Table of Contents

Context: Recently, the yield on the 10-year government bond rose sharply by 9 basis points, marking the largest increase in eight months.

More In News

- Concurrently, the Indian Rupee depreciated by 38 paise, closing at 83.53 against the dollar, representing a 0.47 per cent decrease.

- This decline was the most significant single-day percentage drop since February of the previous year.

- The 10-year bond yield closed at 7.0382 per cent, up from the previous closing rate of 6.9438 per cent.

- During the day, the yields briefly peaked at 7.09 per cent, which was a 12 basis point increase.

What are Bonds and Bond Yields?

- Bond: A bond serves as a method for raising capital and can be issued by either a corporation or a government entity.

- Investors may acquire bonds at a value greater than the nominal amount, known as a premium, or below it, which is referred to as a discount.

- Bond Yield: The yield on a bond reflects the earnings that an investor receives from the investment.

- When investors purchase bonds, they are essentially extending a loan to the issuer, who in return agrees to provide periodic interest payments and return the principal amount of the bond at maturity.

- The yield encompasses the income generated both from the interest collected and any gains from selling the bond.

- Notably, bond prices and their yields move in opposite directions.

Relationship Between Bonds and Bond Yield

- There is an inverse connection between bond values and their yields; as the price of bonds increases, the yield decreases.

- Since bonds typically pay a fixed rate of interest, investors tend to offload bonds in anticipation of rising interest rates and conversely, they may acquire bonds when they predict a decrease in interest rates, causing bond prices to escalate.

Effect on Bond Investors

- An uptick in bond yields suggests a market expectation of higher interest rates, prompting investors to divest from current bonds to mitigate potential losses in principal value.

- The net asset values (NAVs) of debt funds, which include government securities, tend to drop in response to bond price depreciation triggered by escalating yields.

- The pricing of corporate bonds, which are typically more expensive than government bonds, also experiences a downturn due to the overall fall in bond prices.

- Debt market participants experience losses as surging yields contribute to the depreciation of bond values and the NAVs of debt-oriented funds.

- Equity investors may feel the pinch of rising bond yields since they can lead to increased borrowing costs for businesses, which might in turn impact their profitability.

| Understanding Yield Curve Inversion |

|

Minors Bank Account above 10 Years: Chan...

Minors Bank Account above 10 Years: Chan...

Creative Economy in India, Current Situa...

Creative Economy in India, Current Situa...

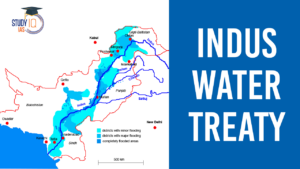

Indus Water Treaty 1960 Suspended by Ind...

Indus Water Treaty 1960 Suspended by Ind...