Table of Contents

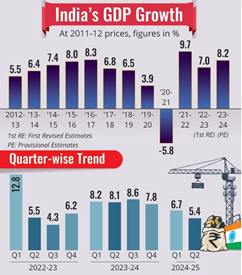

The global ratings agency Moody’s has recently revised India’s economic growth forecast for the fiscal year 2024-2025, downgrading it to 7% from the previous year’s impressive 8.2%. This revision reflects a mix of domestic and global economic challenges, including slower-than-expected performance in key sectors and broader geopolitical uncertainties.

Indian Economy Projected to Grow at 7% in FY25

In its latest report, Moody’s projected India’s GDP growth for FY25 at 7%, a decline from the 8.2% growth recorded in FY24. The downgrade stems from a combination of global and domestic economic slowdowns, rising inflationary pressures, and geopolitical tensions that have adversely affected supply chains and global demand.

Key Factors Influencing the Downgrade

- Global Economic Slowdown: Slower global demand and geopolitical uncertainties have impacted India’s export potential.

- Inflationary Pressures: Persistent inflation and tight monetary policies have dampened consumer demand and private investment.

- Sectoral Performance: Weak performance in industrial sectors, coupled with supply chain disruptions, has contributed to the overall economic slowdown

India’s Q2 GDP Growth Slows to 5.4%

- Q2 GDP Data: 5.4% growth for the July-September quarter of 2024.

- RBI Forecast: The RBI had earlier predicted 6.8% growth for the same period but downgraded its forecast to 6.5% a month ago.

- Comparison: This is the slowest growth since the October-December quarter of 2023.

- Sector Performance:

- Weak Consumption: Consumption showed signs of weakness, particularly in sectors like FMCG and cement.

- Slowed Capex: Government capital expenditure growth dropped to 5.4% in Q2, which had been a key driver of previous growth.

- Earnings Growth: Earnings growth in key companies, like those in the Nifty, grew by just 4%, the second consecutive quarter of low growth.

What were the Reasons?

- Due to poor performance of manufacturing and mining sectors as well as weak consumption.

- But the country continued to remain the fastest-growing large economy.

- Q2 FY 2023-24 Performance: The GDP grew by 1% in the July-September quarter of FY 2023-24.

- Q1 FY 2023-24 Performance: GDP growth in the April-June quarter of FY 2023-24 stood at 7%.

- Previous Low: The lowest GDP growth in recent times was recorded at 4.3% during the October-December quarter of FY 2022-23.

Sector-Wise Performance

- Agriculture and Allied Sectors: Growth accelerated to 5% in Q2 FY 2024-25, compared to 1.7% in the year-ago period.

- Manufacturing Sector: Gross Value Added (GVA) growth slowed to 2.2% in Q2, a steep decline from 3% in the same quarter last year.

- Mining and Quarrying: GVA contracted marginally at -0.01%, compared to a robust growth of 1% a year ago.

- Construction Sector: Growth moderated to 7% in Q2, down from 13.6% year-on-year.

- Financial, Real Estate, and Professional Services: GVA growth improved slightly to 7%, up from 6.2% in the year-ago quarter.

- Electricity, Gas, Water Supply, and Other Utilities: GVA growth slowed to 3%, compared to 10.5% in Q2 FY 2023-24.

- Eight Key Infrastructure Sectors

- October 2024: Growth slowed to 1%, a sharp decline from 12.7% in October 2023.

- September 2024: Monthly growth stood at 4%.

Positives in the Indian Economy

- Government Spending

- Fiscal spending is expected to increase post-elections.

- CRR Cut: Recent cash reserve ratio reductions have released additional funds into the banking system.

- Capex Cycle Revival: Renewed investment-led growth is observed in some sectors, with surging order backlogs for capital goods companies indicating improved activity.

- Utilities Pivot: A shift from renewables back to thermal power could boost industrial growth after years of no thermal capacity additions.

- Possible MSME Recovery

- MSMEs, hit by shocks like demonetization, GST implementation, and the pandemic, are potentially recovering and competing with corporates.

- Rural Recovery: Consumption is rebounding in rural areas despite urban growth slowing.

