Table of Contents

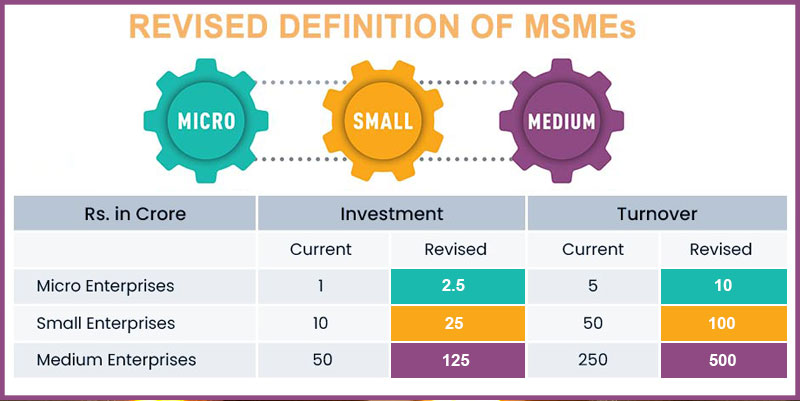

Context: The Economic Survey highlighted areas for MSME growth. The Union government has notified significant revisions to turnover and investment criteria for classifying MSMEs that will take effect from April 1.

Micro, Small and Medium Enterprises (MSME)

- Regulatory Framework: MSMEs are regulated under the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006.

- Governing Body: The Ministry of MSME manages MSMEs in India.

Current Classification of MSMEs (Effective July 2020)

Previously based only on investment in plant and machinery/equipment, now includes annual turnover.

- Micro Enterprise: Investment < INR 1 crore and Turnover < INR 5 crore.

- Small Enterprise: Investment < INR 10 crore and Turnover < INR 50 crore.

- Medium Enterprise: Investment < INR 50 crore and Turnover < INR 250 crore.

Statutory Bodies under the Ministry of MSME

- Khadi and Village Industries Commission (KVIC): Promotes and develops khadi and village industries to enhance rural employment and economy.

- Coir Board: Focuses on the overall development of the coir industry and improving the living conditions of its workers.

- National Small Industries Corporation Limited (NSIC): Established in 1955, NSIC aids, promotes, and fosters the growth of micro and small enterprises in India on a commercial basis.

- National Institute for Micro, Small and Medium Enterprises (NI-MSME): Founded in 1960, responsible for promoting entrepreneurship, enterprise creation, conducting policy-formulating studies, etc.

- Mahatma Gandhi Institute for Rural Industrialisation (MGIRI): Aims to accelerate rural industrialisation, empower traditional artisans, and innovate through research and development using local resources.

Significance of MSMEs

- MSMEs are crucial to the Indian economy, contributing 35.4% to India’s manufacturing output.

- They employ a large portion of the labour force.

Also Read: MSME Sector in India

Challenges for MSMEs

- Compliance Burden: Heavy licensing, inspection, and compliance (LIC) requirements from state and local governments restrict the growth potential of MSMEs and their ability to create jobs.

- Space Regulations: Indian factories require twice the space for workers compared to those in Southeast Asian countries like Hong Kong, Singapore, or the Philippines, limiting employment opportunities within the same amount of floor space.

- Access to Credit: MSMEs face difficulties in accessing timely and affordable credit, which hampers their operational and expansion capabilities.

- Management Training: There is a lack of adequate training in critical areas of enterprise management, which is necessary for the effective operation and growth of MSME businesses.

- Data Collection: Inadequate data collection on production and employment indicators in MSMEs hinders effective policymaking.

Recommendations

- Reduce Compliance Burden: Suggests loosening the stringent LIC requirements to enable MSMEs to grow and create more jobs.

- Regulatory Alignment: Recommends aligning Indian regulatory standards with those of countries like Malaysia to increase the employment capacity within existing facilities.

- Enhance Training Programs: Stresses the need for targeted, practical training for MSME entrepreneurs in enterprise management, including human resources, financial management, and technology.

- Upgrade Data Collection: Calls for improved data collection mechanisms to provide better statistics on the dynamics of production and employment within MSMEs.

- Financial Schemes Improvement: Highlights the importance of schemes like the Pradhan Mantri Mudra Yojana and the Credit Guarantee Fund Trust for Micro and Small Enterprises in improving access to credit.

- Rethink Incentive Structures: Advises the implementation of sunset clauses in threshold-based incentives to prevent these incentives from discouraging MSMEs from expanding beyond certain size thresholds.

| Related Facts |

| ‘Make in India Mittelstand (MIIM)’ program: A collaborative initiative between India and Germany that encouraged German SMEs to invest in India, resulting in over 151 German companies investing more than €1.4 billion from September 2015 to August 2021. |

Government Initiatives for MSME

- Credit guarantee cover for micro and small enterprises enhanced from 5 crore to 10 crore.

- 10 lakh customized credit cards with a 5 lakh limit for micro-enterprises registered on the Udyam portal to be introduced.

- Export Promotion Mission to facilitate easy access to export credit and support MSMEs to tackle non-tariff measures in overseas markets.

- New fund of funds of Rs. 10,000 crore to be set up for start-ups.

- Scheme of Fund for Regeneration of Traditional Industries (SFURTI): It aims to organize traditional artisans into collectives or clusters, facilitating product development, diversification, and value addition.

- Prime Minister’s Employment Generation Programme (PMEGP): It is a credit-linked subsidy scheme for providing employment opportunities through the establishment of micro-enterprises in the non-farm sector.

GPS Spoofing and Its Impact in India: A ...

GPS Spoofing and Its Impact in India: A ...

Amrit Gyaan Kosh Portal: A Comprehensive...

Amrit Gyaan Kosh Portal: A Comprehensive...

Regional Rural Banks in India, Objective...

Regional Rural Banks in India, Objective...