Table of Contents

Context: Finance Ministry has recently set up a four-member committee headed by Finance Secretary T V Somanathan to review the pension system for government employees.

- Panel will deliberate on whether any changes are required to the National Pension System, and suggest the measures which will improve pensionary benefits for government employees while maintain fiscal prudence for the exchequer.

Background

- State governments of Rajasthan, Chhattisgarh, Jharkhand, Punjab and Himachal Pradesh have informed the Centre about their decision to revert to DA-linked Old Pension Scheme (OPS) and have requested a refund of the corpus accumulated under the New Pension Scheme (NPS).

- Employee organisations in some other states are also raising demand for restoring OPS.

- About Old Pension Scheme: Pension to government employees at the Centre as well as states was fixed at 50 per cent of the last drawn basic pay.

- Only government employees are eligible for receiving a pension after retirement.

- Income under the old pension scheme doesn’t attract tax.

- It was described as a ‘Defined Benefit Scheme’, as it lay promise of an assured or ‘defined’ benefit to the retiree.

- Issues with OPS: As per research carried out in the early 2000s, India’s implicit pension debt, owing to central (civil) employees, state government employees and the funding gap of the employees’ pension scheme, was reaching unmanageable, unsustainable levels.

- About New Pension Scheme (NPS): It is an investment cum pension scheme. NPS contributions are invested in securities like debt and equity instruments.

- It does not guarantee fixed pensions but provides high returns in the long term, resulting in a significant lump sum and monthly pensions.

- According to the PFRDA (Pension Fund Regulatory and Development Authority), 26 state governments, with the exception of Tamil Nadu and West Bengal, have notified and implemented NPS for their employees.

Need for Pension Reforms in India

- Global comparison: India ranked 41 out of 44 countries in the Mercer CFS Global Pension Index.

- The MCGPI is a comprehensive study of 44 global pension systems, accounting for 65 percent of the world’s population.

- The index ranks countries on three criteria:

- Adequacy: What benefits are future retirees likely to receive?

- Sustainability: Can the existing systems continue to deliver, notwithstanding the demographic and financial challenges?

- Integrity: Are the private pension plans regulated in a manner that encourages long-term community confidence?

- Coverage and equity: A large portion of the Indian population, particularly those in the unorganized sector, remains uncovered by any pension scheme. This lack of coverage leads to financial insecurity for the elderly.

- At least 85 per cent current workers in India are not members of any pension scheme, and in their old age likely to remain uncovered or draw only social pension.

- Inadequate benefits: Even for those covered under pension schemes, the amount received is often meagre and insufficient for sustenance.

- Inequitable distribution: The variation in benefits based on programs, occupations, and sectors leads to inequities within the pension system.

- Of all elderly, 57 per cent receive no income support from public expenditure, and 26 per cent collect social pension as part of poverty alleviation.

- Fiscal sustainability: The pension sector currently places a significant burden on the government’s fiscal plan. Reforms should aim to create a sustainable pension system that is financially viable in the long term, balancing the needs of retirees with the fiscal constraints of the government.

- The system for old age income support entailed 11.5 per cent of public expenditure, and sub-national governments bear more than 60 per cent.

- Targeted benefits: The current system of tax exemptions on post-retirement benefits is not effectively targeting those in need. Reforms should ensure that the benefits reach the intended recipients, rather than primarily benefiting the high-income group.

Why Rising Demand for OPS

- Predictability: Employees who participate in the OPS receive a set pension based on their last received salary that is periodically raised to reflect inflation.

- Market risk: As a market-linked pension plan, the NPS exposes retirees to market risks. Many employees support for a return to OPS, which offers a predetermined pension sum, as a result of the uncertainties surrounding future pension prospects.

- Comparisons show that OPS offers greater family coverage, lower retirement ages, and higher pension replacement rates. These positive characteristics of OPS create the impression that the benefits are better, which encourages workers to call for its reinstatement.

- Perceived unsustainability: Although the NPS was created to ease financial burdens brought on by the underfunded OPS, questions remain regarding its long-term viability. Some contend that, as opposed to being entirely abandoned, OPS can be maintained through smart budgetary management and reform.

Way Forward

- Adhering to The World Bank Pension Conceptual Framework:

- Zero pillar: A non-contributory basic pension from public finances to deal explicitly with the poverty-alleviation objective

- First pillar: A mandated public pension plan with contributions linked to earnings, with the objective of replacing some pre-retirement income

- Second pillar: Typically, mandated defined contribution (DC) with individual accounts in occupational or personal pension plans with financial assets

- Third pillar: Voluntary and fully funded occupational or personal pension plans with financial assets that can provide some flexibility when compared to mandatory schemes

- Fourth pillar: A voluntary system outside the pension system with access to a range of financial and non-financial assets and informal support such as family, healthcare and housing

- Learning Best Practices: Andhra Pradesh has proposed a Guaranteed Pension Scheme (GPS), which combines the elements OPS and NPS.

- It offers a guaranteed pension of 33 per cent of the last drawn basic pay without any deduction to the state government employees.

- For this, they would need to contribute 10 per cent of their basic salary every month, and the state government will match it.

- Adequate Funding Mechanisms: Pension systems must establish robust funding mechanisms to ensure that pension obligations can be met.

- Empowering individuals with financial knowledge will enable them to make informed decisions and take an active role in securing their retirement income.

- Flexibility and Portability: Pension systems should adapt to the changing nature of work and support individuals with diverse employment patterns.

Conclusion

- India’s pensions system is in a dire need of a reform and that doing so will be both good politics and good economics.

- However, merely fluctuating between OPS and NPS is not a reform.

- OPS was problematic on the count of sustainability while NPS may not only appear hugely discriminatory, at least to officers belonging to the same service but different generations, but might also suffer from inadequacy.

Pension Fund Regulatory and Development Authority (PFRDA)

- It is an Authority set up by the Government of India through the PFRDA Act 2013 to promote old age income security by establishing, regulating and developing pension funds to protect the interest of subscribers to schemes of pension funds and for matters connected therewith or incidental thereto.

SSC GD Constable Recruitment 2026: Notif...

SSC GD Constable Recruitment 2026: Notif...

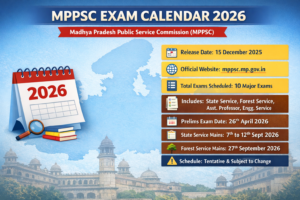

MPPSC Exam Calendar 2026 Released: Check...

MPPSC Exam Calendar 2026 Released: Check...

New Ramsar Sites in India: Latest Additi...

New Ramsar Sites in India: Latest Additi...