Table of Contents

Context: Recently, the Union government hiked the windfall profit tax levied on domestically-produced crude oil as well as on the export of diesel and aviation turbine fuel (ATF).

What are Windfall Profits?

- Windfall profits are sudden and unexpected gains in profit that a company or individual experiences as a result of unforeseen events or circumstances.

- These profits are typically the result of external factors, such as changes in government policy, fluctuations in commodity prices, or unexpected demand for a particular product or service.

- Examples of windfall profits include:

- Oil companies experiencing a sudden increase in profits due to a sharp rise in oil prices.

- A company that produces face masks experiencing a surge in demand and profits during a pandemic.

- Real estate owners in an area that suddenly becomes very popular or desirable experiencing a significant increase in the value of their properties.

The Current Scenario of Windfall Profits for Oil Companies

- Several Western countries reduced their energy imports from Russia in response to its actions in Ukraine, which decreased the supply of fossil fuels and drove up prices, resulting in windfall gains for oil companies.

- According to Reuters, all ‘Big Oil’ companies (including BP, Chevron, Equinor, ExxonMobil, Shell and Total Energies) combined, more than doubled their profits to $219 billion in 2022.

- In India, ONGC’s profit-after-tax (PAT) until September end in the ongoing financial year stood at ₹28,032 crore, compared to the ₹40,306 crore in the complete fiscal ending March 31, 2022.

Why is there a Need to Tax Windfall Profits?

- Revenue for the state: A windfall tax can generate significant revenue for the government, which can be used to fund public services, reduce the deficit, or invest in infrastructure.

- Redistributive justice: A windfall tax can help to reduce the wealth inequalities by ensuring that those who have benefited the most from windfall profits contribute more to society.

- The B.K. Chaturvedi committee’s report on the Financial Position of Oil Companies (2008) had stated that taxing of these windfall gains has been seen as a prerogative of governments, in part to meet fiscal needs and in part to pursue redistributive justice

- Discourages rent-seeking behavior: Companies may engage in rent-seeking behavior in anticipation of windfall profits. A windfall tax discourages this behavior by reducing the amount of profit that can be earned.

Challenges Associated with the Taxing of Windfall Profits

Global Scenario of Windfall Taxation Regimes

- Besides India, a wave of countries including the United Kingdom, Italy, and Germany have either already imposed a windfall profit tax on super normal profits of energy companies or are contemplating doing so.

- In May 2022, the United Kingdom announced a windfall tax on energy companies that have been pocketing extraordinary profits.

- Italy and Romania were the first few countries to tax power generators while the United States and the European Union are also contemplating a tax on the “war-fueled profits” of major energy firms.

World Population Day 2025, Themes, Histo...

World Population Day 2025, Themes, Histo...

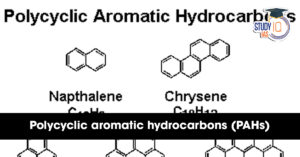

What are Polycyclic Aromatic Hydrocarbon...

What are Polycyclic Aromatic Hydrocarbon...

Marlin Fish: Species, Features, Appearan...

Marlin Fish: Species, Features, Appearan...