Table of Contents

Trade Deficit Reflects Strengths, Not Weaknesses

- Nature of the Trade Deficit:

- India consistently imports more goods than it exports, leading to a trade deficit.

- This situation is not indicative of weak manufacturing but rather highlights India’s robust services sector and attractiveness for foreign investment.

- Services vs. Manufacturing:

- India has a comparative advantage in services, which allows it to be a net exporter in this domain.

- The strength in services means that while India imports more goods, it compensates through significant service exports.

Foreign Investment and Current Account Deficit: Two Sides of the Same Coin

- Capital Inflows and Current Account Deficit:

- Equation: Capital account inflows = Current account deficit + Reserve accumulation.

- This means that attracting foreign investment will inherently lead to a current account deficit, as funds are used for both investment and reserve accumulation.

- Investment and Domestic Demand:

- For Indian manufacturing to expand effectively, growth should be driven by domestic demand rather than solely relying on exports.

- A strong domestic market can stimulate production and help maintain a stable current account deficit.

- Role of Foreign Investment: While foreign direct investment (FDI) is crucial for economic growth, it can also lead to increased imports of technology and capital goods, potentially worsening the current account balance.

- The inflow of FDI is essential as it supplements domestic savings and supports higher investment levels.

- Reserves Management: Reserves are maintained as a buffer against economic shocks, such as fluctuations in oil prices.

- Holding excessive reserves can be costly; thus, India aims to maintain adequate reserves without over-accumulating them.

Current Account Dynamics

- Current Account Deficit (CAD):

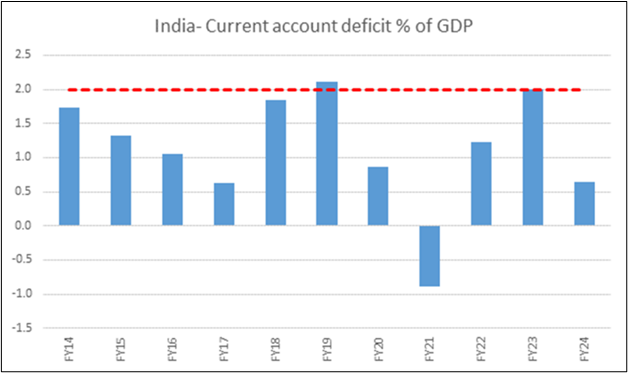

- India’s CAD, maintained at about 2% of GDP, is a desirable outcome of its economic model, which attracts capital inflows and supports investment-driven growth.

- Recent data shows that CAD narrowed to $23.2 billion (0.7% of GDP) in FY24 from $67 billion (2% of GDP) in FY23 due to increased net services exports and remittances.

- Composition of Exports and Imports:

- India exports goods where it holds competitive advantages, such as pharmaceuticals (over one-third of U.S. consumption), automobiles, and IT services.

- The trade balance reflects that while India is a net importer of goods, it maintains a healthy export profile in services.

Conclusion

India’s trade deficit should not be viewed merely as a sign of weakness in manufacturing but rather as an integral part of its economic structure that supports its strengths in services and foreign investment attraction. For sustainable growth in manufacturing, fostering domestic demand is crucial while maintaining an equilibrium with the current account deficit. The interplay between capital inflows and the current account reflects broader economic strategies that need to be understood within the context of India’s evolving economic landscape.

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...

New Phase of Operation Chakra to Combat ...

New Phase of Operation Chakra to Combat ...

Soyuz Aircraft: History, Design and Sign...

Soyuz Aircraft: History, Design and Sign...