Table of Contents

Highlights of the Interim Budget 2024-25

Social Justice

- Prime Minister to focus on upliftment of four major castes, that is, ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth) and ‘Annadata’(Farmer).

‘Garib Kalyan, Desh ka Kalyan’

- Government assisted 25 crore people out of multi-dimensional poverty in the last 10 years.

- DBT of Rs. 34 lakh crore using PM-Jan Dhan accounts led to savings of Rs. 2.7 lakh crore for the Government.

- PM-SVANidhi provided credit assistance to 78 lakh street vendors. 2.3 lakh have received credit for the third time.

- PM-JANMAN Yojana to aid the development of particularly vulnerable tribal groups (PVTG).

- PM-Vishwakarma Yojana provides end-to-end support to artisans and crafts people engaged in 18 trades.

Welfare of ‘Annadata’

- PM-KISAN SAMMAN Yojana provided financial assistance to 11.8 crore farmers.

- Under PM Fasal BimaYojana, crop insurance is given to 4 crore farmers

- Electronic National Agriculture Market (e-NAM) integrated 1361 mandis, providing services to 1.8 crore farmers with trading volume of Rs. 3 lakh crore.

Momentum for Nari Shakti

- 30 crore Mudra Yojana loans given to women entrepreneurs.

- Female enrolment in higher education gone up by 28%.

- In STEM courses, girls and women constitute 43% of enrolment, one of the highest in the world.

- Over 70% houses under PM Awas Yojana given to women from rural areas.

Empowering the Youth

- 4 crore youth trained under Skill India Mission.

- Fostering entrepreneurial aspirations of Youth-43 crore loans sanctioned under PM Mudra Yojana.

Check here: What is Interim Budget?

Strategy for Amrit Kaal

1. Sustainable Development

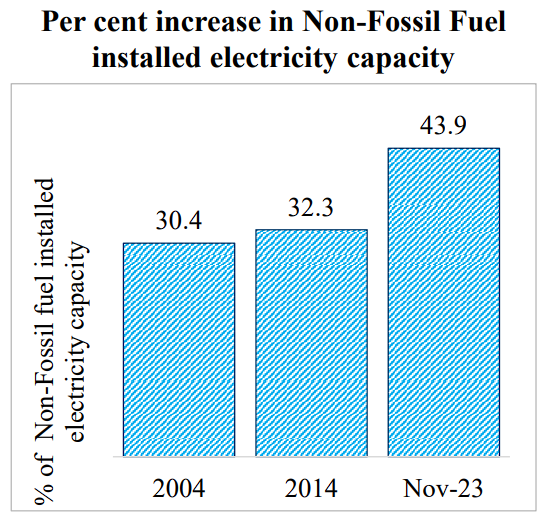

Commitment to meet ‘Net Zero’ by 2070

- Viability gap funding for wind energy

- Setting up of coal gasification and liquefaction capacity

- Phased mandatory blending of CNG, PNG and compressed biogas

- Rooftop solarization and muft bijli

- 1 crore households to obtain 300 units free electricity every month through rooftop solarization.

- Each household is expected to save Rs.15000 to Rs.18000 annually.

