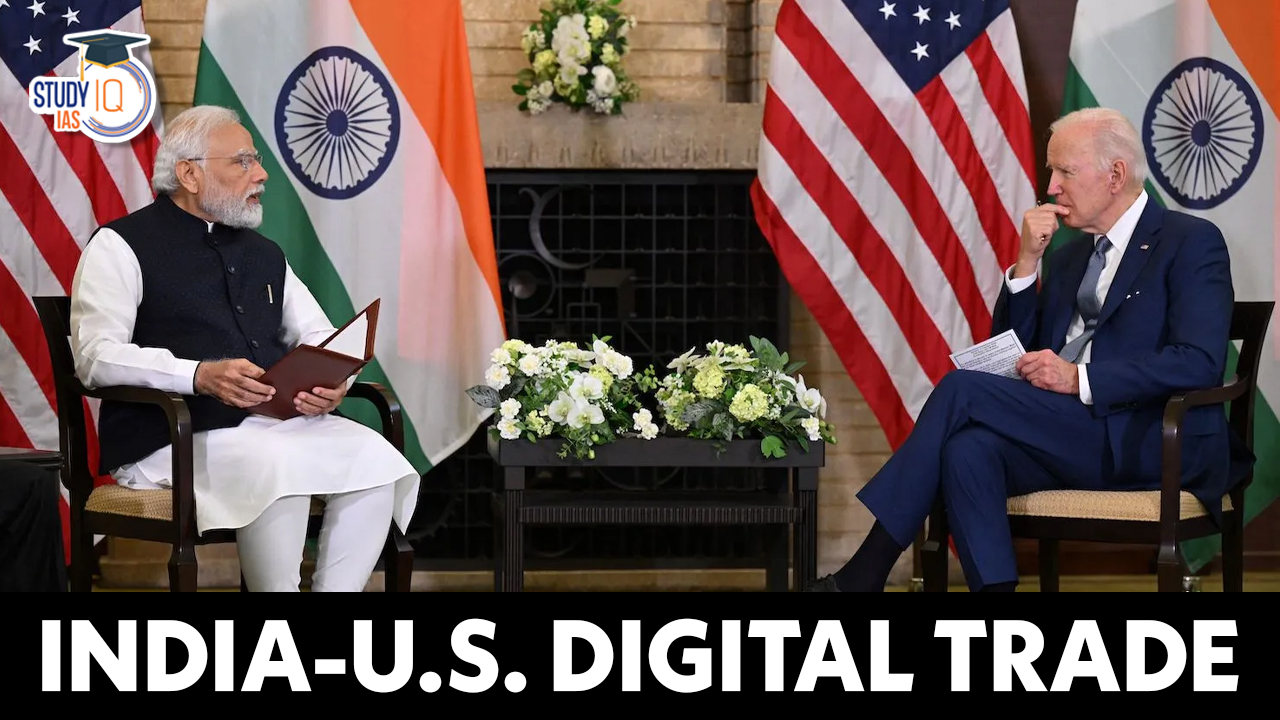

Context: During the recent state visit of the Prime Minister to the United States, technology emerged as a significant area of cooperation, resulting in several positive outcomes; however, several US tech companies have expressed concerns about policy barriers affecting digital trade with India.

Current Status of India-U.S. Technology Trade

- In terms of overall bilateral trade, the United States emerged as India’s largest trading partner in FY2023, with a 7.65% increase in bilateral trade to $128.55 billion in 2022-23.

- However, digital or technology services did not emerge as one of the leading sectors in bilateral trade.

- In recent times, however, both the countries have been intensifying their technology partnership through initiatives such as the Initiative on Critical and Emerging Technology (iCET).

- The iCET was launched by the US President and Indian Prime Minister on the sidelines of the Quad summit on May 2022.

- Under the Initiative, the two nations have unveiled a roadmap for enhanced collaboration in high-technology areas.

- Additionally, under the iCET, India and the U.S. also established a Strategic Trade Dialogue with a focus on addressing regulatory barriers and aligning export controls for smoother trade and “deeper cooperation” in critical areas.

Concerns raised by the U.S. Tech Firms on Digital Trade with India

- Earlier this year, the Computer & Communications Industry Association (CCIA) has flagged 20 policy barriers to trading with India in a note titled “Key threats to digital trade 2023”.

- The CCIA is an international non-profit advocacy organization based in Washington, DC, United States which represents the information and communications technology industries.

- The CCIA include members like Amazon, Google, Meta, Intel, and Yahoo etc.

- Strategic imbalance and misalignment: In its note, CCIA flagged the “significant imbalance” and “misalignment” in the U.S.-India economic relationship.

- It said that “The U.S.’s extension of market access, trade and openness to Indian companies to operate and succeed in the U.S. has not been reciprocated by the Indian side”.

- It also added that the Indian government has deployed a range of “tools to champion their protectionist industrial policy”, tilting the playing field away from U.S. digital service providers in favour of domestic players.

