Table of Contents

National Pensioners Day, observed on December 17 every year, serves as a reminder of the significant strides made in securing dignity and equality for pensioners in India. This day honors the struggles and sacrifices of individuals who have contributed to the nation’s growth and acknowledges the importance of their post-retirement security. In 2024, National Pensioners Day carries even more weight, as the government’s recent initiatives continue to reshape the pension system for the better.

History of National Pensioners Day

National Pensioners Day traces its roots back to December 17, 1982, when the Supreme Court of India delivered a landmark judgment in favor of pensioners’ rights. The case was brought to court by D.S. Nakara, a retired official from the Department of Defense, who sought justice after being denied pension benefits due to the date of his retirement. The Supreme Court’s judgment recognized the discriminatory nature of the pension scheme and emphasized the need for equal benefits to all retired employees, irrespective of their retirement date.

This day marks the victory of pensioners who fought for their rights and is a tribute to those who have contributed selflessly to the country’s progress.

Evolution of Pension System in India

The pension system in India has evolved significantly since the colonial era. The Royal Commission on Civil Establishments, established in 1881, introduced pension benefits for government employees. This marked the beginning of a long journey toward providing financial security for retirees.

In independent India, the pension system continued to expand. The Central Civil Services (Pension) Rules, 1972, provided a standardized framework for pensioners, ensuring that employees who retired after completing 33 years of service were entitled to 50% of their average salary over the last 36 months of employment.

Challenges in the Pension System

Over the years, the pension system faced challenges, with successive governments introducing reforms that created disparities. The introduction of the contributory pension scheme during the NDA government under A.B. Vajpayee excluded many pre-2004 retirees from pension benefits. The UPA government, despite its best efforts, faced opposition in introducing the Pension Fund Regulatory and Development Authority (PFRDA), which was finally passed in 2013.

However, the biggest setbacks came under the current administration. The Modi government faced criticism for freezing the dearness allowance for pensioners and central employees during the COVID-19 pandemic. The move led to financial hardships for retired officials, who had already made substantial contributions to public welfare.

National Pensioners Day 2024

In August 2024, the Indian government introduced the Unified Pension Scheme (UPS), which aims to address many of the challenges that pensioners face. The scheme is designed to simplify and improve the pension system by offering a more inclusive approach to retirement benefits.

The UPS will benefit both existing and future pensioners by ensuring a uniform pension system across various sectors, reducing disparities in retirement income, and providing greater financial stability for retirees.

Key Features of the Unified Pension Scheme (UPS) 2024

- Inclusivity: The UPS ensures that all government employees, irrespective of their sector or date of retirement, will benefit equally. This move is expected to resolve the long-standing issue of pension discrimination.

- Simplified Process: The scheme offers a streamlined process for pensioners to access their benefits. This is aimed at reducing bureaucratic hurdles and delays that often plague pension distribution.

- Improved Benefits: The UPS offers higher pension benefits and ensures that retirees receive regular increments, ensuring that their post-retirement income keeps pace with inflation.

- Portability: For the first time, pensioners can transfer their pension accounts across different states and sectors, providing greater flexibility.

- Increased Coverage: The scheme aims to cover a larger number of pensioners, including those who had been excluded from previous pension schemes.

Importance of Pension Plans for Retirees

Pension plans are a crucial aspect of ensuring financial security after retirement. With the rising cost of living, a reliable pension plan can make a huge difference in maintaining a comfortable standard of living during retirement. In India, several pension schemes are available, including:

- National Pension Scheme (NPS): The NPS is a government-backed pension scheme that allows individuals to contribute regularly to build a retirement corpus. It offers tax benefits under Section 80C of the Income Tax Act, making it an attractive option for salaried individuals.

- Atal Pension Yojana (APY): APY is a government initiative designed to provide pension benefits to the unorganized sector. It ensures that individuals from low-income groups can enjoy financial security during their retirement.

- Employee Pension Scheme (EPS): This pension scheme is available to employees of organizations covered under the Employees’ Provident Fund (EPF) Act. It ensures a steady income stream for employees after retirement.

Conclusion

National Pensioners Day 2024 is a momentous occasion to reflect on the progress made in securing the financial futures of pensioners in India. With the introduction of the Unified Pension Scheme and the ongoing efforts to address disparities in pension distribution, the future looks promising for retirees.

List of Chief Ministers of Jammu and Kas...

List of Chief Ministers of Jammu and Kas...

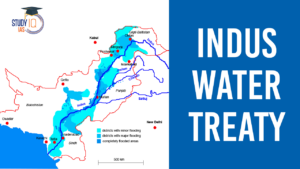

Cabinet Committee on Security Suspends I...

Cabinet Committee on Security Suspends I...

Pahalgam Terror Attack: All Eyes on Paha...

Pahalgam Terror Attack: All Eyes on Paha...