Table of Contents

Context: Global Minimum Tax: Members of the European Union have recently agreed in principle to implement a minimum tax of 15% on big businesses.

Global Minimum Tax News

- This is in accordance with Pillar 2 of the global tax agreement framed by the Organisation for Economic Cooperation and Development (OECD) in 2021.

- In 2021, 136 countries had agreed on a plan to redistribute tax rights across jurisdictions and enforce a minimum tax rate of 15% on large multinational corporations.

- It is estimated that this minimum tax rate would boost global tax revenues by $150 billion annually.

Understanding Global Minimum Tax

- A Global Minimum Tax (GMT) applies a standard minimum tax rate to a defined corporate income base worldwide.

- The framework of GMT aims to discourage nations from tax competition through lower tax rates that result in corporate profit shifting and tax base erosion.

Objectives of Global Minimum Tax Plan

- It aims to ensure that big businesses with global operations do not benefit by domiciling themselves in tax havens in order to save on taxes.

- The minimum tax and other provisions aim to put an end to decades of tax competition between governments to attract foreign investment.

Organization for Economic Cooperation and Development

- The OECD is an intergovernmental economic organisation, founded to stimulate economic progress and world trade.

- Founded: 1961.

- Headquarters: Paris, France.

- Total Members: 36.

- India is not a member, but a key economic partner.

Two Pillars of the Plan

Pillar 1:

- 25% of profits of the largest and most profitable Multinational Enterprise (MNEs) above a set profit margin would be reallocated to the market jurisdictions where the MNE’s users and customers are located.

- It also provides for a simplified and streamlined approach to the application of the arm’s length principle to in-country baseline marketing and distribution activities.

- It includes features to ensure dispute prevention and dispute resolution in order to address any risk of double taxation, but with an elective mechanism for some low-capacity countries.

- It also entails the removal and standstill of Digital Services Taxes (DST) and similar relevant measures, to prevent harmful trade disputes.

Pillar 2:

- It provides a minimum 15% tax on corporate profit, putting a floor on tax competition.

- This will apply to multinational groups with annual global revenues of over 750 million Euros. Governments across the world will impose additional taxes on the foreign profits of MNEs headquartered in their jurisdiction at least to the agreed minimum rate.

- This means that if a company’s earnings go untaxed or lightly taxed in one of the tax havens, their home country would impose a top-up tax that would bring the effective rate to 15%.

Significance of the Plan

- A race to the bottom refers to heightened competition between nations, states, or companies, where product quality or rational economic decisions are sacrificed in order to gain a competitive advantage or reduction in product manufacturing costs.

- BEPS refers to tax avoidance strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations. OECD has issued 15 Action Items to address this.

Limitations of the Plan

Pakistan-Occupied Kashmir (PoK): History...

Pakistan-Occupied Kashmir (PoK): History...

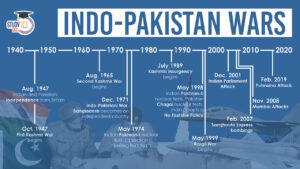

List of Indo-Pakistan Wars and Conflicts...

List of Indo-Pakistan Wars and Conflicts...

Daily Quiz 24 April 2025

Daily Quiz 24 April 2025