Table of Contents

Insolvency and Bankruptcy Code (IBC)

- The Insolvency and Bankruptcy Code (IBC) was introduced to overhaul the corporate distress resolution regime in India and consolidate existing laws to create a time-bound mechanism for debt resolution.

- Insolvency and Bankruptcy Code (IBC) works with a creditor-in-control model as opposed to the debtor-in-possession system. The creditor-in-control model provides control of the debtor to its creditors and relies upon the managerial skills of a newly appointed management to take over an ailing company and ensure business continuance.

- Objectives:

- Resolution of debts through restructuring, mergers, change in ownership and other methods.

- Maximize the asset value of the corporate debtor.

- Promote entrepreneurship, availability of credit, and balancing the interests of stakeholders.

- Triggering Insolvency and Bankruptcy Code (IBC): When the Insolvency and Bankruptcy Code (IBC) is triggered, two outcomes are possible:

- Attempts are made to resolve the insolvency by either coming up with a restructuring or new ownership plan

- If resolution plans fail, the company’s assets are liquidated.

Process under Insolvency and Bankruptcy Code (IBC)

- Initiation: When a corporate debtor (CD) defaults on its loan repayment, either the creditor (lender of credit) or the debtor can apply for initiating Corporate Insolvency Resolution Process (CIRP) under Section 6 of the Insolvency and Bankruptcy Code (IBC).

- Amount of default: Previously, the minimum amount of default after which the creditor or debtor could apply for insolvency was Rs 1 lakh.

- The amount was raised to Rs 1 crore, considering the stress on companies amid the pandemic.

- Authority: For initiating insolvency process, creditor/debtor has to approach a stipulated adjudicating authority (AA) under the Insolvency and Bankruptcy Code (IBC).

- The benches of National Company Law Tribunal (NCLT) across India act as AAs.

- Time-period: The Tribunal has 14 days to accept or reject the application. It has to provide a reason if the admission is delayed.

- The resolution process has to be compulsorily completed within 330 days.

- Committee of Creditors: The CoC decides whether the defaulting company is good enough to be restructured and given a fresh start, or needs to be liquidated.

- The CoC appoints an insolvency professional (IP), who looks after the operations of the company during the resolution process.

- Resolution plan: The IP invites and examines proposals for a resolution plan for a company and submits eligible plans to the CoC. The plan goes ahead if it receives 66% of the voting share of committee members.

- In case no resolution plan is approved, the company goes for liquidation.

- Submission to the tribunal: If a plan is approved, the CoC submits it to the Tribunal. The tribunal then approves the plan which the debtor has to implement. The tribunal has powers to reject the plan.

Challenges for the Insolvency and Bankruptcy Code (IBC)

- Increase in liquidation: The major objective of Insolvency and Bankruptcy Code (IBC) is to ensure resolution of debt. However, data shows that in the last six years, more than 50% of the cases ended in liquidation.

- Time period: The main feature of Insolvency and Bankruptcy Code (IBC) regime was time-bound mechanism. However, in the last few years, the time taken to resolve cases has gone beyond the 330 days deadline.

- Narrowing gap between resolution and liquidation: The value of company through resolution should be more than that of liquidation. The gap between these two values has been narrowing in recent times.

- Haircuts: A haircut is the part of the debt given up by the lender. Data shows that lender had to bear an 80% haircut in more than 70% of the cases.

- Giving up a major part of credit in form of haircut affects the business and profitability of lending entity.

Insolvency and Bankruptcy Code: Way forward

- Addressing delays: Adjudicating tribunal must not take more than 30 days after filing, to admit the insolvency application and transfer control of the company to a resolution process.

- Dedicated benches of NCLT have to be set up for Insolvency and Bankruptcy Code (IBC) cases. There are suggestions to extend the pre-packs option to all corporates after review.

- Determining haircuts: New yardstick has to be used to determine haircuts. It should be seen as a difference between what the company brings along when it enters Insolvency and Bankruptcy Code (IBC) and the value realised.

Insolvency and Bankruptcy Board of India (IBBI)

- IBBI is a statutory body in charge of overseeing insolvency proceedings and entities such as Insolvency Professional Agencies, Insolvency Professionals, and Information Utilities in India.

- It aims to simplify the process of insolvency and bankruptcy proceedings, using tribunals like NCLT (National company law tribunal) and Debt recovery tribunal.

- The governing board of IBBI consists of 10 members, including representatives from the Ministries of Finance, Law and corporate affairs, and the Reserve Bank of India.

Article 142 of Indian Constitution, Sign...

Article 142 of Indian Constitution, Sign...

Pakistan-Occupied Kashmir (PoK): History...

Pakistan-Occupied Kashmir (PoK): History...

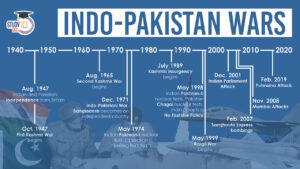

List of Indo-Pakistan Wars and Conflicts...

List of Indo-Pakistan Wars and Conflicts...