Table of Contents

Context: The US Treasury Secretary has said that the World Bank should undertake more reform measures to increase its funding capacity.

The World Bank

- Definition: The World Bank is an international organization dedicated to providing financing, advice, and research to developing nations to aid their economic advancement.

- Formation: It was founded in 1944 at the Bretton Woods Conference, which was convened to establish a new, post-World War II international economic system. Its official name was the International Bank for Reconstruction and Development (IBRD).

- Aim: It works on issues ranging from climate change, poverty, conflict, and food security to education, agriculture, finance, and trade.

- Lending: The Bank lends money to middle-income countries at interest rates lower than the rates on loans from commercial banks.

- The Bank lends money at no interest to the poorest developing countries.

- Members: Presently, it has 189 member nations.

- Organizational Units: It consists of 5 organizations that aim to find long-term solutions to end poverty and promote shared prosperity in developing nations.

- International Bank for Reconstruction and Development (IBRD): It lends to governments of middle-income and creditworthy low-income countries.

- International Development Association (IDA): It provides interest-free loans — called credits and grants to governments of the poorest countries.

- International Finance Corporation (IFC): It is focused exclusively on the private sector and it helps developing countries achieve sustainable growth by financing investment.

- Multilateral Investment Guarantee Agency (MIGA): It promotes foreign direct investment into developing countries to support economic growth and reduce poverty.

- International Centre for Settlement of Investment Disputes (ICSID): It provides international facilities for conciliation and arbitration of investment disputes.

- Headquarter: The World Bank is headquartered in Washington, D.C.

Need for World Bank Reforms

- Poverty eradication: Poverty eradication and progress on shared prosperity remains slow, and human development outcomes have reversed since the COVID-19 pandemic.

- There is a dire need to step up financing capacity by $50 billion to move towards sustainable, resilient and inclusive development.

- Global multiple crises: The world is facing multiple crises, including the ongoing impacts of the pandemic, global food and energy price spikes and broader inflation, and rising global debt.

- The pandemic, energy, food and debt crises are devastating lives and livelihoods now.

- Addressing Climate Change: If left unchecked, rising sea levels, droughts, and other harmful effects of climate change could drive over 130mn people into poverty in the next decade.

- $125tn of climate investment is needed by 2050 to meet net zero targets.

- Operational barriers & bureaucracy: The bank has been criticized for being too slow: the average time taken to disburse funds is 465 days. Bureaucratic procedures of the World Bank cause costly delays to its borrowers.

- Lack of equitable distribution: The issues of global north and global south still dominate the World Bank. Development has not reached many parts of Africa and small Pacific islands.

- Lack of adaptation: The World Bank has been dominated by the US. Many issues of the developing nations like trade, security, monetary framework and funding development remained unattended for decades together.

- Inadequate Financing: The World Bank has underutilized its guarantees and focused largely on loans. It has not financed insurance facilities as much as it could have.

India’s G20 Presidency and World Bank Reforms

- G20 panel on multilateral banks’ reforms has been constituted under the aegis of India’s G20 Presidency.

- Its mandate is to suggest a roadmap for rebooting the ecosystem of multilateral development banks so that they are better equipped to finance sustainable development goals and emerging global challenges like climate change and health.

- Democratisation of World Bank has been a long term line pursued by India. There needs to be differential financing terms for least developed and developing countries.

- India will advocate that the World Bank should increase its lending capacity for climate financing in middle and low income countries.

Potential Reforms

- Climate change and sustainability: As a global institution, the World Bank should focus on climate change and sustainability.

- It must provide monitoring and advice on climate action on a range of issues such as climate adaptation, mitigation, carbon pricing, environmental, social, and corporate governance and net-zero transformation.

- Quality and quantity of funds: There needs to be an increase in the quality and quantity of the Bank’s climate financing to ensure more funding.

- The Bank should explore more innovative finance mechanisms to better meet specific climate investment needs, such as currency risk hedging facilities, green banks, and sovereign guarantees for energy transition.

- Priority to poor countries: The poorest countries, burdened by pandemic debts, must be given priority in the World Bank.

- Encourage rich shareholders: Encouraging richer shareholders to inject more capital can significantly boost the World Bank’s lending capacity with only modest increases.

- Private investors: There needs to be enhanced reliance on private sector finance and expertise, including through partnerships with investment funds, innovative financing, and by de-risking projects.

- Innovative funds: World Bank may need new and more innovative sources of financing for this purpose, including green bonds (debt securities designated to finance environmentally friendly projects).

Way Forward

- With the transformative impact of technological change and the energy transition, the World Bank will also need to go beyond its national approach and operate at regional and sub-national levels, while co-ordinating development efforts.

- With the reforms, the World Bank can play a major role in incentivizing private capital, de-risking instruments, and providing greater concessional finance.

Accredited Social Health Activists (ASHA...

Accredited Social Health Activists (ASHA...

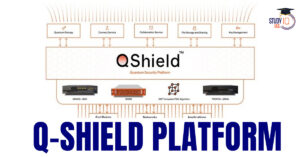

World’s 1st Unique Q-Shield Platform a...

World’s 1st Unique Q-Shield Platform a...

IB ACIO Recruitment Notification 2025 Ex...

IB ACIO Recruitment Notification 2025 Ex...