Table of Contents

Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme History

The US had challenged India’s key export subsidy schemes in the WTO (World Trade Organisation), saying they harmed the American workers.

A dispute panel in the WTO ruled against India, stating that the export subsidy programmes of Indian government violated the provisions of WTO.

RoDTEP Scheme was introduced in January 2021. With expansion of this scheme, eligible export items under Appendix 4R will increase from current 8,731 export items (8 digit tariff lines) to 10,342 export items (8 digit tariff lines).

RoDTEP Scheme Extended

About

- RoDTEP Scheme will rebate/refund the embedded central, state and local duties/taxes to the exporters that were so far not being rebated/refunded.

- This scheme will replace Merchandise export incentive schemes (MIES).

Principle

- RoDTEP is based on the globally accepted principle that taxes and duties should not be exported, and taxes and levies imposed on the exported products should be either exempted or remitted to exporters.

Implementation

- The rebate is provided by Customs as a transferable electronic scrip by the Central Board of Indirect Taxes & Customs (CBIC) in an end to end IT environment.

- It will be refunded in the exporter ledger account of the exporter with a retrospective effect.

Objectives of the RoDTEP Scheme

- To encourage exports in the country by reducing duties

- To provide easy refunds of various taxes to the exporters

- To provide an automatic refund route to avoid the cascading effect of taxes.

- To help exporters in meeting international export standards

Eligibility

- This scheme is applicable to all the sectors involved in the export of goods irrespective of their turnover. However, the country of manufacturing should be in India.

- Goods exported through e-commerce platforms can benefit under this scheme.

- Special Economic Zone Units and Export Oriented Units are also eligible under the scheme.

Non-eligibility

- Rebate under the Scheme shall not be available in respect of duties and taxes already exempted or remitted or credited.

- Re-exported products of the country are not eligible.

Other Conditions

- Eligible exporters can avail the scheme at a notified rate as a percentage of Freight On Board (FOB) value.

- Rebate on certain export products is subject to value cap per unit of the exported product.

Sectors Covered

- Marine, Agriculture, Leather, Gems & Jewellery, Automobile, Plastics, Electrical / Electronics, Machinery, textiles etc are some of the sectors covered under the scheme.

What is the Significance of RoDTEP Scheme?

- Making Domestic Industry Competitive: The scheme aims to support domestic industry and make their products more competitive in the international markets.

- Economic Boost: The scheme is expected to boost exports, generate employment and contribute to the overall economy.

- Regenerate Export Sector: India’s exports have entered negative territory after a gap of about two years, due to global demand slowdown, resulting in widening of trade deficit. The scheme is expected to promote exports.

India’s Declining Exports

- India’s export of goods contracted by more than 16% in October this year, slipping below the $30-billion mark for the first time in 20 months.

- Engineering, including steel products, dropped over 21% to $7.4 billion. Drugs and pharma exports had witnessed a fall by more than 9% in October, while chemical exports slid by a steeper 16.4%.

Merchandise Exports from India Scheme (MEIS)

- MEIS is an export incentive scheme introduced under the Foreign Trade Policy 2015-20. It was introduced with an objective to promote the export of goods from India by providing incentives in the range of 2-7%.

- These incentives make Indian goods competitive in the global markets by offsetting infrastructural inefficiencies and associated costs involved in exports from India.

SSC CGL Exam 2025 Apply Online Starts Ap...

SSC CGL Exam 2025 Apply Online Starts Ap...

Daily Quiz 19 April 2025

Daily Quiz 19 April 2025

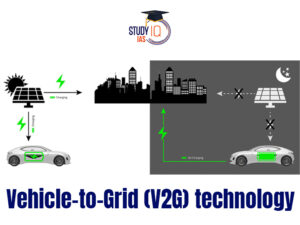

Vehicle-to-Grid (V2G) Technology and its...

Vehicle-to-Grid (V2G) Technology and its...