Table of Contents

Context: The threat of U.S. stagflation is unsettling global markets, prompting some investors to adjust their portfolios in anticipation of the economic strain that new tariffs could impose on growth and inflation in the world’s largest economy.

What is Stagflation?

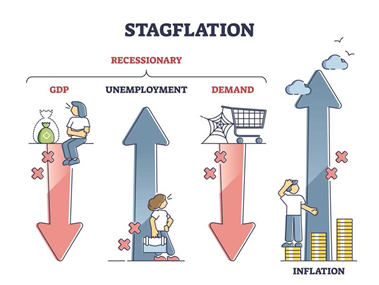

- Stagflation is an economic situation characterised by high inflation, slow economic growth, and high unemployment.

- The term comes from the words “stagnation” and “inflation“.

| Related Terms |

|

Origin and Historical Context

- First Use of the Term: The term “stagflation” was coined in the 1960s by British politician Iain Macleod. He used it to describe the simultaneous occurrence of economic stagnation and inflation in the United Kingdom.

- Global Recognition: Stagflation became globally recognised during the 1970s when major economies like the United States experienced it. The 1973-74 oil crisis played a significant role in contributing to the phenomenon of stagflation. A sharp rise in oil prices led to higher production costs, which contributed to inflation, while economic activity slowed due to the subsequent recession.

Causes of Stagflation

Several factors can lead to stagflation:

- Supply-Side Shocks: A sudden increase in the cost of essential resources like oil can increase production costs across industries, leading to inflation without corresponding economic growth. This was seen in the 1970s oil crisis.

- Poor Economic Policies: Sometimes, misguided monetary or fiscal policies can contribute to stagflation. For example, if a government or central bank pursues expansionary monetary policies (increasing money supply) to stimulate growth during a supply shock, it may end up increasing inflation without improving employment or output.

- Structural Rigidities in the Economy: Stagflation can also result from structural problems in an economy, such as labour market rigidities (difficulty in hiring and firing workers), lack of technological advancements, or inefficient resource allocation.

Economic Impacts of Stagflation

Stagflation creates several significant challenges:

- Diminished Purchasing Power: As inflation rises, the real income of households falls, reducing their purchasing power and overall consumption.

- Increased Unemployment: As businesses face higher production costs and slower demand, many are forced to reduce their workforce, leading to higher unemployment rates.

- Reduced Investment: Uncertainty about the economic future often discourages investment, further worsening the economic stagnation.

- Wage-Price Spiral: Workers may demand higher wages to keep up with rising prices. However, businesses may then pass the higher wage costs on to consumers by raising prices further, creating a vicious cycle of inflation.

Key Features of Stagflation

- Persistent Inflation: The inflation experienced during stagflation is not transitory but persists despite poor economic growth.

- Weak Economic Performance: Indicators like GDP growth, industrial output, and employment remain weak or stagnant.

- Inability to Apply Conventional Policies: Traditional macroeconomic policies, like monetary easing to boost growth or tightening to control inflation, often fail to address stagflation effectively due to the simultaneous occurrence of inflation and stagnation.

Challenges in Addressing Stagflation

Policymakers face a difficult trade-off when dealing with stagflation:

- Inflation Control: Controlling inflation through tighter monetary policies (such as raising interest rates) can further slow down economic growth and increase unemployment.

- Stimulating Growth: Conversely, using expansionary monetary policies (like lowering interest rates or increasing government spending) to stimulate economic growth can lead to higher inflation, exacerbating the stagflation problem.

This makes stagflation one of the most complex economic challenges to manage.

Policy Measures to Tackle Stagflation

- Supply-Side Reforms: Governments can implement long-term structural reforms to increase productivity and efficiency in the economy. This may involve improving labour market flexibility, reducing regulation, investing in infrastructure, or encouraging innovation and technological advancements.

- Targeted Fiscal Policies: Governments can pursue targeted fiscal policies that focus on alleviating the immediate impacts of stagflation, such as providing subsidies for essential goods, reducing taxes on lower-income households, or incentivising investment in key sectors.

- Monetary Policies: Central banks may need to strike a balance between controlling inflation and supporting economic growth. This could involve gradual interest rate adjustments and managing inflation expectations to avoid excessive tightening or loosening of monetary policy.

- Managing Inflation Expectations: Controlling inflation expectations through communication and credible policy action can prevent a wage-price spiral from occurring, thus breaking the inflationary cycle.

Examples of Stagflation

- 1970s Oil Crisis: The most prominent example of stagflation occurred during the 1970s when oil prices surged due to geopolitical tensions in the Middle East, causing inflation to rise sharply while economic growth slowed. Many Western economies, including the US and UK, struggled with high unemployment and inflation during this period.

- India’s Experience: In the early 2020s, India faced a potential stagflation threat due to disruptions from the COVID-19 pandemic, leading to rising inflation driven by supply-side constraints, especially in food and fuel prices, coupled with slow economic growth and high unemployment.

Relevance of Stagflation in the Contemporary World

- Global Economic Uncertainties: The COVID-19 pandemic disrupted supply chains worldwide, leading to inflationary pressures in many economies. Combined with global economic slowdowns and high unemployment rates, fears of stagflation emerged in the post-pandemic recovery period, particularly in developing economies.

- Energy Price Shocks: Geopolitical tensions, such as the Russia-Ukraine conflict, have caused volatility in global energy markets, driving up oil and gas prices. This could lead to stagflation-like conditions in some economies if inflation persists while growth stagnates.

Conclusion

Stagflation represents a significant challenge for policymakers and economists due to the simultaneous occurrence of slow economic growth, high unemployment, and inflation. It requires a careful balancing of fiscal and monetary policies, along with supply-side reforms, to manage both inflationary pressures and stagnant growth. For UPSC aspirants, understanding stagflation is essential, as it has implications for economic policy, governance, and global economic trends.

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...

Fisheries Sector in India, Current Statu...

Fisheries Sector in India, Current Statu...