Table of Contents

Ombudsman

- An ombudsman is an official of the government who deals with complaints made by ordinary citizens against public organizations. This concept originated in Sweden.

- It refers to an officer appointed by the Legislature to handle complaints against a service or administrative authority.

- Need for an ombudsman in an organisation:

- Address concerns: Ombudsman gives an opportunity for the public to express their grievances against an organisation. This feedback will help in improving service to the public.

- Impartial working: Ombudsman works in an impartial, confidential and independent manner. They function independently without the influence of the organisation.

- Avoid duplication of work: The ombudsman can carry out a single investigation into multiple complaints about the same topic, which avoids duplication and excessive cost.

- Streamlining complaints: Ombudsman will establish a procedure for taking and resolving complaints from the public.

The Integrated Ombudsman Scheme of the RBI

Launch

- The Reserve Bank – Integrated Ombudsman Scheme (RB-IOS) was launched in November 2021 after integrating three erstwhile ombudsman schemes of RBI.

- These included the Banking Ombudsman Scheme, 2006; the Ombudsman Scheme for Non-Banking Financial Companies, 2018; and the Ombudsman Scheme for Digital Transactions, 2019.

- The scheme will also bring under its ambit Non-Scheduled Primary Co-operative Banks with a deposit size of Rs 50 crore and above.

Legality

RBI framed the scheme by exercising powers under:

- Section 35A of the Banking Regulation Act, 1949 (10 of 1949)

- Section 45L of the Reserve Bank of India Act, 1934 (2 of 1934)

- Section 18 of the Payment and Settlement Systems Act, 2007 (51 of 2007)

Objectives

- The scheme will provide cost-free redressal of customer complaints involving deficiency in services provided by entities regulated by RBI, which have not been resolved within a period of 30 days by the regulated entity.

Appellate Authority

- Executive Director-in charge of Consumer Education and Protection Department of RBI.

Filing Complaints Under the Scheme

- Visiting the website

- Through a dedicated email id

- Physical application directed to ‘Centralized Receipt and Processing Centre’ in Chandigarh

- Contacting a dedicated toll-free number

Features of the Scheme

- Category neutral: Complainant need not identify under which scheme he/she should file complaint with the Ombudsman.

- Narrowing grounds for rejection: ‘Deficiency in service’ has been provided as the ground for filing a complaint, with a specified list of exclusions. Hence, complaints would no longer be rejected simply on account of “not covered under the grounds listed in the scheme”.

- Jurisdiction neutral: The scheme operates on a ‘One Nation One Ombudsman’ approach, making it jurisdiction neutral.

- Usage of technology: RBI will make use of Artificial Intelligence tools so that regulated entities and investigating agencies could coordinate in a better way in the fastest time possible.

- Representing regulated entity: The Principal Nodal Officer in the rank of a General Manager in a Public Sector Bank or equivalent will be responsible for representing the Regulated Entity and furnishing information in respect of complaints filed by customers.

- Single email id: Customers can file complaints, submit documents, track status, and give feedback through a single email address.

- Right to appeal: Regulated entity will not have the right to appeal against the order in cases where the ombudsman has ruled against it for not furnishing satisfactory and timely information/documents.

Significance of the Scheme

- Customer satisfaction: The ombudsman scheme is expected to enhance grievance redressal mechanism against RBI’s regulated entities and improve customer satisfaction.

- Uniform standards: The scheme will ensure uniformity and streamline user-friendly mechanisms across the country.

- Easy access to services: The integrated platform allows for easy lodging and tracking of complaints by customers. This will benefit bank customers from rural areas.

SSC CGL Exam 2025 Apply Online Starts Ap...

SSC CGL Exam 2025 Apply Online Starts Ap...

Daily Quiz 19 April 2025

Daily Quiz 19 April 2025

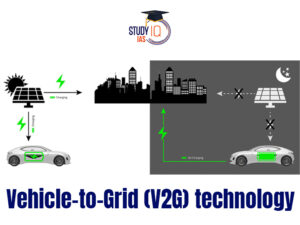

Vehicle-to-Grid (V2G) Technology and its...

Vehicle-to-Grid (V2G) Technology and its...