Table of Contents

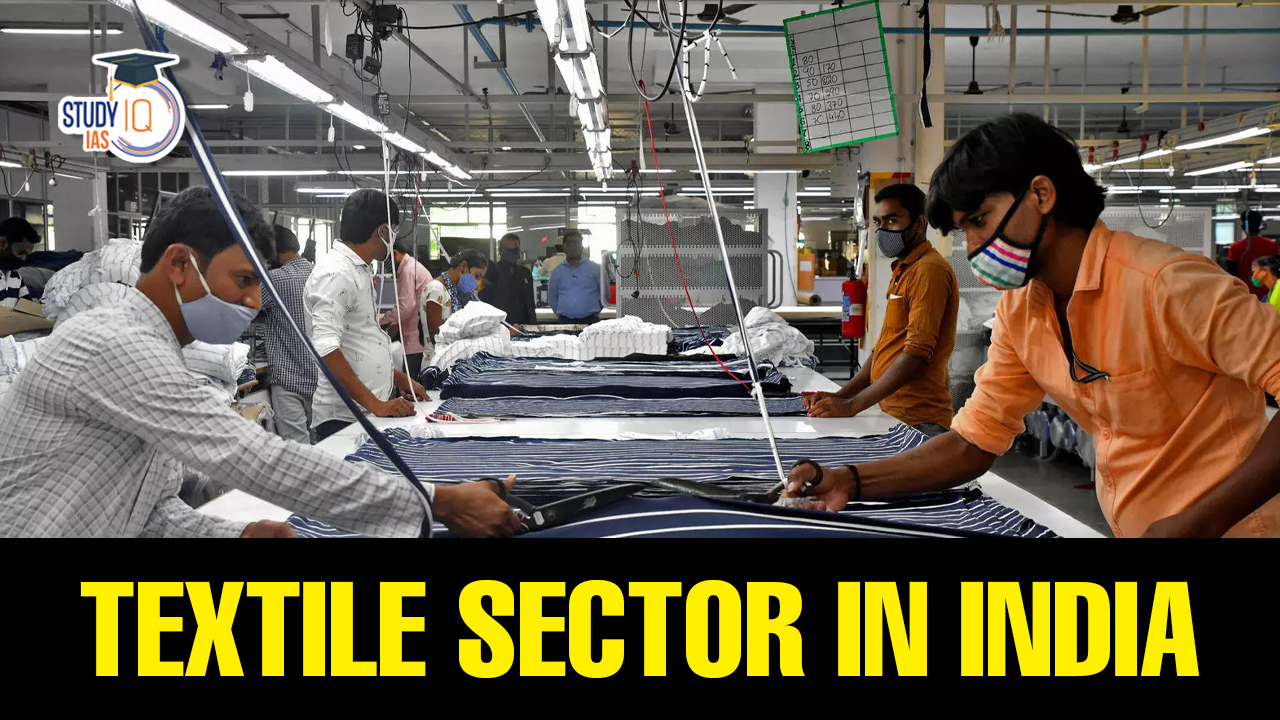

Context: Textiles and apparel exports registered a 12.2% decline in May as the industry continued to face low demand in its key overseas markets including the U.S.

More on the News

- The main reason behind the declining exports is the sluggish demand in major importing countries including the U.S., Germany, and the U.K. on account of inflation and also piled up inventory, experts observed.

- However, reports suggest that there are positive signs in the trade sector as exporters are gradually receiving orders for merchandise, indicating an improving situation.

- The reopening of China following the COVID-19 pandemic is expected to create favorable business prospects, particularly for yarn and fabrics.

- Additionally, the domestic prices of cotton are becoming more balanced, raising hopes for increased sales starting from July/August.

An Overview of Textile Sector in India

- India’s textiles sector is one of the oldest industries in the Indian economy, dating back to several centuries.

- The Indian textile industry uses a wide variety of fibres ranging from natural fibres like cotton, jute, silk and wool to manmade fibres like polyester, viscose, acrylic and multiple blends of such fibres and filament yarn.

- Economic contribution: Our economy is largely dependent on the textile manufacturing and trade in addition to other major industries.

