Table of Contents

The Staff Selection Commission (SSC) conducts the Combined Graduate Level (CGL) Examination to recruit candidates for various government posts, including the prestigious post of Income Tax Inspector under the Central Board of Direct Taxes (CBDT). The Income Tax Inspector post is one of the most sought-after positions due to its high salary, job security, and authority. In this article, we will provide detailed information about the SSC CGL Income Tax Inspector Salary 2025, job profile, career growth, and allowances.

SSC CGL Income Tax Inspector Salary

SSC CGL Income Tax Inspectors hold good salary packages and enjoy several benefits in the form of allowances during their career. These positions are filled by the Staff Selection Commission (SSC). The annual salary package for an Income Tax Inspector in SSC CGL is quite attractive for aspiring aspirants. Here is the basic details of their salary packages:

- Basic Pay: This ranges from ₹538800 to ₹1708800 per year, depending on the job level.

- Grade Pay: The grade pay is ₹4600 per year.

- Allowances: Inspectors get various allowances like Dearness Allowance (DA), House Rent Allowance (HRA), Transport Allowance, and many more.

- Other Benefits: As government employees, Income Tax Inspectors also get benefits like medical facilities, pensions, and Canteen access, which add even more value to their annual income.

SSC CGL Income Tax Inspector Salary Structure

The salary for SSC CGL Income-Tax Inspectors in 2025 is based on the 7th Pay Commission. These inspectors work for the Central Board of Direct Taxes (CBDT) under the Indian Government. The table below shows their salary details.

| SSC CGL Income Tax Inspector 2024 Salary | |

| Pay Level | Pay Level-7 (Rs. 44,900 to Rs. 1,42,,900) |

| Basic pay | Rs. 44,900 |

| Grade Pay | Rs. 4600 |

SSC CGL Income Tax Inspector Salary Slip

After passing the SSC CGL exam, a new Income Tax Officer (ITO) usually starts with a monthly salary between ₹44000 and ₹47000. This amount includes basic pay plus allowances like House Rent Allowance (HRA) and Dearness Allowance (DA). The exact salary can differ depending on the location and specific pay scales, but it generally falls within this range for new recruits. Over time, there is an promotions and salary hikes, which can significantly increase the gross earnings.

- Basic Salary: Basic pay is the set amount of money an employee gets according to the pay scale. This amount stays the same every month unless there’s a change in their pay scale or they receive a salary increase.

- Grade Pay: Grade pay is extra money added to the basic salary of government employees. It is based on their job level or grade and helps make salaries fair across different positions and ranks in the government.

- Various Allowances: Income Tax Inspectors get several benefits like medical, house rent, transportation, and dearness allowances (DA, HRA, and TA). These help cover living, housing, transportation, and medical costs.

- Some Deductions: To find out the net salary, certain amounts like income tax and provident fund are subtracted from the gross salary, then the total amount will be estimated.

- Gross Salary: Gross salary is the total money an employee earns before any deductions like taxes, insurance, or retirement contributions are taken out. It includes the basic salary plus all extra earnings like allowances, bonuses, and overtime.

SSC CGL Income Tax Inspector Perks and Allowances

The Perks and Allowances for the inspector posts are as per as the central government criteria which includes: Central Government Health Scheme (CGHS) which is a special health program for government employees, offering medical facilities in best multispecialty hospitals. Transport Allowance for travel expences. House Rent Allowance (HRA) is for accommodation costs. Pensions for employees and other benefits are mentioned below in a clear format.

- Dearness Allowance (DA): This is about 50% of an employee’s total pay and is regularly adjusted to keep up with inflation, ensuring their purchasing power remains stable.

- House Rent Allowance (HRA): This allowance helps cover housing costs and varies depending on the city where the employee works. Cities are categorized into different classes, and the HRA percentage is higher in more expensive cities.

- Transport Allowance: This covers the cost of commuting to and from work. The amount varies based on the employee’s rank and location, ensuring they can manage their travel expenses.

- Medical Allowance: This helps cover medical expenses through the Central Government Health Scheme (CGHS). It provides access to necessary healthcare services, including treatments at top multispecialty hospitals.

- Pension and Retirement Benefits: After retirement, employees receive a pension along with other benefits like gratuity and provident fund payments. These benefits provide financial security and support during their retirement years.

- Children’s Education Allowance: This helps families with the cost of their children’s education. It can come in the form of scholarships or subsidies.

- Special Duty Allowance: This is extra pay for employees who do special or tough jobs in difficult conditions or in difficult areas.