- Employment Gains: Periodic Labour Force Survey (PLFS) indicates improved salaried employment and increased female labor force participation:

- Post-graduate women’s employment rose from 34.5% (FY18) to 39.6% (FY24).

- Higher secondary-level women’s employment increased from 11.4% to 23.9%.

- Growth in Services

- Services Surplus: Hit a new high in October 2024, driven by IT exports, cross-border telecom bandwidth expansion, and remote working trends.

- Goods vs. Services Exports: Services exports surpassed goods exports in November 2024 due to strong IT growth and disrupted goods demand.

- Technology Risks: New AI technologies could challenge IT export composition.

Negatives in the Indian Economy

- Sluggish Investments

- Corporate investment is struggling despite pre-Covid corporate tax cuts.

- Urban Demand Issues: Companies like Nestle and Tata Consumer report muted urban demand due to high food inflation and election-related factors.

- Challenges in Investment Environment: India’s tax laws and administration hinder optimism.

- Savings-Investment Gap

- Declining Savings: Household financial savings fell to 5.3% of GDP in FY23 from 7.3% in FY22, below the 8% average of the last decade.

- Rising Debt: Household debt jumped to 5.8% of GDP, the second-highest since the 1970s.

- Financial savings increasingly bypass the banking sector, causing further concerns.

- Sliding Credit Growth

- Credit growth for households and industries has been declining since 2021.

- Bond-Financed Government Spending: Largely used for cleaning old debt rather than stimulating growth.

- Rising NPAs: New non-performing asset concerns in personal loans and credit card segments, which are unsecured and carry high interest rates.

- Fiscal Prudence

- Centre: Fiscal deficit reduction (6.4% to 5.9% of GDP in FY24) stabilizes public debt at ~83% of GDP.

- States: Increasing subsidies (farm waivers, cash transfers) pose a fiscal problem.

- Cost of Handout Schemes: 14 states may spend Rs 1.9 lakh crore annually (~0.6% of GDP) on women-targeted schemes by 2025.

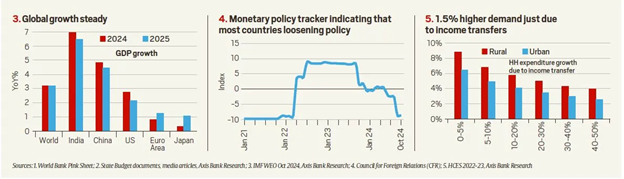

IMF Projects India’s GDP Growth at 7% for FY25

The International Monetary Fund (IMF) has retained India’s GDP growth projection at 7% for FY25, reinforcing its confidence in the country’s strong economic recovery and resilience. This growth forecast positions India as one of the fastest-growing major economies globally. The IMF’s optimistic outlook is driven by strong domestic demand, improving investment, and robust government initiatives promoting economic expansion.

On a global scale, the IMF noted that the fight against inflation is mostly over, with many countries experiencing a significant reduction in inflationary pressures due to tight monetary policies. However, the IMF also issued warnings about emerging risks that could threaten economic stability, including geopolitical tensions, climate change, and potential financial market disruptions.

World Bank Raises India’s Growth Forecast to 7% for FY25

The World Bank has raised its forecast for India’s economic growth to 7% for the fiscal year 2024-25, up from its previous estimate of 6.6%. This optimistic revision comes in light of a recovery in agriculture, an increase in rural demand, and robust government infrastructure investments, despite a slowdown in the April-June quarter due to lower government spending during national elections.

Key Drivers Behind Growth

- Agricultural Recovery & Rural Demand

India’s agricultural sector has shown signs of recovery, with increased rural demand contributing significantly to the growth projection. This positive trend underscores the resilience of rural economies. - Infrastructure Spending

The government’s ongoing investments in infrastructure have played a crucial role in bolstering growth prospects, driving both short-term and long-term economic stability.

Challenges and Outlook

- Unemployment

Despite the upward growth forecast, unemployment remains a key concern. The urban unemployment rate has averaged 17%, and addressing job creation will be critical for sustaining this growth. - Medium-Term Growth Prospects

The World Bank projects India’s average economic growth to remain strong, around 6.7%, over the next two fiscal years. Increased private investment is expected to support recovery in consumption and boost overall economic activity.

