Table of Contents

Context: Despite the commitments to update Nationally Determined Contribution (NDC) under the Paris Agreement to the UNFCCC in August 2022, thermal power plants remain a significant source of electricity in India.

Key Commitments in India’s Updated NDC

- Adopting a climate-friendly and cleaner path to economic development

- Reducing emissions intensity of GDP by 45% by 2030 (compared to 2005 levels)

- Achieving 50% cumulative installed electric power capacity from non-fossil fuel sources by 2030.

- Creating a carbon sink of 2.5–3 billion tonnes of co₂ equivalent by 2030

- Enhancing energy efficiency and promoting sustainable lifestyles (Mission LiFE)

- Better adapt to climate change by enhancing investments in development programs.

- Mobilize domestic and new funds from developed countries.

- Build capacities, and create domestic framework and international architecture for quick diffusion of climate technology.

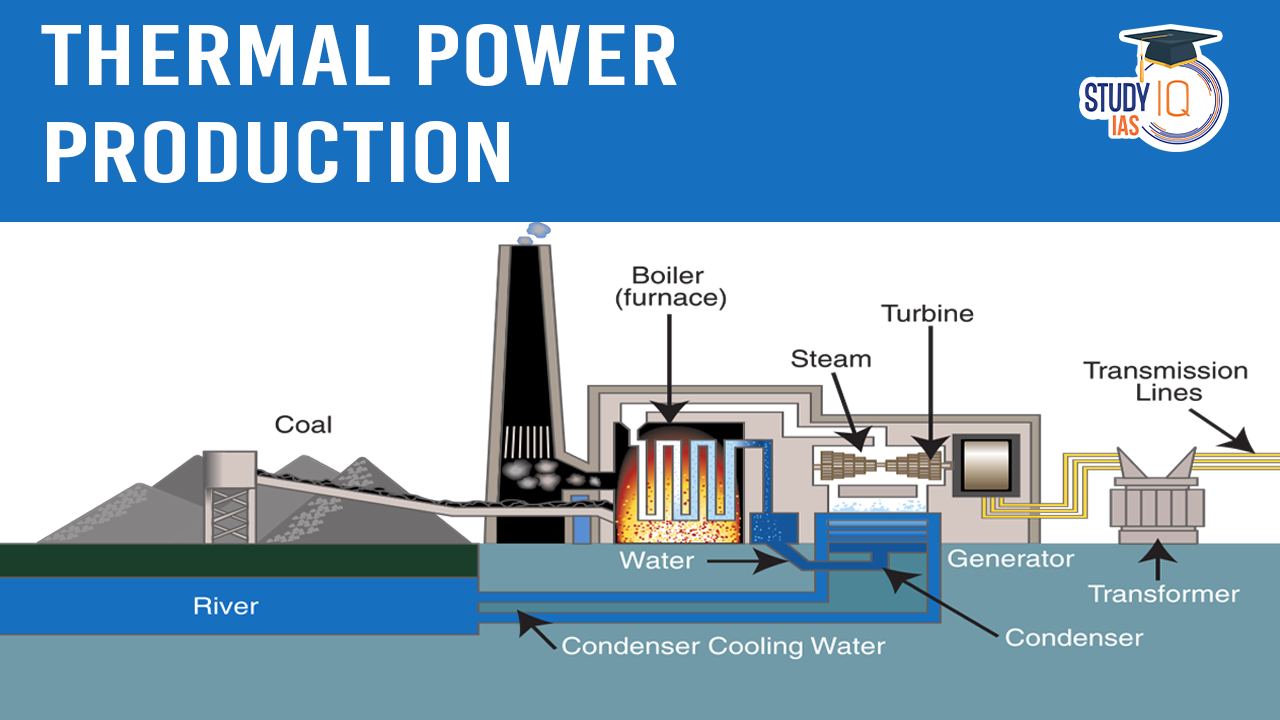

Thermal Power Production: Disproportionate Pollution Burden

- High Dependence on Thermal Power: Thermal power (mainly coal-based) contributes significantly to India’s electricity generation, leading to high carbon emissions.

- Eg., India accounts for 20,794.36 kg of carbon emissions from electricity generation.

- Dominant share of coal: Approximately 59.12% of the total energy supply in India comes from coal. In 2022-23, about 73.08% of electricity was generated from coal, while only 1.48% came from oil and natural gas.

- Disparities in Electricity Production and Consumption: Some States (e.g., Chhattisgarh, Odisha, Jharkhand) produce more power than they consume, while others (e.g., Gujarat, Maharashtra) import power.

- Uneven distribution of pollution: States that produce thermal power bear a disproportionate pollution burden compared to those that consume it.

| Facts |

|

Lack of Compensation for Pollution Burden

- Constitutional constraints: States can tax electricity consumption and sale but not generation, while the central government does not impose a specific tax on electricity production.

- GST exemption: Electricity as a commodity is exempt from the Goods and Services Tax (GST), and services related to its transmission or distribution are also GST-exempt.

Proposed Solutions for Compensation

- Taxing thermal power generation: Allowing States where central sector power plants are located to tax thermal power generation, or the Union government can collect and transfer the generation tax to the producing States.

- Compensation through the Finance Commission: Utilizing the Finance Commission of India to develop a fiscal road map that compensates thermal power-producing States for the burden of other States’ electricity consumption

List of National Parks in India 2025, Ch...

List of National Parks in India 2025, Ch...

Bonnet Macaques: Habitat, Features, Beha...

Bonnet Macaques: Habitat, Features, Beha...

Periyar Tiger Reserve, Map, Flora, Fauna...

Periyar Tiger Reserve, Map, Flora, Fauna...