Table of Contents

Context: The Reserve Bank of India (RBI) has decided to stop raising interest rates for inflation-targeting.

What is Inflation?

- Inflation is defined as increase in prices of goods and services over a period of time. Inflation reduces purchasing power of currency.

- Types of inflation

- Cost-push inflation: Cost-push inflation is fuelled by increases in the cost of producing goods and services, rather than by increase in aggregate demand.

- Demand-pull inflation: Demand-pull inflation occurs due to rise in aggregate demand, because of expansionary policies of the government.

- Built-in inflation: It occurs when workers demand for raise in wages to help maintain their living costs, because of increase in prices of goods and services.

Effects of Inflation

- Reduces purchasing power of households.

- Rise in inequality as profits for business owners and entrepreneurs rise while purchasing power of poor sections decrease.

- Increase in cost of projects due to increase in cost of raw materials.

- Depreciation of domestic currency due to lower purchasing power parity.

- Export loses competitiveness due to increase in cost of raw materials.

Measures to Control Inflation

- Controlling money supply through monetary policy measures, such as increasing repo rate, CRR, SLR.

- Increasing taxes so as to reduce disposable income, thereby controlling demand.

- Banning export of certain commodities, especially food, so as to control prices.

- Reducing import duties on high-demand imported goods such as vegetable oil and petroleum.

- Appreciation of domestic currency exchange rate to reduce import cost of essential goods.

What is Inflation-Targeting?

- Inflation-targeting is Central Bank’s Monetary Policy that aims to keep inflation rate close to an agreed target.

- Repo rate: The rate at which central bank of a country lends money to commercial banks.

- Reverse repo rate: The rate at which the central bank of a country borrows money from commercial banks.

- Statutory Liquidity Ratio (SLR): Minimum percentage of deposits that a commercial bank has to keep in the form of liquid cash, gold or other securities.

- Cash Reserve Ratio (CRR): It is the percentage of a bank’s total deposits that it needs to maintain as liquid cash with the RBI.

- New Zealand, Canada and the United Kingdom were the first three countries to implement fully-fledged inflation targeting.

- Different methods of Inflation-targeting:

- Hiking interest rates: Central bank can increase rate of borrowing so that rate of lending is also increased. This can reduce money supply in the economy. Ex: Repo and Reverse Repo.

- Open market operations: Central bank may conduct open-market operation and sell government securities to institutional investors. This will suck out excess liquidity from the market.

- Reserve ratio: The central bank may raise CRR and SLR for banks, which mandates them to store excess liquidity without lending. This will reduce money supply.

- Appreciating domestic currency: It also involves central bank stabilizing currency exchange rate by maintaining a reserve of domestic currency and most tradable currencies.

Inflation-Targeting in India

- The Union government and the RBI are both in charge of reducing inflation India. The major authority of inflation containing lies with the RBI, which has to maintain a certain level of inflation.

- RBI has a legal mandate to maintain inflation rate of 4, with a leeway of +/- two percentage points either side.

- RBI primarily contains inflation by raising interest rates in the economy. As loans become costlier, the demand reduces, which in turn decreases inflation rate.

- The major impact of this move is that economic growth contracts.

Framework for Inflation-Targeting in India:

- In 2016, Parliament of India amended the RBI Act, 1934 to change the monetary policy, and introduce an inflation targeting framework.

- According to the framework, the union government, in consultation with RBI sets:

- an inflation target

- an upper and lower tolerance level for retail inflation

- Accordingly, the target has been set at 4%, with an upper tolerance limit of 6% and a lower tolerance limit of 2%. Every five years, the target and bands are revised.

- In case the inflation is above or below the prescribed limits for three quarters, RBI has to submit a report to the Union government explaining the reasons for rising (or falling) prices persistently, what will be corrective measures, and an estimate of when the target will be achieved.

Pros and Cons of Inflation-Targeting

| Cons | Pros |

| In pursuit of lowering the inflation rate, the Central Bank may raise interest rate to such an extent that demand falls drastically, pushing the economy into recession.

There are lags in monetary transmission in India, and over-shooting can have persistent damaging effects, including instability. It does not focus on removing supply bottlenecks or shortages, which are other major contributors of inflation. It is a short term measure that fails to address long-term structural issues. |

Countries that have implemented inflation targeting framework tend to “maintain regular channels of communication with the public”, thereby enhancing transparency.

Inflation targeting allows a country to focus on domestic considerations and to respond to shocks to the domestic economy. An inflation-targeting framework makes the central bank and union government accountable to the people. It will allow businesses, investors, and the government to plan their investments and policies based on prevalent inflation rate. Price stability through better targeting also maintains the purchasing power of consumers. |

Efficacy of Inflation-Targeting in India

- Contrary to the notion of an overheating economy, in India’s case it is the supply costs and bottlenecks that have created inflation and mere raising interest rate would not give much result.

- Merely raising interest rates may rather prove counter-productive. It may hamper economic growth without actually translating into lower inflation rates.

- Instead of addressing the demand side of the inflation problem, RBI and the government should focus equally on the supply side.

- Possible alternatives:

- Short-term imports: Agriculture and allied sectors are major contributors to inflation as a result of production constraints. To tackle this, supply has to be increased.

- Allowing imports will remove supply constraints and ensure that agricultural inflation does not percolate into the broader economy.

- Fiscal policy: The Union government can also contribute towards lowering inflation by reducing excise duties and address supply chain issues.

- Short-term imports: Agriculture and allied sectors are major contributors to inflation as a result of production constraints. To tackle this, supply has to be increased.

Important Terms Related to the Concept

- Deflation: Decline in inflation rate is called as deflation. It is also called as negative inflation.

- Recession: Decline in economic activity (negative growth) in a given period of time is termed recession.

- Technical recession: An economy enters a technical recession if there have been two consecutive quarters of negative growth.

Accredited Social Health Activists (ASHA...

Accredited Social Health Activists (ASHA...

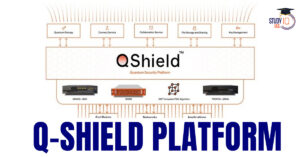

World’s 1st Unique Q-Shield Platform a...

World’s 1st Unique Q-Shield Platform a...

IB ACIO Recruitment Notification 2025 Ex...

IB ACIO Recruitment Notification 2025 Ex...