Table of Contents

India’s pension system has evolved significantly over the years, marked by three major schemes: the Old Pension Scheme (OPS), the New Pension Scheme (NPS), and the proposed Unified Pension Scheme (UPS). Each scheme represents a different phase of government policy, reflecting shifts between state-backed welfare and market-driven approaches, with varying impacts on retirees.

Old Pension Scheme (OPS)

- Characteristics: The OPS was in place before 2004 and provided a defined benefit pension to government employees. The pension amount was fixed based on the last drawn salary.

- Stability and Security: The OPS offered financial stability, insulating retirees from market risks.

- Employees could plan their retirements with confidence, knowing they would receive a guaranteed income stream.

- Government Responsibility: The government was solely responsible for disbursing pensions, reflecting a commitment to social security without market involvement.

New Pension Scheme (NPS)

- Change in Model: The NPS replaced OPS, shifting from a defined-benefit model to a defined-contribution model where both the employee and government contribute to a pension fund invested in financial markets.

- Market Dependency: The pension payout under NPS is directly tied to market performance, making retirees’ incomes vulnerable to market volatility and economic downturns.

- This represents a neoliberal shift, reducing state involvement and transferring financial risks to individuals.

- Criticism of NPS:

- Exposure to Market Risks: Retirees face uncertainties due to fluctuating market conditions, which undermines financial stability, particularly during economic downturns.

- Concerns Over Social Responsibility: The NPS has been criticised for commercialising public welfare and weakening state-backed social protections.

Global Context and Welfarism

- Retreat from Neoliberalism: The global retreat from neoliberal policies, especially after the 2008 financial crisis and the COVID-19 pandemic, has reignited calls for stronger social safety nets and a return to welfarism.

- India’s Shift: India is experiencing similar demands for enhanced state-backed welfare provisions, leading to discussions about the UPS as a potential solution.

Proposed Unified Pension Scheme (UPS)

- The UPS aims to provide universal pensions while balancing state involvement with market participation. It is seen as a response to issues raised by the NPS.

- Current Limitations:

- Reduced Returns: Critics argue that the UPS promises retirement payouts but offers lower returns compared to the OPS while still exposing retirees to market risks.

- Eligibility Concerns: A requirement of 25 years of service for full pension disadvantages late joiners.

- Potential underfunding raises concerns about future delays or depletion of pension funds.

- Coverage Gaps: Currently limited to Union government employees, it excludes many public sector workers and informal labourers, which undermines its inclusivity.

Need for Reform

- State Intervention: There is a critical need for greater state intervention in the UPS to protect retirees from market fluctuations. Suggestions include incorporating safeguards such as minimum guaranteed pensions akin to those offered under OPS.

- Government Contribution Levels: The UPS’s hybrid model may not adequately mitigate risks associated with market reliance; thus, reforming government contribution levels is essential for creating a balanced pension system.

- Inclusivity Across Sectors: Expanding the UPS’s scope to cover informal labour is crucial for ensuring comprehensive pension security aligned with global trends toward welfarism.

Conclusion

The comparison between OPS, NPS, and UPS illustrates the ongoing tension between state-backed welfare and market-driven policies within India’s pension system. While OPS provided stability, NPS introduced uncertainties tied to market conditions. As global trends shift back toward welfarism, there is an opportunity for India to rethink its pension system. Properly restructuring the UPS could protect retirees’ financial security while addressing the shortcomings of the NPS, ultimately ensuring that Indian retirees are supported by a robust welfare system rather than left vulnerable to market forces.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

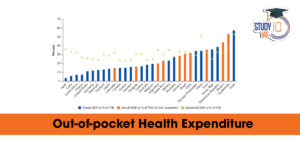

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...