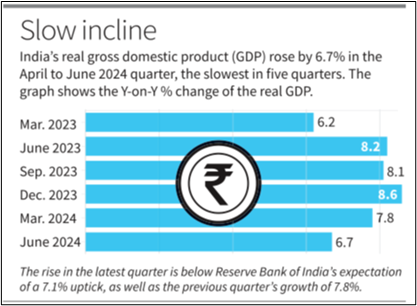

India’s Q1 FY25 GDP Data Highlights

- GDP Growth: India’s GDP growth slowed to 6.7% in Q1 FY25, marking the lowest growth rate in five quarters.

- Real GVA Growth: The Gross Value Added (GVA) at constant prices grew by 6.8%.

- Economic Impact: The slowdown is attributed to factors including global economic uncertainties and domestic challenges.

- Sector Performance: Key sectors such as manufacturing and services showed varied performance, influencing the overall growth rate.

- Policy Response: The government and RBI may consider policy adjustments to stimulate growth and address underlying economic issues.

Sectoral Performance

- Manufacturing and Construction: Manufacturing grew by 7.0% and construction by 10.5% in Q1 2024-25.

- These figures are higher compared to 5% and 8.6% growth respectively in the same period last year.

- Agriculture: The agriculture sector posted a Gross Value Added (GVA) growth rate of 2.0%, a decline from 3.7% last year.

- Mining: GVA growth of 7.2% compared to 7.0% in the previous year.

- Services Sector:

- Trade, Hotels, Transport, Communication & Broadcasting: GVA growth of 5.7%, down from 9.7% in the previous year.

- Financial, Real Estate & Professional Services: Growth slowed to 7.1% compared to 12.6% last year.

- Public Administration, Defence & Other Services: Grew by 9.5%, up from 8.3% in the same quarter last year.

Capital Expenditure (Capex)

- Government capital expenditure contracted sharply by 35% in Q1, and by 18% in April-July, attributed to the election phase.

- Private Final Consumption Expenditure and Gross Fixed Capital Formation have witnessed growth rates of 7.4 per cent and 7.5 per cent, respectively, during this period.

Current Status and Challenges

- Election Impact on Public Spending: The prolonged general election has significantly delayed public capital expenditure (capex), putting pressure on the government to intensify efforts to meet its spending targets.

- Private Consumption: Private consumption spending saw a rise partly due to easing headline inflation. However, food prices remain high.

- Monsoon and Agriculture: The monsoon has been better than last year but has been inconsistent in both time and space.

- As a result, farm GVA growth reached a four-quarter high of 2%.

- The upcoming weeks will be crucial in determining whether the agricultural sector truly recovers, which is necessary for cooling food inflation.

- Projections of above-normal rainfall in September could negatively impact standing kharif crops, making this a key factor for the RBI to monitor.

Future Outlook

- RBI’s Concern: Members of the RBI’s independent monetary policy panel have suggested that a 1% GDP growth loss could occur this year and the next if interest rate cuts are delayed.

- Medium-Term Growth Expectations: India’s growth is still expected to be between 6.5% and 7% for this fiscal year.

- However, growth is anticipated to decline to 6.5% in 2025-26.

- The medium-term growth potential is likely stabilising around this figure, which is considered insufficient for the country’s needs.

India’s GDP Growth Rate in Two Phases (1950-2024)

The Indian Growth Story can be categorised into two categories to see the key drivers of growth:

Phase 1 (1950-2014)

- Low GDP growth below 5% for the last two years.

- High food inflation.

- Structural constraints hindering growth:

- Slow project decision-making.

- Inefficient subsidies.

- Large informal sector.

Phase 2 (2014-2024): Transformative Growth

- Numerous structural reforms strengthened macroeconomic fundamentals.

- India became the fastest-growing G20 economy.

- Job creation and impressive post-pandemic recovery.

- Key reforms:

- Goods and Services Tax (GST)

- Insolvency and Bankruptcy Code (IBC)

- Infrastructure development

- Demonetization, credited for boosting cashless payments.

