Table of Contents

Context: For India to achieve a net-zero economy, hydrogen is a promising substitute for future electricity needs.

Rising Power Demand in India

- Development-driven consumption: As India transitions into a developed economy by 2047, electricity demand is expected to grow significantly due to urbanisation, industrial expansion, electric mobility, and digital infrastructure.

- Eg., According to the National Electricity Plan 2023-2032, published by the Ministry of Power, India’s peak demand is forecast to reach 458 GW in 2032—an 83% increase from 2024.

- Shift to electrification: Sectors such as transport (EVs), cooking (electric stoves), and industry (electric arc furnaces, e-boilers) are increasingly shifting from fossil fuels to electricity, further increasing demand.

- Net-zero commitment: India’s commitment to reach net-zero emissions by 2070 implies a cleaner, more electrified economy. This adds pressure to ensure sufficient, reliable, and low-carbon electricity generation.

Limitations of Conventional Renewable Sources

- Intermittency of solar and wind: While solar and wind are key to India’s renewable push, they generate power only during specific hours or weather conditions, making them unreliable for continuous supply.

- Hydropower limitations: Large hydro projects face environmental, resettlement, and geographical constraints. In addition, climate change impacts water availability, affecting hydroelectric generation.

- Flexibility challenges: Currently, coal-fired plants provide flexibility to balance renewable intermittency, but this is not sustainable for a net-zero future.

Hydrogen as a Strategic Game-Changer (“Hydrogen Factor”)

- Industrial decarbonization: Hydrogen can replace fossil fuels in hard-to-abate sectors like steel (as a reducing agent), cement (high-temperature heat), and fertilisers (as feedstock in ammonia production).

- Grid balancing tool: Hydrogen production through electrolysis can be timed during surplus solar/wind power generation, acting as a buffer to stabilise the grid and reduce curtailment of renewables.

- Energy storage substitute: Hydrogen can store excess renewable electricity in chemical form, offering longer-term and scalable energy storage compared to batteries.

- Export potential: With abundant solar potential, India could become a major exporter of green hydrogen and its derivatives like green ammonia, tapping into global demand from Europe and Japan.

| Nuclear Power In India | ||||||||||

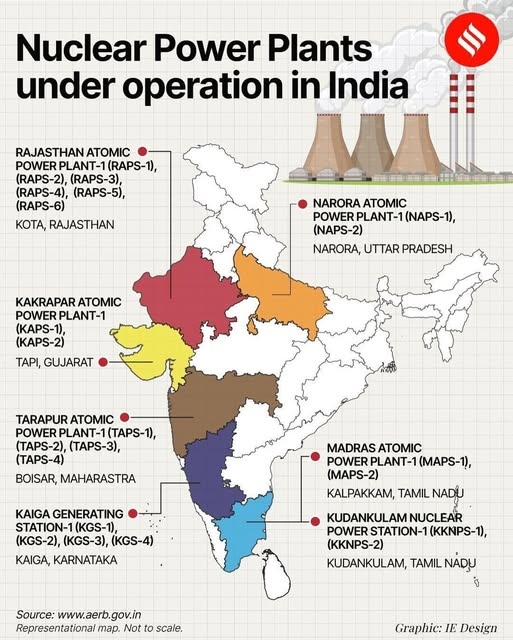

| As of September 2024, India has 23 operational nuclear reactors with a total installed capacity of 8,180 MW, contributing approximately 3% to the country’s electricity generation.

Expansion Targets

Challenges with Nuclear Power

|

Government Push and Policy Support

- National Green Hydrogen Mission: Launched with a budget of ₹19,744 crore, the mission aims to produce 5 million tonnes of green hydrogen annually by 2030 and develop domestic electrolyser capacity.

- Incentives and certification: India offers production incentives and is working on a green hydrogen certification scheme.

- There is also discussion to broaden the term to “low-carbon hydrogen” to include nuclear-based hydrogen.

- Public-private collaboration: Leading PSUs like NTPC, Indian Oil, and private firms are investing in pilot projects for green hydrogen production, storage, and use in transport and refineries.

Challenges Ahead

- High cost of green hydrogen: Green hydrogen is currently more expensive than grey (fossil-based) hydrogen due to the high cost of electrolysers and renewable electricity.

- Infrastructure gap: Hydrogen storage, transport pipelines, and refuelling infrastructure are still underdeveloped in India.

- Technology readiness: Electrolysers and hydrogen-based industrial processes are still evolving; scaling them up efficiently is a major task.

- Policy clarity needed: Regulatory certainty, carbon pricing, and a well-defined taxonomy (e.g., distinguishing green, blue, and nuclear hydrogen) are needed to build investor confidence.

Conclusion

India’s rising power demand, driven by development and decarbonization goals, creates both a challenge and an opportunity. Hydrogen—especially green and low-carbon variants—emerges as a key enabler in this transition. With the right mix of policy, technology, and infrastructure, the ‘hydrogen factor’ can help India not only meet its net-zero ambitions but also position itself as a global clean energy leader.

Mantis Shrimp - Latest Research News and...

Mantis Shrimp - Latest Research News and...

Cheetah Project Steering Committee Key R...

Cheetah Project Steering Committee Key R...

Alfalfa Flowering Plant, Benefits and Nu...

Alfalfa Flowering Plant, Benefits and Nu...