Context: India reduced the 15% import duty for Electric Vehicles (EV) to attract manufacturers like Tesla.

New Electric Vehicle Policy

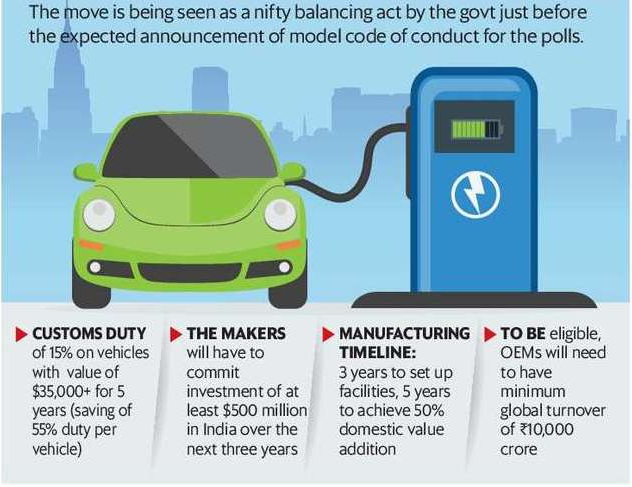

- Import Duty Reduction: The Indian government has slashed the import duties for electric vehicles (EVs) that are imported as completely built units (CBUs) to 15%, down from the existing range of 70% to 100%.

- Objective: To expand the electric vehicle market in India by attracting new players and introducing advanced EV technology to the country.

- It is not intended to undercut the existing market but to complement and enhance it by fostering technological growth and broadening consumer choice.

- Manufacturing Incentive: This reduction in import duties is contingent upon the EV manufacturer committing to set up a local manufacturing unit in India within three years of availing the duty reduction.

- Investment and Production: Automakers are required to invest a minimum of ₹4,150 crore (or around $500 million), begin manufacturing locally within three years, and achieve at least 25% domestic value addition within that time frame.

- Limitation: The concessional duty rate applies only to EVs that are priced at $35,000 or more, which includes cost, insurance, and freight charges.

- There is a limitation on the number of vehicles that can be imported at the reduced duty, capped at 8,000 vehicles per year.

- Policy Duration: The duty relief is valid for five years.

We’re now on WhatsApp. Click to Join

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...

New Phase of Operation Chakra to Combat ...

New Phase of Operation Chakra to Combat ...

Soyuz Aircraft: History, Design and Sign...

Soyuz Aircraft: History, Design and Sign...