- Adoption of e-buses for public transport network

- Strengthening e-vehicle ecosystem by supporting manufacturing and charging

We’re now on WhatsApp. Click to Join

2. Infrastructure and Investment

Infrastructure

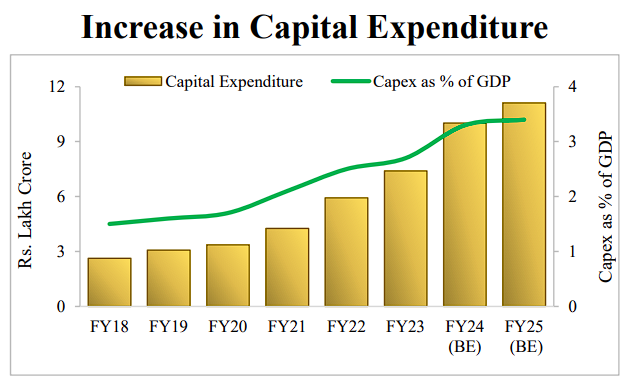

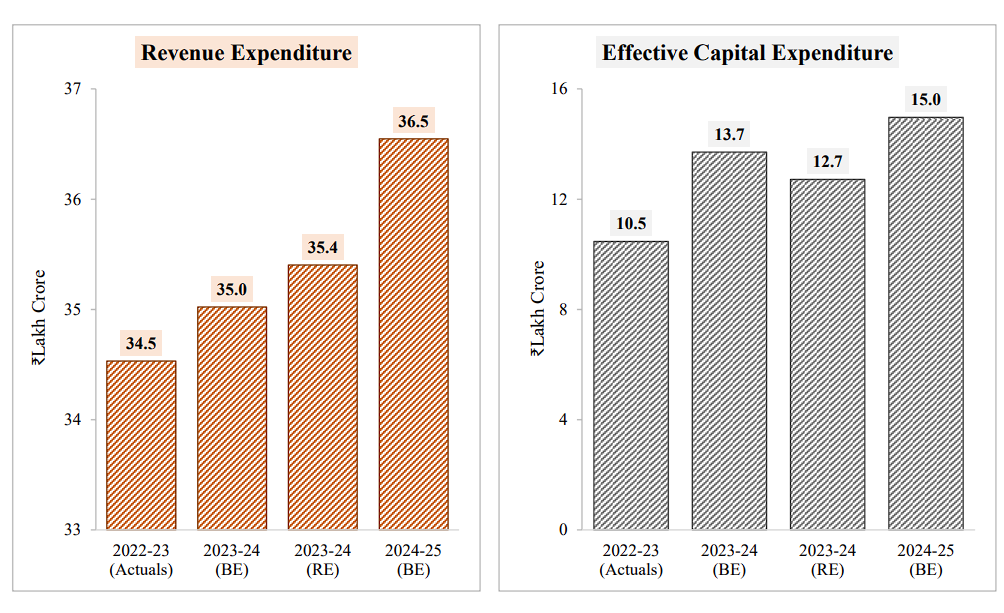

- Capital expenditure outlay for Infrastructure development and employment generation to be increased by 11.1 per cent to Rs.11,11,111 crore, that will be 4 percent of the GDP.

Railways

- 3 major economic railway corridor programmes identified under the PM Gati Shakti to be implemented to improve logistics efficiency and reduce cost

- Energy, mineral and cement corridors

- Port connectivity corridors

- High traffic density corridors

- Forty thousand normal rail bogies to be converted to Vande Bharat standards.

Aviation Sector

- Number of airports in the country doubled to 149.

- Five hundred and seventeen new routes are carrying 1.3 crore passengers.

- Indian carriers have placed orders for over 1000 new aircrafts.

Green Energy

- Coal gasification and liquefaction capacity of 100 MT to be set up by 2030.

- Phased mandatory blending of compressed biogas (CBG) in compressed natural gas (CNG) for transport and piped natural gas (PNG) for domestic purposes to be mandated.

Investments

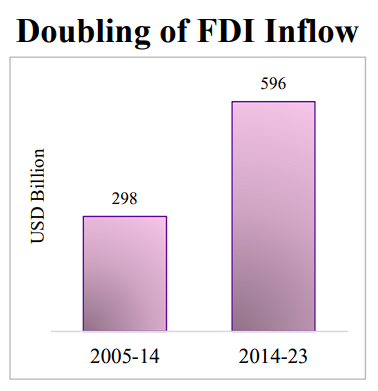

- FDI inflow during 2014-23 of USD 596 billion was twice of the inflow during 2005-14.

3. Inclusive Development

- Aspirational District Programme to assist States in faster development, including employment generation

Health

- Encourage Cervical Cancer Vaccination for girls (9-14 years) Saksham Anganwadi and Poshan 2.0 to be expedited for improved nutrition delivery, early childhood care and development

- U-WIN platform for immunisation efforts of Mission Indradhanush to be rolled out

- Health cover under Ayushman Bharat scheme to be extended to all ASHA, Angawadi workers and helpers Inclusive Development in Aspirational Districts (112)

PM Awas Yojana (Grameen)

- Despite COVID challenges, the target of three crore houses under PM Awas Yojana (Grameen) will be achieved soon.

- Two crore more houses to be taken up in the next five years.

Tourism sector

- States to be encouraged to take up comprehensive development of iconic tourist centres including their branding and marketing at global scale.

- Framework for rating of the tourist centres based on quality of facilities and services to be established.

- Long-term interest free loans to be provided to States for financing such development on matching basis.

Reforms in the States for ‘Viksit Bharat’

- A provision of Rs.75,000 crore rupees as a fifty-year interest free loan is proposed to support milestone-linked reforms by the State Governments.

