Table of Contents

Context

- The Reserve Bank of India (RBI) has effectively managed consumer price inflation within its mandated range of 4% ± 2%.

- Strategic use of monetary policy has stabilised prices and protected consumer purchasing power.

Ensuring Financial Stability and Surplus Generation

- Financial Stability: The RBI has maintained overall financial stability in the country.

- Financial Surpluses: Prudent financial management has resulted in unprecedented financial surpluses.

- Transferred ₹2.11 trillion to the central government, bolstering fiscal resources for development projects and welfare schemes.

Collaboration with the Government for Economic Growth

- Cooperation: Close cooperation between the RBI and the Ministry of Finance has driven India’s GDP growth above 7%.

- Coordinated Policies: Monetary and fiscal policies are well-coordinated to achieve high growth while controlling inflation.

- Economic Environment: RBI’s monetary interventions and the government’s fiscal measures create a conducive environment for sustained economic expansion.

Addressing Food Inflation through Trade Policies

- Despite RBI’s efforts, food prices for essentials like wheat, rice, and pulses remain high.

- Government has implemented export controls on agricultural products to stabilise prices.

- Measures beneficial for consumers can limit farmers’ market access and revenue potential.

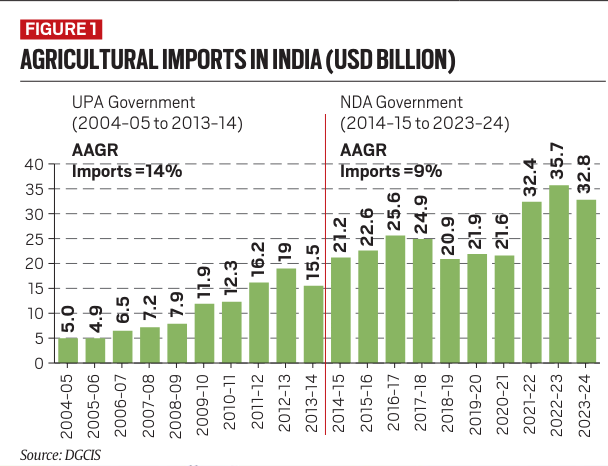

Decline in Agricultural Imports

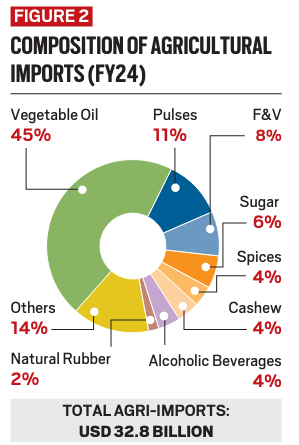

- Import Reduction: Agricultural imports declined by 8% in 2023-24, falling to $32.8 billion from $35.7 billion in 2022-23.

- Edible Oils: Significant decrease in the import value of edible oils due to lower global prices, especially palm oil.

- Stable quantity of edible oil imports indicates a shift towards cost-effective procurement.

- Pulses and Edible Oil Import Dynamics:

- Pulses: Import value of pulses doubled in 2023-24 due to domestic production shortfalls and rising prices.

- Edible Oils: Fluctuating global prices directly impact India’s import expenses.

- Government liberalised pulses imports at zero duty to control domestic prices, risking farmers’ incomes.

Integrating Trade and MSP Policies

- Rational Trade Policy: Trade policy should align with Minimum Support Price (MSP) policy to protect farmers and ensure consumer affordability.

- Calibrated Approach: Avoid abrupt import duty changes to balance market dynamics.

- Ensure landed prices of imports do not undercut domestic MSPs.

- Support Mechanisms: Large-scale procurement by agencies like NAFED can support price stability and build buffer stocks.

- Promoting Self-Reliance in Edible Oils: Achieving self-sufficiency in edible oils by promoting palm oil cultivation.

- Expand palm oil cultivation on suitable lands for higher yield compared to traditional oilseeds.

- Integrate efforts with sustainable agricultural practices to balance economic and environmental objectives.

Conclusion

- Policy Integration: Integrate trade policies with MSP policies for sustainable agricultural development.

- Balance Interests: Balance protecting farmers’ interests with ensuring affordable consumer prices.

- Food Security and Stability: Promote self-reliance in pulses and edible oils to enhance food security and economic stability.

- Support Farmers: Support farmers while aligning with environmental goals for balanced economic growth and ecological sustainability.

Serious Fraud Investigation Office (SFIO...

Serious Fraud Investigation Office (SFIO...

Article 142 of Indian Constitution, Sign...

Article 142 of Indian Constitution, Sign...

Pakistan-Occupied Kashmir (PoK): History...

Pakistan-Occupied Kashmir (PoK): History...