Table of Contents

Context of the Article: There is an element of growth orientation in the latest budget, given the higher capex, but the private sector should start firing to accelerate growth.

Author’s Views

- The author writes about the growth and the macroeconomic effect of the budget. After the announcement of the budget, Sensex went down, bond yields moderated and the rupee strengthened.

- The rupee movement may not be directly affected by the Budget content. But the softening of bond yields indicates that the fiscal path outlined by the Finance Minister is working.

Multi-faceted Effects of the Budget

- Element of growth orientation: There is an element of growth orientation given the higher capex of the government at Rs 10 lakh crore.

- As this would be directed mainly at roads and railways, where there are strong backward linkages with industries such as steel, cement, machinery, electrical goods etc., the push given is commendable.

- Sops given on the income tax: There are exemptions given on the income tax front, provided one switches to the new tax regime.

- If there is a significant migration to the new regime as there are tax savings to be had, there could be a positive effect on consumption at the margin. Given inflation has eroded consuming power; this can be a game changer.

- Marginal thrust to saving: The new schemes announced for women can work provided the interest rate being provided at 7.5 per cent is better than that on bank deposits.

- But several banks are offering higher rates which will make this scheme unattractive.

- Boost to investment: Investment will get a direct boost from the capex of the government. States need to follow up with their action.

- This is so because with overall investments in the country going by the gross fixed capital formation rate being around Rs 90 lakh crore, until the private sector comes in, there would be some heavy lifting to be done by governments.

- Credit guarantee scheme for SMEs: SMEs would benefit from the credit guarantee scheme announced. The outlay of Rs 9,000 crore is supposed to generate credit of Rs 2-lakh crore.

- Such schemes are the right way to go because the outlay is a contingent liability which kicks in only when there is a default.

- Unaffected inflation: Inflation would be largely unaffected by the Budget as the indirect taxes which come under the purview of GST primarily have not been affected. The government could have lowered the excise duty on fuel.

- Disinvestment: There is not any direct sop for the stock market in terms of capital gains tax or any benefit for corporate; the disinvestment programme will sound good.

- Debt Servicing: The interest payments for FY24 will cross the Rs 10-lakh crore mark this year. Overall debt of the government is to increase from Rs 152.6-lakh crore to Rs 169.5-lakh crore in FY24.

World Population Day 2025, Themes, Histo...

World Population Day 2025, Themes, Histo...

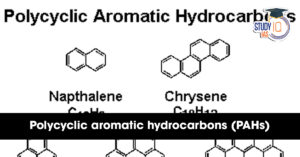

What are Polycyclic Aromatic Hydrocarbon...

What are Polycyclic Aromatic Hydrocarbon...

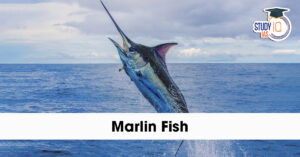

Marlin Fish: Species, Features, Appearan...

Marlin Fish: Species, Features, Appearan...