Table of Contents

The SSC CGL Tax Assistant is one of the most sought-after posts under the Staff Selection Commission (SSC). Candidates appointed as Tax Assistants in the Central Board of Direct Taxes (CBDT) and Central Board of Indirect Taxes and Customs (CBIC) receive an attractive salary package along with various perks and allowances. The salary structure of a Tax Assistant includes basic pay, house rent allowance (HRA), dearness allowance (DA), transport allowance (TA), and other benefits as per the 7th Pay Commission. This article provides a detailed breakdown of the SSC CGL Tax Assistant Salary, including the in-hand salary, allowances, and career growth opportunities. Read this article to find out about the SSC CGL Tax Assistant Salary and Job Profile for 2025.

SSC CGL Tax Assistant

A Tax Assistant in the Income Tax Department or the Central Board of Indirect Taxes and Customs (CBIC) hold the various clerical and administrative tasks. These include helping with tax return assessments, keeping records, entering data, and managing refunds and audits. SSC CGL Tax Assistants get a good salary along with various benefits and allowances. These Tax Assistants are recruited by the Staff Selection Commission and earn Rs. 25500 per month. With additional allowances like Dearness Allowance, transport, House rent allowance and DA on TA, their total monthly salary increased up to 48207 approximately.

SSC CGL Tax Assistant Salary 2025

Tax Assistant’s salary in the SSC CGL exam ranges from ₹25500 to ₹81100, which is Level 4 in the 7th Pay Commission pay matrix. The total monthly salary can vary based on the posting location and applicable allowances. The gross salary is between ₹35,000 and ₹50,000 per month, depending on these factors.

| SSC CGL Tax Assistant(CBDT,CBIC) 2025 Salary | |

| Pay Level | 7th Pay Commission (Rs. 25,500 to Rs. 81,100) |

| Basic pay | Rs. 25,500 |

| Grade Pay | Rs. 2,400 |

SSC CGL Tax Assistant Allowances

The perks and allowances for Tax Assistant posts include the Central Government Health Scheme (CGHS), which provides medical facilities at top multispecialty hospitals, a Transport Allowance to cover travel expenses, a House Rent Allowance (HRA) to help with accommodation costs, and pensions to provide financial security after retirement. below we give you a basic idea in brief about the different types of allowances which is very attractive.

- Dearness Allowance (DA) is approximately 50% of the total salary and is regularly adjusted to keep pace with inflation, ensuring that the purchasing power of the employee remains stable despite rising living costs.

- House Rent Allowance (HRA) varies according to the city where the employee is based. Higher percentages are provided in more expensive cities to help cover the increased cost of housing.

- Transport Allowance is given to cover the expenses of commuting to work. The amount varies depending on the employee’s rank and location, reflecting different transportation needs and costs. For cities: Rs. 3,600 plus DA on TA For other places: Rs. 1,800 plus DA on TA

- Medical Allowance helps cover medical expenses through the Central Government Health Scheme (CGHS), ensuring employees have access to high-quality healthcare services.

- Pension and Retirement Benefits offer financial security after retirement. This includes a pension, gratuity, and provident fund payments, which provide a steady income and financial support when employees retire.

- Children’s Education Allowance assists with the costs associated with educating children through scholarships or subsidies, reducing the financial burden on employees.

- Special Duty Allowance is additional pay provided for handling particularly challenging or difficult jobs, compensating for the tough conditions or special responsibilities involved.

- Uniform Allowance covers the costs of uniforms for the armed forces, as their specific and distinctive uniforms are not readily available for purchase in the market.