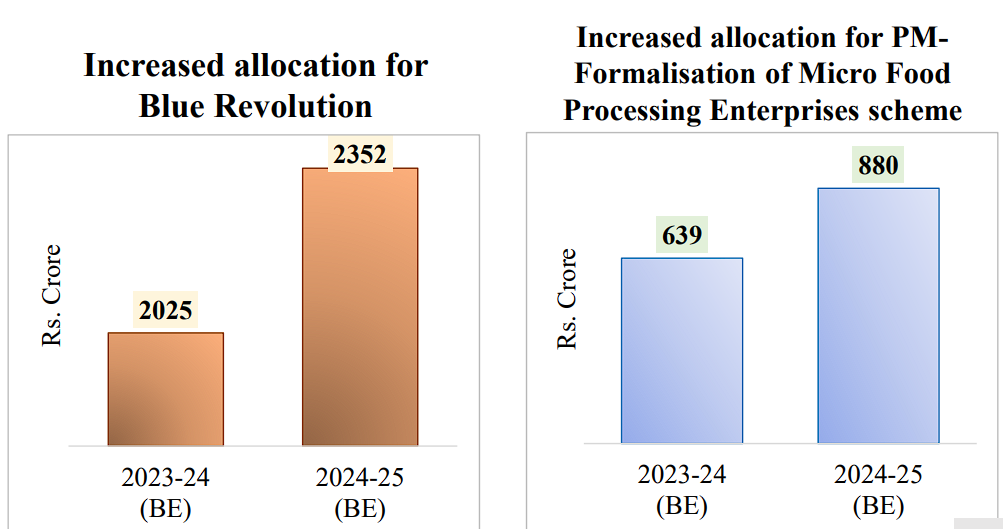

4. Agriculture and Food Processing

- Pradhan Mantri Kisan Sampada Yojana has benefitted 38 lakh farmers and generated 10 lakh employment.

- Pradhan Mantri Formalisation of Micro Food Processing Enterprises Yojana has assisted 2.4 lakh SHGs and 60000 individuals with credit linkages.

Research and Innovation for catalyzing growth, employment and development

- A corpus of Rs.1 lakh crore to be established with fifty-year interest free loan to provide long-term financing or refinancing with long tenors and low or nil interest rates.

- A new scheme to be launched for strengthening deep-tech technologies for defence purposes and expediting ‘atmanirbharta’.

