Table of Contents

Context

- The Bilateral Investment Treaty (BIT) between India and the United Arab Emirates (UAE), marks a significant shift in India’s investment treaty framework.

- This treaty replaces the previous agreement, the Bilateral Investment Promotion and Protection Agreement (BIPPA).

|

Fact |

| It was signed on 13th February, 2024 and entered into force from 31st August, 2024. |

Key Features of the India-UAE BIT

- Exhaustion of Local Remedies: The BIT reduces the period for foreign investors to exhaust local remedies before seeking international arbitration from 5 years to 3 years.

- This change aims to provide quicker access to Investor-State Dispute Settlement (ISDS) mechanisms, addressing concerns about lengthy judicial processes in India.

|

Fact |

In case of a violation of a Bilateral Investment Treaty (BIT)

|

- Definition of Investment: The BIT simplifies the definition of what constitutes an investment by removing the requirement that it must significantly contribute to the host state’s development.

- Instead, an investment must demonstrate key economic characteristics such as capital commitment, profit expectation, and risk assumption.

- This alteration reduces subjective interpretations by ISDS tribunals.

- Treatment of Investments: Article 4 explicitly lists circumstances under which state actions may constitute treaty violations, such as denial of justice or fundamental breaches of due process.

- Notably, this article does not reference customary international law (CIL), which previously allowed arbitral tribunals to interpret the law more broadly.

- This omission aims to provide greater clarity and limit arbitral discretion.

| Fact |

|

- Exclusion of Most-Favoured-Nation (MFN) Clause: The India-UAE BIT does not include an MFN provision, which is crucial for non-discrimination in international economic relations.

- Taxation Issues: The BIT excludes state actions related to taxation from its scope, meaning foreign investors may not challenge tax measures even if deemed abusive, thereby maximising state regulatory powers at the expense of investment protection.

- Limitation on ISDS Tribunal Jurisdiction: Article 14.6(i) bars ISDS tribunals from reviewing the merits of domestic court decisions.

- Ambiguity: States might interpret merits to block ISDS claims on cases already adjudicated domestically.

- Disallowance of Third-Party Funding: Investors cannot rely on external financiers to fund ISDS claims. This impacts investors’ ability to pursue claims without sufficient financial backing.

- Fraud and Corruption Exclusion: ISDS becomes unavailable if there are allegations of fraud or corruption against the investor.

Implications

- The India-UAE BIT aims to enhance bilateral economic cooperation by providing a stable legal framework that encourages investment flows between the two nations.

- The UAE contributed approximately $19 billion from April 2000 to June 2024 (about 3% of total FDI inflows) into India.

- The treaty’s introduction comes at a time when India’s previous investment treaties have faced challenges, leading to a decline in active bilateral treaties and a drop in FDI inflows—specifically a 24% decline in equity inflows and a 15.5% reduction in total FDI between April 2023 and September 2024.

- Experts suggest that while the BIT may attract more UAE investments into India, it could also increase the likelihood of arbitration claims against India due to reduced local remedy requirements.

- This duality reflects India’s attempt to balance investor protection with its sovereign right to regulate.

List of Chief Ministers of Jammu and Kas...

List of Chief Ministers of Jammu and Kas...

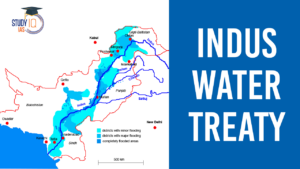

Cabinet Committee on Security Suspends I...

Cabinet Committee on Security Suspends I...

Pahalgam Terror Attack: All Eyes on Paha...

Pahalgam Terror Attack: All Eyes on Paha...