- Uniform Allowance: This helps cover the cost of uniforms for armed forces, as their unique uniforms are not easily available in the market.

| City type | X City | Y City | Z City |

| Basic pay | 44,900 | 44,900 | 44,900 |

| HRA | 10,776 | 7,184 | 3,592 |

| DA | 7,633 | 7,633 | 7,633 |

| TA | 3,600 | 1,800 | 1,800 |

| DA on TA | 612 | 306 | 306 |

| NPS Deduction10% (Basic + DA) | 5,253 | 5,253 | 5253 |

| CGHS | 350 | 350 | 350 |

| CGEGIS | 30 | 30 | 30 |

| Gross Earnings | 67,521 | 63,929 | 60,337 |

| Total Deductions | 5,633 | 5,633 | 5,633 |

| Govt. Contribution | 7,355 | 7,355 | 7,355 |

| Net Earnings | 61,888 | 58,296 | 54,704 |

SSC CGL Income Tax Inspector Job Profile and Responsibility

The job of an inspector can vary based on the type of inspector’s role. However, common duties for inspectors in government agencies or organizations include:

- General Responsibilities: Inspection and Evaluation: Inspect facilities, operations, or documents to ensure they follow rules and standards. Reporting: Write detailed reports about inspection findings, including any problems found. Compliance Enforcement: Make sure operations follow laws and regulations. Take action if they don’t. Record Keeping: Keep accurate records of inspections, including observations and follow-up actions.

- Specific Responsibilities: Income Tax Inspector Audit and Investigation: Check individuals or businesses to ensure they report taxes correctly. Tax Assessments: Verify tax returns and financial statements. Enforcement Actions: Take action against tax evaders. Documentation: Prepare and review tax-related documents.

- Skills Required: Attention to Detail: Notice and document small details. Analytical Skills: Assess information and make decisions. Communication: Good verbal and written skills to report findings. Problem-Solving: Identify and solve problems. Technical Knowledge: Relevant knowledge for the specific inspection field.

- Work Environment: Fieldwork: Inspectors often visit sites or locations. Office Work: They also prepare reports and documentation in offices. In summary, an inspector’s job involves checking compliance with standards or regulations, writing reports, and keeping accurate records. The exact duties depend on the type of inspector role.

Also, Check SSC CGL Previous Year Question Paper

Career Growth and Promotions

As an Income Tax Inspector, you have great career promotion opportunities within the Indian government’s tax department. below we mentioned the sequence

- Income Tax Inspector Role: Conduct audits, and investigations, and assess tax returns to ensure they follow tax laws.

- Assistant Commissioner of Income Tax (ACIT)

Promotion: After several years of experience and good performance, you can be promoted to Assistant Commissioner. This role involves managing a team and overseeing larger projects.

- Deputy Commissioner of Income Tax (DCIT)

Promotion: The next step is Deputy Commissioner. Here, you handle significant cases, lead larger teams, and make strategic decisions.

- Joint Commissioner of Income Tax (JCIT)

Promotion: With more experience and strong leadership skills, you can become a Joint Commissioner. This role involves higher-level administrative duties and overseeing multiple units.

- Additional Commissioner of Income Tax

Promotion: Further promotions lead to Additional Commissioner. This senior role includes overseeing large regions or sectors and handling complex issues.

- Commissioner of Income Tax

Promotion: The highest position is Commissioner of Income Tax. This role involves leading the entire department, setting policies, and ensuring overall compliance.

- Principal Commissioner of Income Tax

Promotion: In some cases, the top position is Principal Commissioner, responsible for major administrative and strategic functions.

- Chief Commissioner of Income Tax

Promotion: The Chief Commissioner is the senior-most position, with overall responsibility for a region or large sector.

- Criteria for Promotion:

Experience: Gaining experience in various roles. Performance: Showing strong performance, leadership, and problem-solving skills. Exams and Assessments: Passing required departmental exams and assessments. Training and Development: Participating in relevant training programs.

Also, Check SSC CGL Syllabus 2024

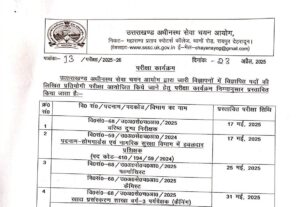

UKSSSC Exam Calendar 2025 Out: Check Gro...

UKSSSC Exam Calendar 2025 Out: Check Gro...

SSC CGL 2025 Notification Postponed: Che...

SSC CGL 2025 Notification Postponed: Che...

JSSC CGL Recruitment 2025: Application P...

JSSC CGL Recruitment 2025: Application P...