Table of Contents

Context: As the transition to clean energy becomes imperative, India’s tryst with hydrocarbons can offer a roadmap of what not to do.

India’s Fossil Fuel Lessons for Net Zero Background

- Four decades back, India introduced the upstream (exploration and production) petroleum sector, occupied by the public sector enterprises, to market and competition. The decision was driven by the strategic imperative to reduce India’s exposure to external supply shocks.

- In 2020, India introduced the production-linked incentive (PLI) scheme to incentivize investment, inter alia, in the minerals, components and equipment required for the generation and consumption of clean energy.

- These provide learnings to develop a self-sufficient fossil fuel energy system as guideposts for the current effort to transition to a self-reliant (atmanirbhar) clean energy system.

Decoding the Editorial: Lessons to the Clean Energy Sector from the Hydrocarbon Sector

- Clean energy sector must not presume that the availability of technical talent and capital will be enough.

- The liberalisation of upstream petroleum widened the gap between the domestic demand for petroleum and indigenous supply. The economic, technical and operating ecosystem must enable their conversion into commercially useful products.

- The bulk of India’s hydrocarbon resources are located in harsh terrain and complex geology. They are:

- Difficult to locate and even when located,

- Difficult to produce on a commercial basis.

- This is because of the high cost of drilling and development.

- The system will have to minimise the avoidable costs associated with procedural red tape like land acquisition, erratic supplies of water and power and legal redress.

- Clean energy sector must not presume that technology is sufficient for manufacturing competitiveness.

- The recovery rate of oil and gas from India’s producing fields has averaged between 25-30 per cent. The recovery rate of fields of comparable geology across the world is between 40-60 per cent.

- The reason for this difference is not access to Enhanced oil recovery (EOR) technologies. The reason is the utilisation of these technologies. These have not been efficiently implemented.

- China’s dominance of the clean energy value chain is because its process engineers have perfected the implementation of the several technological steps required to convert raw material into end product.

- India cannot compete on the size of the incentive package.

- Liberalisation triggered the expectation that there would be a flood of investor interest. This did not happen because –

- International companies regarded our geology as high risk and

- They did not consider our fiscal and commercial terms as internationally competitive.

- The PLI scheme could also turn out to be the same.

- The endeavour should instead be to lower entry barriers, ease business conditions and remove the perception that India offers a high-cost operating environment.

- Liberalisation triggered the expectation that there would be a flood of investor interest. This did not happen because –

- The country should desist from building a high-cost, domestic, clean energy hub that is forever dependent on subsidies.

- Like oil, clean energy minerals and components are internationally traded. They can be purchased on the international market.

- India should continue with its two-track policy with China.

- China is the lowest-cost supplier of clean energy components. One track will put us eye-ball-to-eye-ball on the border, the other should strengthen our trading relationship.

- Self-reliance does not have to be built on the bedrock of self-sufficiency.

- India’s dependence on the external market for petroleum does not warrant pricing at a strategic premium to secure self-sufficiency. Oil is tradable and there are multiple sources of supply. The government has in recent years adeptly secured supplies without getting embroiled in domestic or regional politics and conflicts.

Beyond the Editorial

- New Exploration Licensing Policy (NELP): 1997 – 2016

- Directorate General of Hydrocarbons (DGH) is the nodal agency.

- A competitive bidding system ensures that National Oil Companies (NOCs) compete on an equal footing with Indian and foreign companies to secure Petroleum Exploration Licences (PELs).

- Hydrocarbon Exploration and Licensing Policy (HELP): post-2016

- uniform licence for exploration and production of all forms of hydrocarbon,

- an open acreage policy,

- easy to administer revenue sharing model and

- marketing and pricing freedom for the crude oil and natural gas produced.

- There are 26 sedimentary basins in India that can be divided into three categories based on maturity of hydrocarbon resources as under:

- Category-I: Basins, which have reserves and are already producing.

- Category-II: Basins, which have contingent resources pending commercial production.

- Category-III: Basins, which have prospective resources awaiting discovery.

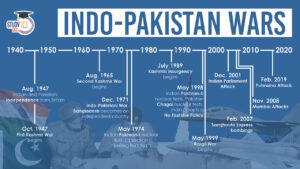

Pakistan-Occupied Kashmir (PoK): History...

Pakistan-Occupied Kashmir (PoK): History...

List of Indo-Pakistan Wars and Conflicts...

List of Indo-Pakistan Wars and Conflicts...

Daily Quiz 24 April 2025

Daily Quiz 24 April 2025