Table of Contents

The Union Budget 2025 as presented by the Finance Minister of India, Ms. Nirmala Sitharaman, grabs all the front pages with her comprehensive forward-looking fiscal plan presentation on February 1, 2025, which is essential to boost growth in the economy and makes easier fiscal management alongside an upgrade for various sectors along with infrastructure technology, etc. In this article, we have covered every aspect of budget time, budget date and time, live streaming details, and other highlights of Union Budget 2025.

Union Budget 2025: Date and Time

The much-anticipated Union Budget 2025 was formally delivered on February 1, 2025. The speech on a budget started at 11:00 AM IST and lasted for nearly two hours. Under Finance Minister Nirmala Sitharaman’s leadership, it was her seventh successive budget presentation under the Modi government. This has established consistency in its fiscal policy and economic planning.

Check here: Economic Survey 2025

Key Highlights of Union Budget 2025

The Union Budget 2025 is not just about numbers; it represents the government’s vision for a resilient and robust economy. Here are the main highlights and sector-wise initiatives announced:

| Sector | Key Highlights |

|---|---|

| Fiscal Management |

|

| Income Tax & New Tax Regime |

|

| Agriculture & Rural Development |

|

| Infrastructure & Urban Development |

|

| Healthcare & Education |

|

| MSMEs & Startups |

|

| Technology & AI Development |

|

| Economic Growth & Fiscal Discipline |

|

| Social Welfare |

|

| Foreign Investment & Global Trade |

|

| Climate Change & Sustainability |

|

| Defense & National Security |

|

| Skill Development & Employment |

|

Summary of Key Budget Proposals

The Union Budget 2025 highlights various dimensions of economic development that include fiscal discipline, infrastructure development, healthcare system, and digital transformation. These measures are towards building resilience in the economy while improving social welfare and propelling technological innovation to shape a sustainable, inclusive future for India. Building on initiatives through sectors, this Budget will pay special attention to creating a business-friendly environment for startups and MSMEs besides propelling the digital revolution and a green economy.

Union Budget 2025 Tax Slabs

The Union Budget 2025 introduced some key changes to income tax slabs, mainly focusing on the new tax regime and providing relief for taxpayers. Here are the key tax slabs under the new and old regimes:

1. New Tax Regime (Revised) for FY 2025-26:

Under the new tax regime, the government has made a few significant changes to provide relief to individual taxpayers.

| Income (₹) | Tax Rate |

|---|---|

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 to ₹6,00,000 | 5% |

| ₹6,00,001 to ₹9,00,000 | 10% |

| ₹9,00,001 to ₹12,00,000 | 15% |

| ₹12,00,001 to ₹15,00,000 | 20% |

| ₹15,00,001 and above | 30% |

Key Changes

- Tax exemption limit is increased from ₹7 lakh to ₹8 lakh.

- The tax slabs remain unchanged, but the tax-free income threshold has been raised to benefit middle-class taxpayers.

- Standard deduction of ₹50,000 for salaried individuals has been incorporated.

- Senior citizens benefit from higher exemption limits.

2. Old Tax Regime for FY 2025-26:

Under the old tax regime, taxpayers can continue to claim various exemptions, deductions, and rebates.

| Income (₹) | Tax Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 to ₹5,00,000 | 5% |

| ₹5,00,001 to ₹10,00,000 | 20% |

| ₹10,00,001 and above | 30% |

Minors Bank Account above 10 Years: Chan...

Minors Bank Account above 10 Years: Chan...

Creative Economy in India, Current Situa...

Creative Economy in India, Current Situa...

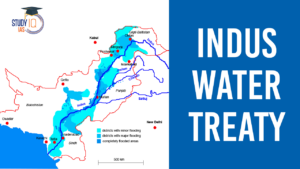

Indus Water Treaty 1960 Suspended by Ind...

Indus Water Treaty 1960 Suspended by Ind...