Check here: Economic Survey 2024 (Pre-General Election)

India Remains Fastest-Growing Major Economy

The Finance Ministry has officially declared India as the fastest-growing major economy globally. In the July-September quarter of 2023-24, India recorded an impressive 7.6% economic growth, propelled primarily by stellar performances in the manufacturing, mining, and services sectors.

Key Contributors to Growth

Several factors have been instrumental in India’s economic surge, including robust domestic fundamentals, low inflation expectations, a surge in investment demand, a notable uptick in industrial activity, and sustained strength in domestic demand.

Global Economic Impact

India’s growth trajectory is poised to leave a substantial imprint on the global stage. Projections indicate that over the next five years, India’s growth is expected to contribute significantly, accounting for 12.9% of global economic expansion. This surpasses the projected share of the United States, which stands at 11.3%. India’s economic prowess positions it as a key driver of global growth in the coming years.

What is GDP of India?

GDP is the total monetary or market value of all finished goods and services produced within a country’s borders in a given time period. It serves as a comprehensive scorecard of a country’s economic health because it is a broad measure of overall domestic production. The government changed the base year for national accounts in January 2015 from the previous base year of 2004-05 to the new base year of 2011-12 and national accounting’s base year had already undergone revision in January 2010.

The Gross Domestic Product (GDP) at factor cost was abandoned in favour of the gross value added (GVA) at basic prices adopted by other countries in the new series by the Central Statistical Office (CSO).

Real vs Nominal GDP

| Aspect | Nominal GDP | Real GDP |

| Definition | Total market value of all final goods and services produced in a country during a specific period, calculated using current market prices. | Economic output adjusted for inflation, reflecting the actual quantity of goods and services produced. |

| Adjustment | No adjustment for inflation. Reflects current year prices. | Adjusted for inflation to reflect the constant prices over time. |

| Measurement | Measures the current market value of production. | Measures the actual volume of production. |

| Use in Analysis | Useful for current economic assessment but can be misleading for comparisons over time or across countries due to inflation. | Provides a more accurate comparison of economic performance over time by isolating real output from price changes. |

| Calculation | Calculated based on current prices without adjusting for inflation. | Calculated using a price index like the Consumer Price Index (CPI) to adjust nominal GDP for inflation, showing the real value of output. |

India’s GDP Growth Rate Last 10 years

In 10 years, India has moved from the 10th largest economy of the world to the 5th largest economy of the world. In 10 years, India is now seen as a country with immense potential which is backed by impressive performance.” India’s GDP Growth rate in the last 10 years has been at an average Growth rate of 6-7 per cent. From 2006 to 2023, India averaged 6.15 per cent, with a high of 8.7 per cent in 2022 and a low of -6.6 per cent in 2021.

India surpassed the United Kingdom to become the world’s fifth-largest economy. The only countries with economies larger than India’s are the United States, China, Japan, and Germany. In an uncertain world, real GDP growth of 6-6.5% is the new normal, and India is on track to become the third-largest economy by 2029. The table below shows India’s GDP growth rate over the last 10 years as per the Economic Survey:

| Year | GDP Growth Rate |

| 2014-15 | 8.0 |

| 2015-16 | 8.2 |

| 2016-17 | 7.2 |

| 2017-18 | 7.1 |

| 2018-19 | 4.5 |

| 2019-20 | 3.7 |

| 2020-21 | -6.6 |

| 2021-22 | 8.7 |

| 2022-23 | 7.0 |

| 2023-24 | 6.0-6.8 |

It’s important to note that the GDP Growth rate estimates for 2023-24 are subject to change as data becomes available, and the policies have had a significant impact on the Indian economy. However, the estimates suggest India’s economy is expected to rebound strongly in the fiscal year of 2023-24.

List of Chief Ministers of Jammu and Kas...

List of Chief Ministers of Jammu and Kas...

Cabinet Committee on Security Suspends I...

Cabinet Committee on Security Suspends I...

Pahalgam Terror Attack: All Eyes on Paha...

Pahalgam Terror Attack: All Eyes on Paha...