Table of Contents

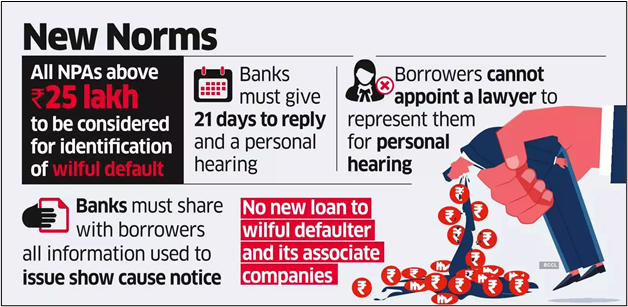

Context: The Reserve Bank of India (RBI) released a Master Direction on the treatment of wilful defaulters.

Framework for Wilful Defaulters

- Objective:

- Establish a transparent and non-discriminatory procedure for classifying borrowers as wilful defaulters

- Disseminate credit information about wilful defaulters to caution lenders against extending further finance to them

- Applicability:

- Effective 90 days from publication

- This applies to all commercial banks, cooperative banks, financial institutions, non-banking financial companies (NBFCs), asset reconstruction companies (ARCs), and credit information companies (CICs)

- Restrictions on further financial accommodations extend to all RBI-regulated entities

- Reporting Requirements:

- Lenders must report wilful defaulters to Credit Information Companies (CICs)

- Responsibility for accurate reporting lies with the lender

- Lenders must cross-check information with relevant databases (e.g., Registrar of Companies)

- Specific guidelines for reporting settled cases, defaulted loans sold to other lenders or ARCs, and accounts resolved under IBC or other frameworks

- Preventive Measures:

- Lenders must implement robust credit appraisal systems

- Monitor end-use of funds

- Scrutinise quarterly progress reports

- Conduct regular inspection of borrowers’ assets

- Perform periodic management audits

- Role of Auditors:

- Critical in detecting and preventing wilful defaults

- Lenders must report negligent auditors to the National Financial Reporting Authority (NFRA) or the Institute of Chartered Accountants of India (ICAI)

What Is Wilful Defaulter?

As per RBI guidelines, a wilful default occurs when a borrower (a person or company) misuses borrowed funds, diverting them from their intended purpose, syphoning off money, or disposing of assets securing a term loan without the lender’s knowledge.

Consequences of Being Declared a Wilful Defaulter

- Credit Access Restrictions:

- Ineligibility to borrow from any financial institution.

- Complete shutdown of access to credit channels.

- Impediment to New Ventures:

- Inability to secure institutional finance for starting new businesses for a period of five years.

- Hindrance to entrepreneurial initiatives.

- Legal Implications:

- Lenders have the option to initiate criminal action against the defaulter.

- Potential legal consequences for the borrower.

- Reporting to Credit Information Companies:

- Banks are obligated to provide a list of wilful defaulters with outstanding loan balances exceeding ₹25 lakh (where suits have been filed) to credit information companies such as CIBIL, Experian, Equifax, and High Mark at the end of each quarter.

- Reporting includes the names of current directors and directors associated with the company when the borrower was declared a defaulter.

- This reporting can deter potential lenders from extending credit to the individual or entity.

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...

Fisheries Sector in India, Current Statu...

Fisheries Sector in India, Current Statu...