- To describe, it cites the example of India’s guidelines on the sharing of geospatial data, which it accuses of providing preferential treatment to Indian companies.

- Here are the several concerns raised by CCIA regarding India-U.S. digital trade:

| Concerns with Taxation |

Equalisation Levy:

- U.S. tech firms raised concerns about the introduction of the 6% Equalisation Levy in 2016 by the Indian government.

- The equalization levy is aimed at taxing foreign companies which have a significant local client base in India but are billing them through their offshore units, effectively escaping the country’s tax system.

- U.S. tech firms argue that they are already subject to taxes in their home countries, and this levy resulted in double taxation.

- They have also argued that the 2020 amendment to the Equalisation Levy, known as Equalisation Levy 2.0, was sweeping and vague in its scope.

- Equalisation Levy 2.0 imposed a 2% tax on gross revenues received by non-resident e-commerce operators providing services to Indian residents or non-resident companies with a permanent establishment in India.

Global Minimum Tax Deal:

- The CCIA argues that India unilaterally imposed the levies while 135 other countries await clarity on an Organisation for Economic Cooperation and Development (OECD) agreement to overhaul the global tax system.

- Global Minimum Corporate Tax (GMCT) is a direct tax imposed on the net income or profit that enterprises make from their businesses.

- OECD finalized a landmark agreement to subject multinational enterprises (MNEs) to a minimum 15% tax from 2023. A total of 136 countries, including India, have agreed to join the historic agreement.

|

| Concerns with India’s IT Rules 2021 |

- The IT Rules place compliance burden on social media intermediaries (SMIs) and platforms with five million registered users or more, which means several U.S. firms end up falling under the ambit.

- Some points of concern raised are the “impractical compliance deadlines and content take-down” protocols.

- The IT Rules require intermediaries to take down content within 24 hours upon receiving a government or court order.

- The platforms are also required to appoint a local compliance officer.

- There is also major criticism against the government’s institution of the three-member Grievance Appellate Committees (GAC), which will hear user complaints about the decisions of SMIs regarding their content-related issues and have the power to reverse those decisions.

- Additionally, in January 2023, the Ministry of Electronics and IT (MeitY) added another layer of compliance, requiring platforms to make reasonable efforts to prevent the publication of content fact-checked as fake or false by the Press Information Bureau (PIB).

|

| Criticism of the new draft data protection law |

Ambiguities on Cross-Border Data Flows:

- The new draft of the Digital Personal Data Protection Bill still lacks clarity on cross-border data flows.

- Section 17 of the Act states that cross-border data flow will only be allowed to countries notified by the Indian government, but the basis and terms of such transfers are not mentioned.

- Industry experts raise concerns about potential blacklisting of countries not included in the notification, suggesting a need for proactive support of cross-border data flows.

Data Localisation Concerns:

- Data localisation refers to the requirement of storing data created within a country’s borders within that country.

- Foreign tech companies find it convenient to store data outside India, raising concerns about data leaving Indian borders.

- The previous version of the Bill imposed data localisation requirements, but the new draft drops these provisions, leaving room for speculation on de- facto localisation.

|

| Concerns with the Draft Telecom Bill |

Broad Regulatory Ambit:

- The draft Telecommunications Bill, 2022 expands the definition of “telecommunication services” to include internet-enabled services beyond traditional telephony and broadband services.

- The CCIA argues that this broad regulatory ambit may subject platforms to onerous obligations, such as licensing requirements, government access to data, encryption requirements, internet shutdowns, and seizure of infrastructure.

Impact on OTT Communication Services:

- The draft bill categorizes Over-the-top (OTT) communication services, including messaging platforms, under “telecommunication services.”

- The CCIA highlights potential burdensome obligations, licensing requirements, and monetary obligations that could be imposed on the sector.

|

| Other policy barriers to digital trade with India |

Proposed Digital Competition Act:

- Last year, the Parliamentary Committee on Finance proposed a “Digital Competition Act” to address anti-competitive practices by big tech companies.

- The CCIA raises concerns about estimated taxes targeting significant digital intermediaries, which appear to primarily affect U.S. tech companies.

CCI Fines on Google

- CCIA also expressed discontent about the Competition Commission of India (CCI)’s two successive fines of ₹936.44 crore and ₹1,337.76 crore, respectively, on Google last year, for “anti-competitive practices”,

- CCIA went on to categorize this as part of India’s attempt “to use antitrust laws as a smokescreen for protectionist industrial policy”.

|

Sharing is caring!

Daily Quiz 19 April 2025

Daily Quiz 19 April 2025

Vehicle-to-Grid (V2G) Technology and its...

Vehicle-to-Grid (V2G) Technology and its...

Waqf Act (Amendment) 2025: Key Highlight...

Waqf Act (Amendment) 2025: Key Highlight...