Table of Contents

Context: Tobacco is the leading preventable cause of disease and death globally, affecting both consumers and cultivators. India’s tobacco exports likely cross ₹13,000 crore this year.

About Tobacco

- Tobacco cultivation in India was introduced by the Portuguese in 1605.

- It is one of the important commercial crops cultivated in India.

- Tobacco types cultivated in India: Flue-cured Virginia (FCV), Burley, Bidi, Chewing, Natu, Oriental, HDBRG, Lanka, Hookah, Motihari and Jati tobaccos etc.

- Ideal conditions for growth:

- Frost-Free Climate: Tobacco requires about 100 to 120 days of frost-free climate to mature.

- Temperature: An average temperature of around 80°F (27°C)

- Soil: Tobacco is grown in warm climates with rich, well-drained soil.

- India is the only country which produces tobacco in 2 seasons.

- Highest Production in India: (1) Gujarat (41%) (2) Andhra Pradesh (22%) (3) Uttar Pradesh

- Highest Production Worldwide: (1) China (2) India (3) Brazil

Tobacco’s Impact in India

- India has the world’s second-highest number of tobacco users (26 crore), and the health of 60 lakh tobacco industry workers is at risk.

- Environmental Degradation: Tobacco farming depletes soil, contributes to deforestation (5.4 kg wood per 1 kg tobacco), and generates 1.7 lakh tonnes of waste annually in India.

- Economic Burden: Tobacco-related health costs exceed ₹1.7 lakh crore in India, dwarfing the ₹48,000 crore health budget in 2017-2018.

- Cleaning tobacco waste costs ₹6,367 crore annually, excluding soil and deforestation costs.

Check here all about World No Tobacco Day.

Status of Tobacco Use in India

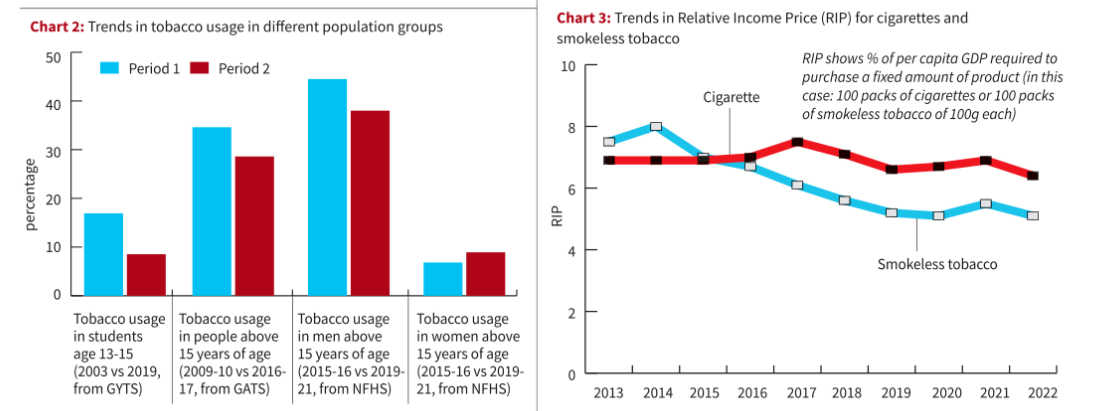

- Surveys such as the Global Adult Tobacco Survey (GATS), Global Youth Tobacco Survey (GYTS), and India’s National Family Health Survey (NFHS) show a decline in tobacco usage among the surveyed demographics, except for a slight increase among women from 2015-2016 to 2019-2021.

- No surveys have been conducted post-COVID-19, which leaves a gap in current data.

Tobacco Board of India

- It was established in 1976 as a statutory body under Section (4) of the Tobacco Board Act, 1975. (HQ – Guntur, Andhra Pradesh)

- Nodal Ministry: Union Ministry of Commerce and Industry

- Functions:

- To promote the export of tobacco and its related products.

- To ensure that tobacco growers receive fair and remunerative prices for their produce.

Awareness and Control Programs

- Legal Framework: India has been a signatory of WHO’s Framework Convention on Tobacco Control (FCTC) since 2005 and has the Cigarettes and Other Tobacco Products Act (COTPA) 2003 governing tobacco sales.

- National Tobacco Control Program (NTCP): Launched in 2007 to implement COTPA and FCTC, raise awareness, and aid quitting efforts.

- Taxation: Tobacco is taxed, but implementation is weak, with non-compliance of smokeless tobacco products (SLTs) with COTPA guidelines, poorly regulated smuggled products, and outdated fines.

- Surrogate Advertising: While direct ads are banned, indirect ads (surrogate advertising) persist, promoting tobacco brands through proxy products.

Affordability and Implementation Challenges

- Failed Amendments: Proposed COTPA amendments in 2015 and 2020, addressing surrogate ads and licensing, were not passed.

- NTCP Ineffectiveness: A 2018 study found no significant difference in bidi or cigarette consumption reduction between NTCP and non-NTCP districts due to insufficient staffing, resources, and monitoring.

- Tax Evasion: Tobacco taxes remain low due to evasion, smuggling, illicit manufacturing, and counterfeiting. Transition to GST further increased affordability.

- Lobbying Power: The tobacco lobby influences policy, with exemptions for bidis and smaller manufacturers, government officials engaging with the industry, and the central government holding a stake in ITC Ltd.

Additional Challenges and Opportunities

- E-Cigarettes: Banned by the Prohibition of Electronic Cigarette Act (PECA) 2019, yet remain a challenge with 23% reported use and 8% daily use in an online survey.

- Farmer Support: Government support for tobacco farmers to switch to alternate crops like jowar, which can be more profitable, is crucial.

- Data Needs: Up-to-date data on tobacco use trends is needed to counter the industry’s evolving strategies.

Way Forward

- Strengthen Implementation: Stringent implementation of COTPA, PECA, and NTCP.

- Increase Taxation: Align taxes with FCTC recommendations, inflation, and GDP growth.

- Support Farmers: Aid tobacco farmers in transitioning to alternate crops.

- Gather Data: Collect up-to-date data to track tobacco use trends.

| UPSC PYQ |

With reference to the “Tea Board” in India, consider the following statements: (2022)

Which of the statements given above are correct? (2022)

Answer: D |

National Technology Readiness Assessment...

National Technology Readiness Assessment...

Justice Mission-2025: China’s Live-Fir...

Justice Mission-2025: China’s Live-Fir...

Suryastra: First Made-in-India Long-Rang...

Suryastra: First Made-in-India Long-Rang...