SSC CGL Tax Assistant Gross Salary

A Tax Assistant in the Income Tax Department is a Level 4 job with a basic pay of ₹25500. The salary also depends on the city class (X, Y, or Z) and the Dearness Allowance (DA), which is revised every 6 months, usually by 3-4%. we posted the salary slip for the candidate’s convenience.

| SSC CGL Tax Assistant Gross Salary | |||

| Component | Amount (Rs.) | Government recoveries | Amount |

| Basic Pay | 25500 | CGEGIS | 10 |

| Dearness Allowance (42%) | 11,730 | EmpTier1 | 3723 |

| House Rent Allowance (27%) | 4590 | ||

| TPT Allow | 2628 | ||

| Gross Salary | 44448 (Approx.) | 3733 | |

| Net Pay | 40715 | ||

Also, Check SSC CGL Salary 2025

SSC CGL Tax Assistant Salary Deductions

From your total salary, money is usually taken out for the National Pension Scheme (NPS) to save for retirement. Income tax is also deducted based on the tax rates, and professional tax might be deducted if local rules apply on it. These deductions are made to follow financial and legal rules as per as the central government

SSC CGL Tax Assistant In-Hand Salary

As already discussed above in the article, a Tax Assistant receives a basic salary of Rs. 25500 per month. However, the Dearness Allowance is given for each month along with the basic salary. The sum of basic salary and dearness allowance becomes the monthly in-hand salary for a Tax Assistant. The SSC CGL Tax Assistant’s in-hand salary ranges between Rs.25500 to Rs.81000 per month

SSC CGL Tax Assistant Career Growth and Promotions

1. Tax Assistant

- Role: Handles tax assessments, returns, and other office tasks.

2. Income Tax Inspector

- Promotion: After gaining experience, a Tax Assistant can become an Income Tax Inspector. This role involves more duties like audits and investigations.

3. Assistant Commissioner of Income Tax (ACIT)

- Promotion: With more experience, an Income Tax Inspector can be promoted to Assistant Commissioner. This role involves managing larger teams and complex cases.

4. Deputy Commissioner of Income Tax (DCIT)

- Promotion: The next step is Deputy Commissioner. This role includes managing regional operations and making strategic decisions.

5. Joint Commissioner of Income Tax (JCIT)

- Promotion: Further promotion leads to Joint Commissioner, overseeing multiple units and implementing policies.

6. Additional Commissioner of Income Tax

- Promotion: This position involves managing larger regions or key areas within the department.

7. Commissioner of Income Tax

- Promotion: The top position is Commissioner, leading the entire department and setting policies.

8. Principal Commissioner of Income Tax / Chief Commissioner of Income Tax

- Promotion: The highest positions are Principal Commissioner or Chief Commissioner, responsible for major administrative functions.

Promotion Criteria:

- Experience: Years of service and experience.

- Performance: Achievements in the current role.

- Exams and Assessments: Passing internal exams.

- Training: Completing relevant training programs.

SSC CGL Tax Assistant Job Profile

There are two departments where Tax Assistants serve which are CBIC and CBDT. Job Profiles of SSC CGL Tax Assistant are as follows

Tax Assistant in CBIC: In this role, the work primarily involves clerical duties such as preparing reports and handling dispatch tasks. Tax Assistants typically work under the supervision of a Superintendent or Appraiser, but they may also be assigned to work with an Examiner, PO, or Excise Inspector.

Tax Assistant in CBDT: This position focuses on managing income tax assessments for individuals, partnerships, or companies. Responsibilities include entering data into the computer and performing clerical tasks like diary maintenance, dispatch, and drafting. Tax Assistants in this role might also participate in raid teams.

SSC CGL Tax Assistant Work Environment

Tax Assistants generally work in government offices like the CBIC (Central Board of Indirect Taxes and Customs) or the CBDT (Central Board of Direct Taxes). They are provided with office tools such as desks, computers, and office supplies. Their tasks include clerical duties like preparing reports, entering data, handling dispatches, and keeping records. In the CBDT, they deal in income tax assessments, process tax returns, and manage related paperwork. They work under the guidance of senior officers, such as Superintendents or Inspectors, and need to coordinate with other team members to ensure everything runs smoothly. Their work hours are from Monday to Friday.

Also, Check SSC CGL Syllabus 2025

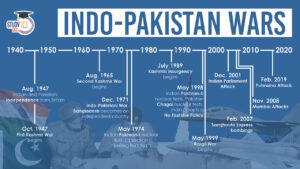

List of Indo-Pakistan Wars and Conflicts...

List of Indo-Pakistan Wars and Conflicts...

Daily Quiz 24 April 2025

Daily Quiz 24 April 2025

United States Federal Reserve (US Fed)

United States Federal Reserve (US Fed)