Revised Estimates (RE) 2023-24

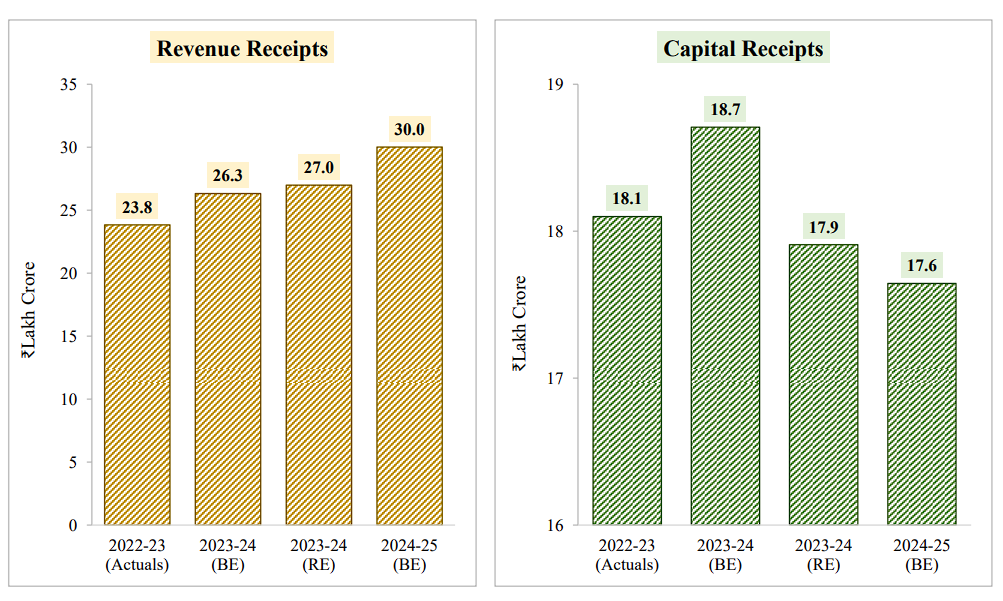

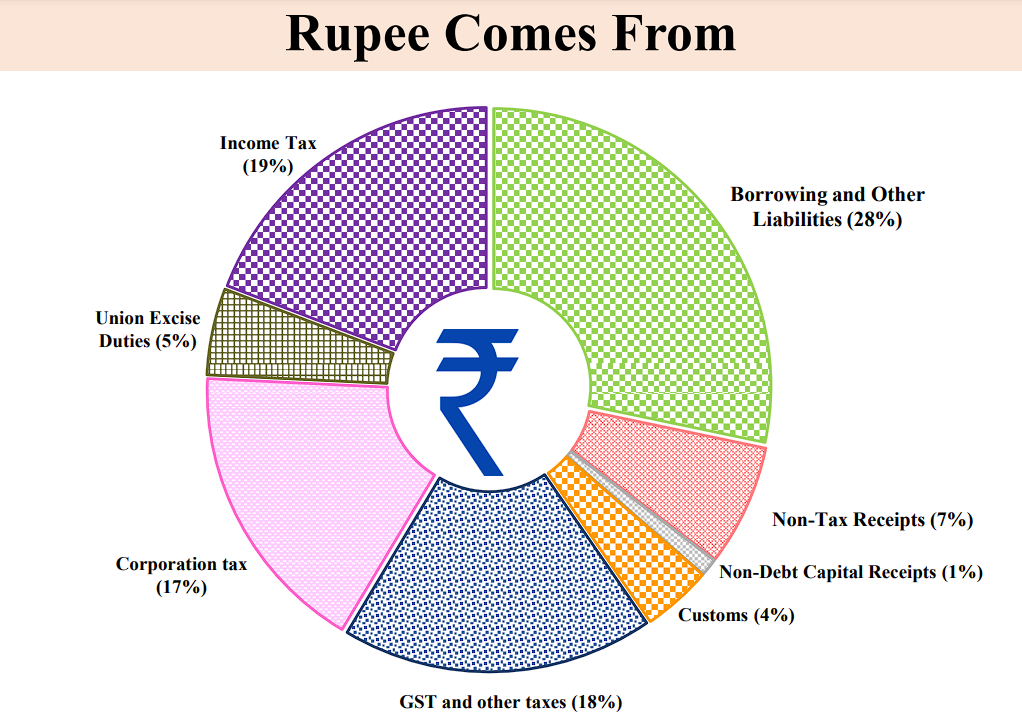

- RE of the total receipts other than borrowings is27.56 lakh crore, of which the tax receipts are Rs.23.24 lakh crore.

- RE of the total expenditure is Rs.44.90 lakh crore.

- RE of the fiscal deficit is 5.8 per cent of GDP for 2023-24.

Budget Estimates 2024-25

- Total receipts other than borrowings and the total expenditure are estimated at Rs.30.80 and Rs.47.66 lakh crore respectively.

- Tax receipts are estimated at26.02 lakh crore.

- Fiscal deficit in 2024-25 is estimated to be 5.1 per cent of GDP

Achievements of Taxation Reforms

- Direct Tax Milestones:

- Tripled direct tax collection in the last decade.

- Return filers increased 2.4 times.

- Efficient Refund Process:

- Reduced average processing time for returns from 93 days (2013-14) to 10 days (2023-24).

- Gross GST Collections Surge:

- Average monthly Gross GST collections doubled to ₹1.66 lakh crore in FY24.

- State Revenue Boost:

- Tax buoyancy of State revenue increased from 0.72 (2012-16) to 1.22 in the post-GST period (2017-23).

- Consumer Benefits:

- Reduced logistics costs and prices of most goods and services.

- Positive GST Impact:

- 94% industry leaders view the transition to GST as largely positive.

- 80% of respondents feel GST has led to supply-chain optimization.

Tax Proposals

- Tax Continuity for Start-ups and Investments:

- Tax benefits for start-ups and investments by sovereign wealth funds/pension funds extended.

- Tax exemption for certain IFSC units extended until 31.03.2025.

- Direct Tax Demand Withdrawal:

- Withdrawal of outstanding direct tax demand:

- Up to ₹25,000 for FY10.

- Up to ₹10,000 for FY11-FY15.

- Expected to benefit approximately 1 crore taxpayers.

- Retention of Tax Rates:

- Continuation of same tax rates:

- Corporate Taxes: 22% for existing domestic companies, 15% for certain new manufacturing companies.

- No tax liability for taxpayers with income up to ₹7 lakh under the new tax regime.

- Continuation of same tax rates:

GPS Spoofing and Its Impact in India: A ...

GPS Spoofing and Its Impact in India: A ...

Amrit Gyaan Kosh Portal: A Comprehensive...

Amrit Gyaan Kosh Portal: A Comprehensive...

Regional Rural Banks in India, Objective...

Regional Rural Banks in India, Objective...