- The textiles and clothing sector contributes about 14% to the industrial production and 3% to the gross domestic product of the country.

- About 27% of the foreign exchange earnings are on account of export of textiles and clothing alone.

- Around 8% of the total excise revenue collection is contributed by the textile industry.

- It accounts for as large as 21% of the total employment generated in the economy. Around 35 million people are directly employed in the textile manufacturing activities. Indirect employment including the manpower engaged in agricultural based raw-material production like cotton and related trade and handling could be stated to be around another 60 million.

- India’s global position:

- India is the largest producer of cotton & jute in the world, the second largest producer of silk in the world the 6th largest producer of Technical Textiles.

- India stands as the 3rd largest exporter of Textiles & Apparel in the world.

- 95% of the world’s hand-woven fabric comes from India.

- Locational factors for the textile industry: Six geo-economic factors on which the localization of textile industry depends are as follows: Climate, Power, Raw Material, Labour, Transport, and Markets.

Challenges faced by the Textile Sector in India

- High fragmentation: The textile industry in India is characterized by high fragmentation, with the unorganized sector and small and medium enterprises dominating the sector.

- Infrastructure bottlenecks: Inadequate infrastructure, such as poor transportation facilities and power shortages, increases the cost of production and reduces the competitiveness of the Indian textile industry.

- Technology Obsolescence: Many textile units in India still use outdated technology, making them less competitive than their counterparts in other countries.

- Highly competitive export market: In the global market tariff and non-tariff barriers coupled with lack of free/preferential trade agreements are posing a major challenge to the Indian textile Industry.

- There is fierce competition from China, Bangladesh and Sri Lanka in the low-price garment market.

- Impact of Goods and Services Tax (GST): GST has created distortions in the Textile and Apparel sector in India, impeding its competitiveness.

- For instance, man-made fibres (MMF) are taxed at 18 per cent for fibre, 12 per cent for yarn and 5 per cent for fabric. This inverted tax structure makes MMF textiles costly.

- Environmental issues: Textile processing, which heavily relies on non-biodegradable chemicals and consumes vast amounts of water, poses significant environmental challenges.

PM Mega Integrated Textile Region and Apparel (PM MITRA) Scheme

- Launch: The scheme was first announced in the union budget speech of 2021-22, under which seven mega textile parks are proposed to be set up to make Indian textile sector globally competitive.

- Mega Textile Parks are designed to integrate the entire textile value chain, from spinning, weaving, processing/dyeing and printing to garment manufacturing, all within a single location.

- Objective: To create an ecosystem that promotes competitiveness, productivity, and innovation in the textile industry.

- Outlay: The total outlay for the project is ₹4,445 crore, though the initial allocation in the 2023-24 Budget is only ₹200 crore.

- Key features of the scheme:

- 5F Vision: The PM MITRA scheme is Inspired by the 5F vision – Farm to Fibre to Factory to Fashion to Foreign.

- PM MITRA park will be developed by a Special Purpose Vehicle which will be owned by the Central and State Government and in a Public Private Partnership (PPP) Mode.

- The Ministry of Textiles will provide financial support through development capital support up to Rs. 500 crores per park to the Park SPV.

- A competitive incentive Support (CIS) of up to Rs 300 crore per park to the units in PM MITRA Park shall also be provided to incentivise speedy implementation.

- Each MITRA Park will have an incubation centre, a common processing house, a common effluent treatment plant, and other textile-related facilities such as design centres and testing centres.

- Sites for PM MITRA Parks will be selected by a Challenge Method based on objective criteria.

Other Initiatives by the Government for Growth of Textile Industry

| Technology Upgradation |

|

| Sector Specific Missions |

|

| Capacity Building and Social Security |

|

| Other measures |

|

MP Police Constable Admit Card 2025 Out ...

MP Police Constable Admit Card 2025 Out ...

UPPSC PCS Cut Off 2025: Check Expected a...

UPPSC PCS Cut Off 2025: Check Expected a...

Diwali 2025 Calendar: Dhanteras to Bhai ...

Diwali 2025 Calendar: Dhanteras to Bhai ...