Table of Contents

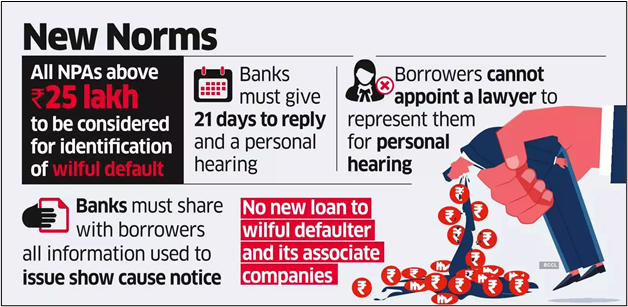

Context: The Reserve Bank of India (RBI) released a Master Direction on the treatment of wilful defaulters.

Framework for Wilful Defaulters

- Objective:

- Establish a transparent and non-discriminatory procedure for classifying borrowers as wilful defaulters

- Disseminate credit information about wilful defaulters to caution lenders against extending further finance to them

- Applicability:

- Effective 90 days from publication

- This applies to all commercial banks, cooperative banks, financial institutions, non-banking financial companies (NBFCs), asset reconstruction companies (ARCs), and credit information companies (CICs)

- Restrictions on further financial accommodations extend to all RBI-regulated entities

- Reporting Requirements:

- Lenders must report wilful defaulters to Credit Information Companies (CICs)

- Responsibility for accurate reporting lies with the lender

- Lenders must cross-check information with relevant databases (e.g., Registrar of Companies)

- Specific guidelines for reporting settled cases, defaulted loans sold to other lenders or ARCs, and accounts resolved under IBC or other frameworks

- Preventive Measures:

- Lenders must implement robust credit appraisal systems

- Monitor end-use of funds

- Scrutinise quarterly progress reports

- Conduct regular inspection of borrowers’ assets

- Perform periodic management audits

- Role of Auditors:

- Critical in detecting and preventing wilful defaults

- Lenders must report negligent auditors to the National Financial Reporting Authority (NFRA) or the Institute of Chartered Accountants of India (ICAI)

What Is Wilful Defaulter?

As per RBI guidelines, a wilful default occurs when a borrower (a person or company) misuses borrowed funds, diverting them from their intended purpose, syphoning off money, or disposing of assets securing a term loan without the lender’s knowledge.

Consequences of Being Declared a Wilful Defaulter

- Credit Access Restrictions:

- Ineligibility to borrow from any financial institution.

- Complete shutdown of access to credit channels.

- Impediment to New Ventures:

- Inability to secure institutional finance for starting new businesses for a period of five years.

- Hindrance to entrepreneurial initiatives.

- Legal Implications:

- Lenders have the option to initiate criminal action against the defaulter.

- Potential legal consequences for the borrower.

- Reporting to Credit Information Companies:

- Banks are obligated to provide a list of wilful defaulters with outstanding loan balances exceeding ₹25 lakh (where suits have been filed) to credit information companies such as CIBIL, Experian, Equifax, and High Mark at the end of each quarter.

- Reporting includes the names of current directors and directors associated with the company when the borrower was declared a defaulter.

- This reporting can deter potential lenders from extending credit to the individual or entity.

Fair and Remunerative Price (FRP), Facto...

Fair and Remunerative Price (FRP), Facto...

Concept of GDP, GNP, NNP and NDP, Basic ...

Concept of GDP, GNP, NNP and NDP, Basic ...

IMF’s Fiscal Monitor and Financial Sta...

IMF’s Fiscal Monitor and Financial Sta...