Table of Contents

Context: The government has introduced significant income tax cuts in the Union Budget 2025.

Key Highlights Include

- Complete tax rebate for individuals earning between ₹7-₹12 lakh per year (earlier applicable only for those below ₹7 lakh).

- Increase in the basic exemption limit from ₹3 lahks to ₹4 lahks for those earning above ₹12 lakh per year.

- Reduction in marginal tax rates across multiple tax slabs.

- Estimated revenue loss of ₹1 lakh crore, approximately 8% of total direct income tax collections in the current fiscal year.

Why the Tax Cuts Are a One-Way Gamble

Overestimation of Tax Revenue Growth

- Despite an 8% fall in the effective tax rate, the government projects a 14% increase in direct tax collections.

- This requires 24% income growth, which is highly optimistic given that nominal GDP growth is projected at just 10.1%.

- If income growth doesn’t meet expectations, tax revenues will fall short, affecting government spending.

Risk of Widening Income Inequality (K-Shaped Growth)

- If the tax revenue growth comes from higher earnings among existing taxpayers, it would lead to a further concentration of wealth among upper-income groups.

- This would exacerbate the K-shaped recovery, where high-income earners thrive while lower-income groups struggle.

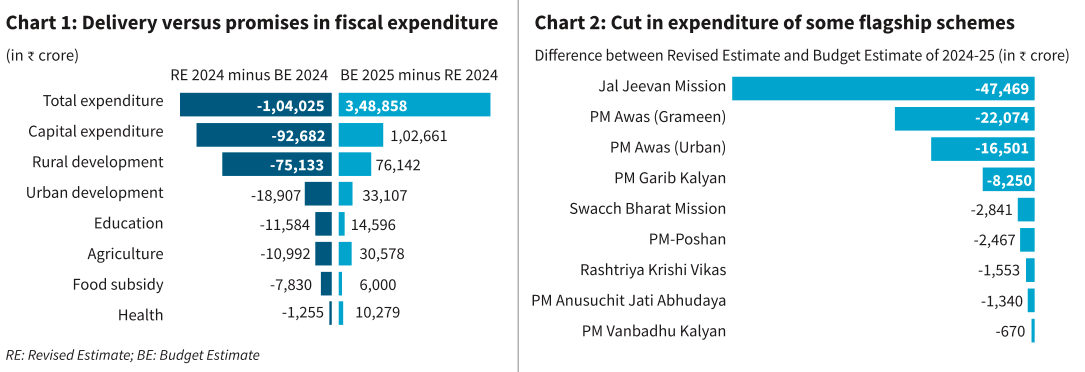

Fiscal Constraints and Spending Cuts

- If tax revenue falls short, the government will have to cut expenditures, especially on welfare schemes.

- With the Fiscal Responsibility and Budget Management (FRBM) Act in place, the government cannot exceed the fiscal deficit limit, making it harder to increase spending during slowdowns.

Shift to Pro-Cyclical Fiscal Policy

- The government is reducing its fiscal deficit target from 4.8% (2024 RE) to 4.4% (2025 BE), signaling fiscal contraction instead of expansion.

- This is problematic because fiscal policy is meant to be counter-cyclical (increase spending in slowdowns), but instead, it is moving with the economic cycle, potentially deepening the slowdown.

Dependence on Private Investment and Exports

With government expenditure constrained, the government is banking on corporate investment and exports to drive growth.

- However, private investment has not increased significantly despite past tax cuts and capital expenditure efforts.

- The 2025 Economic Survey indicates weak global demand, making exports an unreliable growth driver.

Uncertain Consumption Boost from Tax Cuts

- The government expects that lower taxes will increase disposable income, boosting consumption, and in turn, investment and growth.

- However, if people choose to save instead of spending, the intended economic stimulus may not materialize.

Conclusion

The tax cuts are a one-way gamble because the government is placing all bets on income growth and tax buoyancy, with little room for alternative fiscal measures. If revenue projections fall short, expenditure cuts will hurt economic growth and social spending, making the economy more vulnerable.

Foreign Contribution Regulation Act (FCR...

Foreign Contribution Regulation Act (FCR...

World Economic Forum’s Future of Jobs ...

World Economic Forum’s Future of Jobs ...

Rising Household Debt, Trends, Causes an...

Rising Household Debt, Trends, Causes an...