Table of Contents

Context

- The split verdict in the Lok Sabha election has highlighted the crucial roles of Telugu Desam Party (TDP) leader Chandrababu Naidu and Janata Dal (United)’s Nitish Kumar in forming a central government.

- Consequently, these leaders are expected to renew their previous demands for granting special status to Andhra Pradesh and Bihar.

Special Category Status (SCS)

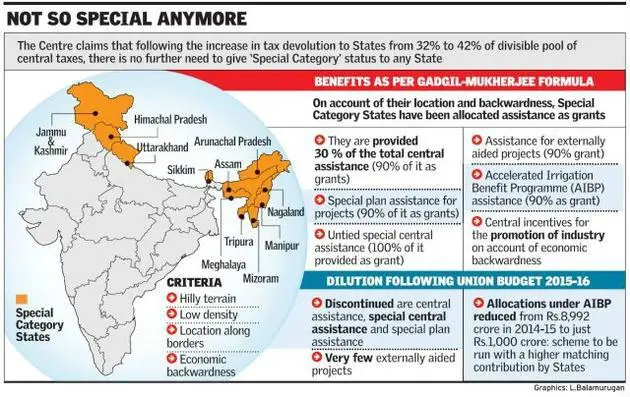

| About Special Category Status (SCS) | |

| Origin | Introduced by the 5th Finance Commission in 1969. |

| Purpose | Special Category Status was designed to assist states facing historical economic or geographical disadvantages. |

| Criteria (Based on Gadgil Formula) |

|

| Changes Over Time | The 14th Finance Commission recommended discontinuing SCS, proposing instead to increase the tax devolution from 32% to 42% to bridge the resource gap in states. |

States with Special Category Status

- Initial Beneficiaries: Initially, SCS was granted to Assam, Jammu and Kashmir, and Nagaland following the approval of the Gadgil formula for fund allocation by the National Development Council in 1969.

- Expansion of SCS: More states received SCS upon achieving statehood, including Himachal Pradesh (1970-71), Manipur, Meghalaya, and Tripura (1971-72); Sikkim (1975-76); and later Arunachal Pradesh and Mizoram (1986-87), along with Uttarakhand (2001-02).

- Current Status: Presently, 11 states hold the Special Category Status, with Telangana being one of them due to its separation from Andhra Pradesh, which adversely affected its financial stability.

- States Demanding SCS: Odisha has been demanding Special Category Status for several years now. Andhra Pradesh and Bihar governments have also echoed the demand for this status.

List of Special Category Status States in India

There were initially 11 states that were granted Special Category Status (SCS) in India. These states were identified based on various socio-economic and geographical disadvantages. The states that held special category status include:

- Arunachal Pradesh

- Assam

- Himachal Pradesh

- Jammu and Kashmir (now a union territory)

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Uttarakhand

- Telangana

14th Finance Commission

The 14th Finance Commission did away with the ‘special category status’ for States, except for the North-eastern and three hill states.

- Instead, it suggested that the resource gap of each State be filled through ‘tax devolution’, urging the Union to increase the States’ share of tax revenues from 32% to 42%, which has been implemented since 2015.

- After the Union Government accepted the recommendations of the Fourteenth Finance Commission in 2015, however, the concept of SCS has effectively disappeared.

Granting Authority of SCS

Central plan assistance to SCS States has been granted in the past by the erstwhile Planning Commission body, the National Development Council (NDC). Now, it is done by the Union Government.

Benefits of Special Category Status (SCS)

- Financial Support: The central government covers 90% of the funds for centrally sponsored schemes in SCS states, in contrast to the usual 30% grant and 70% loan ratio for non-SCS states.

- Special Plan Assistance: SCS states receive special plan assistance for state-specific projects that are considered of critical importance.

- Fund Utilisation Flexibility: Funds allocated to SCS states do not lapse at the end of the financial year, allowing unused funds to carry over.

Demand for Special Status by Bihar and Andhra Pradesh

Bihar’s Demand

- Background: Bihar has sought SCS since Jharkhand, a mineral-rich region, was separated from it in 2000.

- Economic Condition: Bihar is one of India’s poorest states with a per-capita GDP of approximately Rs 54,000 and is home to 94 lakh poor families.

- Funding for Welfare: Granting SCS is seen as a way to secure about Rs 2.5 lakh crore needed for welfare measures over five years.

