U.S. dollars, based on market exchange rates, of a SDR basket of currencies.

- SDR basket of currencies includes the U.S. dollar, Euro, Japanese yen, pound sterling and the Chinese renminbi (included in 2016).

- The SDR basket is reviewed every five years.

- SDRs represent a claim to currency held by IMF member countries for which they may be exchanged.

- Important publications:

- The World Economic Outlook

- The Global Financial Stability Report

World Population Day 2025, Themes, Histo...

World Population Day 2025, Themes, Histo...

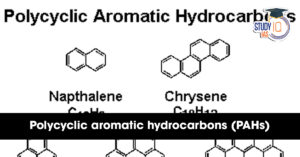

What are Polycyclic Aromatic Hydrocarbon...

What are Polycyclic Aromatic Hydrocarbon...

Marlin Fish: Species, Features, Appearan...

Marlin Fish: Species, Features, Appearan...