Table of Contents

Context: While addressing the Global Fintech Festival 2023, the governor of RBI asked the FinTech firms to form a Self-Regulatory Organisation (SRO) within a year for better regulation of the sector.

What is FinTech?

- Fintech, short for “financial technology,” refers to the innovative use of technology to deliver a wide range of financial services and products.

- Fintech companies leverage cutting-edge technology, including software, applications, and digital platforms, to create more efficient, accessible, and user-friendly solutions in the financial industry.

- These technologies are typically used to streamline and enhance various financial processes and services, including banking, payments, lending, insurance, investments, and more.

Significance of FinTech

- Financial Inclusion: Fintech has extended financial services to underserved and unbanked populations, particularly in regions with limited traditional banking infrastructure.

- Cost Reduction: By automating processes, eliminating the need for physical branches, and reducing paperwork, fintech can offer services at lower costs compared to traditional financial institutions.

- Improved Customer Experience: FinTech start-ups provide convenience, personalization, transparency, accessibility, and ease-of-use to their customers, empowering them to a high degree.

- Economic Growth: Fintech contributes to economic growth by providing financing options for startups and small businesses, supporting entrepreneurship, and stimulating economic activity.

- Globalization: Fintech has made it easier for individuals and businesses to engage in cross-border transactions and access financial services internationally. This has facilitated global trade and investment.

An Overview of India’s FinTech Sector

- With more than 9,000 fintechs, India is home to the third-highest number of fintechs globally and holds a 14 per cent share of Indian start-up funding.

- Indian FinTech industry’s market size is $ 50 Bn in 2021 and is estimated at ~$ 150 Bn by 2025.

- According to McKinsey India, fintech sector is poised to generate $400 billion in value creation by 2030, indicating a 4X increase from its current level in 2022.

- Some of the top fintech companies in India are Paytm, Razorpay, Pine Labs, Policy Bazaar, Cred, Zeta, and much more.

Growth Drivers of FinTech Sector in India

- Increasing internet & smartphone penetration: India already has the 2nd highest number of smartphone users globally and is the 2nd largest Internet user market.

- The internet penetration rate in India went up to nearly 48.7 percent in 2022, from just about four percent in 2007.

- The number of households with internet connections with an increase by 46%, reaching 233 Mn households by 2026, compared to 160 Mn in 2021.

- Favourable Demographics: 68% of India’s population is young and 55% of its population is in the age group of 20-59 (working population) in the year 2020 and is estimated to reach 56% of the total population by 2025.

- By 2030, India will add 140 Mn middle-income and 21 Mn high-income households which will drive the demand and growth of Indian FinTech space.

- Government Support:

- IndiaStack: IndiaStack is a set of APIs that allows governments, businesses, startups and developers to utilise a unique digital Infrastructure to solve India’s hard problems towards presence-less, paperless, and cashless service delivery.

- JAM Trinity:

- Jan Dhan Yojana: The world’s largest financial inclusion initiative, “Jan Dhan Yojna”, has helped in new bank account enrolment of over 480 Mn beneficiaries.

- Aadhaar: The world’s largest biometric identification system (1.3+ Bn Aadhaars generated so far).

- Mobile connectivity: India has the 2nd highest number of smartphone users.

- The success of UPI: Unified Payment Interface (UPI) is a popular mobile payment method launched by the National Payments Corporation of India in April, 2016.

- From just 1 million transactions in October 2016, UPI has now crossed 10 billion transactions.

- Financial Inclusion Initiatives: Such as PMJDY, DAY-NRLM, Direct Benefit Transfer, Atal Pension Yojana among others have accelerated the digital revolution and brought more citizens, especially in rural areas, within the ambit of digital financial services.

- Financial Literacy: The RBI has set up the National Centre for Financial Education and plans to expand the reach of Centres for Financial Literacy (CFLs) to every block of the country. These steps aim to promote financial education across India for all sections of the population.

- Account Aggregator Framework (AA): AA is an advanced framework of sharing consent based financial information between Financial Information Providers (FIPs) and Financial Information Users (FIUs). With 23 Banks onboarded to the AA framework, more than 1.1 Bn bank accounts are eligible to share data on AA.

- Digital Rupee: India launched its Central Bank Digital Currency (CBDC) or digital rupee or e-rupee recently. It is an electronic version of cash and will primarily accelerate the growth of the FinTech market in India.

Major Challenges associated with the FinTech Sector

- Financial Illiteracy: Only 27% of Indian adults – and 24% of women meet the minimum level of financial literacy as defined by the Reserve Bank of India.

- Regulatory Challenges: Regulation is also a problem in the emerging world of FinTech, especially cryptocurrencies.

- The Indian government is following a wait and watch policy towards cryptocurrencies.

- Absence of regulatory authority has led to increased chances of fraud threat to investor protection and movement of money in the economy.

- Cyber Attacks: Fintech companies in India are becoming an attractive target for hackers due to the sensitive data they store, the large amounts of financial transactions they process, and the potential lack of robust cybersecurity measures in place.

- In 2020, the Indian fintech sector witnessed over 60 per cent of phishing activities outnumbering the healthcare sector.

- Illegal Digital Lending: A Reserve Bank of India (RBI) Working Group on digital lending has identified a whopping 600 illegal lending apps operating in India in the FY 21.

- As per RBI, “Sachet”, a portal established by RBI against unregistered entities, has received approximately 2,562 complaints against digital lending apps between the start of January 2020 to end of March 2021.

Way Forward

- Establishing an Effective Regulatory Framework: A robust regulatory framework marked by transparency is essential for bolstering the fintech sector’s long-term viability.

- Such regulation will not only empower the fintech industry but also act as a catalyst for the Indian economy’s growth by fueling its economic engine.

- Ensuring Data Privacy: A regulatory framework for managing data within the FinTech sector can be collaboratively developed by the Ministries of Corporate Affairs and Electronics and Information Technology.

- It should mandate that FinTech companies use consumer data solely for the benefit of the consumer and not for any other purpose.

- Raising Consumer Awareness: Alongside implementing technological safeguards, educating and training consumers will play a pivotal role in democratizing fintech and safeguarding against cyberattacks.

SSC CGL Exam 2025 Apply Online Starts Ap...

SSC CGL Exam 2025 Apply Online Starts Ap...

Daily Quiz 19 April 2025

Daily Quiz 19 April 2025

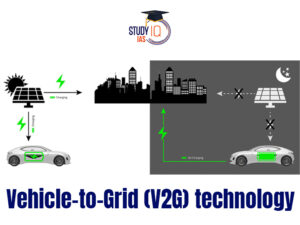

Vehicle-to-Grid (V2G) Technology and its...

Vehicle-to-Grid (V2G) Technology and its...