- Poverty Index: According to the Centre’s Multidimensional Poverty Index (MPI), nearly 52% of Bihar’s population lacks adequate health, education, and living standards.

- Geographical Criteria: Despite meeting most SCS criteria, Bihar does not qualify under the criteria related to hilly terrain or geographic difficulties.

Andhra Pradesh’s Demand

- Background: Post-bifurcation in 2014, AP lost significant revenue sources to Telangana, including Hyderabad, the state’s economic hub.

- Leadership’s Advocacy: Both Naidu (CM from 2014-2019) and Jagan Mohan Reddy (CM from 2019-2024) have actively pursued SCS to alleviate financial strain.

- Revenue and Debt Issues: Post-devolution revenue deficit was estimated at Rs 22,113 crore for 2015-2020 but escalated to Rs 66,362 crore. Debt increased from Rs 97,000 crore at bifurcation to over Rs 3.5 lakh crore.

- Economic Disparity: Andhra Pradesh, mainly agrarian, reported a per capita revenue of Rs 8,397 in 2015-16, significantly lower than Telangana’s Rs 14,411.

Benefits of Special Category Status for Andhra Pradesh and Bihar

- Increased Central Funding: Special Category Status would significantly increase the central government funding to these states.

- For example, Special Category States receive per capita grants of Rs 5,573 crore annually, compared to Andhra Pradesh’s current Rs 3,428 crore.

- Economic Development: The increased funding and special incentives associated with SCS would accelerate industrial development in these primarily agrarian states.

- This would create more job opportunities, particularly benefiting the youth.

- Investment Attraction: SCS would make these states more attractive to investors.

- Expected investments include specialty hospitals, five-star hotels, manufacturing, high-value service industries like IT, and premier educational and research institutions.

- Enhanced Infrastructure and Services: The status would facilitate better infrastructure development and improved public services, enhancing the overall quality of life for residents.

Difference between Special Category Status and Special Status

- Constitutional Provisions: The Constitution provides special status through an Act that has to be passed by 2/3rds majority in both the Houses of Parliament.

- The Constitution of India does not include any provision for categorisation of any State in India as a Special Category Status (SCS) State.

- For example, Jammu and Kashmir enjoyed a special status as per Article 370 and also special category status.

- But now that Article 35A has been scrapped and it has become a Union Territory with legislature, special category status doesn’t apply to J&K anymore.

- Powers: Special status empowers legislative and political rights while special category status deals only with economic, administrative and financial aspects.

Shortcomings in SCS

- Dependence on Central Funding: The SCS created a dependence on central transfers that the States are unable to shrug off.

- Most of the revenue expenditure of these States is not met through their own resources.

- An Inadequate Solution: While the central funds have sustained the State finances, a solution based largely on the transfer of central funds is inadequate.

- Discretionary Finances: The granting of SCS and liberal central assistance is at the Centre’s discretion rather than based on any strict principle/ criterion.

- Political Influence: The allocation of resources by the Planning Commission was influenced by political rather than economic considerations.

- Cut in Allocation: The difference between funds allotted to SCS and other States has been sizably reduced and the status has remained more of a symbol of political mileage.

- Misuse of Funds: The generous central assistance, often without a proper accountability mechanism, led to the misuse and diversion of these easy funds and fed and fuelled corruption.

- No Concrete Improvement: The situation of the States having SCS does not show any perceptible improvements in terms of industrialization, aiming which they received tax incentives such as capital investment subsidy, excise duty and income tax exemptions, and transportation cost subsidies.

- Intensification of Demand: Granting SCS to more States would lead to intensification of similar demands from States such as Odisha, Bihar, etc.

Way Forward

- One way of moving forward may be the abolition of “SCS” and the introduction of the “least developed states’ category as recommended by the Raghuram Rajan committee (2013).

- It should be based on the 10 equally weighted indicators for monthly per capita consumption expenditure, education, health, household amenities, poverty rate, female literacy, percentage of the Scheduled Caste, Scheduled Tribe population, urbanisation rate, financial inclusion and physical connectivity.

- This would help in better understanding the development needs of individual States.

Topological Materials: The Future of Qua...

Topological Materials: The Future of Qua...

China’s Deep Sea Station in South Chin...

China’s Deep Sea Station in South Chin...

Mechanisms to Combat Judicial Corruption...

Mechanisms to Combat Judicial Corruption...