Table of Contents

Context

- Kerala filed a lawsuit challenging the Central Government’s decisions to curtail its borrowing limits.

- The Court referred the case to a Constitution Bench without granting an interim order to revert to the pre-limit imposition status but will examine the Union’s authority over State borrowings.

Core Issue of Kerala’s Fiscal Federalism

- Nature of Dispute: The case transcends a mere disagreement over fiscal mismanagement accusations by the Centre against Kerala’s Left Front regime, evolving into a constitutional debate on Centre-State fiscal autonomy.

- Article 293’s Role: At dispute’s centre is Article 293, granting States the executive power to borrow within limits set by their legislatures and the conditions under which the Union can regulate these borrowings.

Kerala’s Arguments

- Against Centre’s Overreach: Kerala argues that Article 293 doesn’t allow the Centre to regulate all State loans, only to impose conditions on loans from the Union.

- Challenge to Borrowing Ceiling: Kerala contests the inclusion of State-owned enterprises’ borrowings and public account liabilities in its Net Borrowing Ceiling, set at 3% of its projected Gross State Domestic Product (GSDP) for 2023-24, or ₹32,442 crore.

- Need for More Spending: For Kerala to leverage its social advancements for economic growth, increased government investment, especially in higher education and research, is advocated.

- Borrowing Justification: A large part of government borrowing comes from domestic financial institutions, suggesting Kerala’s private savings could be tapped for productive investments.

Union Government’s Stance

- Public Finance as National Concern: The Union justified its actions by highlighting the need to prevent off-budget borrowings and manage the general government debt—comprising Central and State debts—capped at 60% of GDP by a 2018 amendment to the Fiscal Responsibility and Budget Management Act.

- Concerns Over Unlimited Borrowing: It argued that unchecked State borrowing could elevate borrowing costs and crowd out the private sector, with a particular emphasis on national fiscal health.

Kerala’s Spending on Social Sector

- Historical Commitment: For four decades (1960s-1990s), Kerala allocated 40%-50% of its budget to social sectors, leading the states until the mid-2000s.

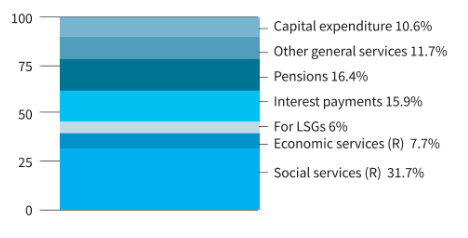

- Local Self-Governments (LSGs): A significant portion (6% in 2022-23) of Kerala’s budget is allocated to LSGs for social sector spending, potentially exceeding the average of other states.

Funding Sources for State Governments

- Three Main Sources: Own revenues, transfers from the Union (tax shares and grants), and market borrowings.

- Kerala’s Fiscal Strategy: In response to COVID-19, Kerala increased its spending to 18% of its GSDP in 2020-21, supported by relaxed borrowing norms.

| State vs. Union Government Spending |

|

| Developmental vs. Non-Developmental Expenditures |

|

Broader Implications

- Impact on State Finances: The case is pivotal at a time when a new revenue distribution formula, perceived as penalising States with better social performance, is in effect. This is particularly significant for Kerala, known for its social advancements.

- Fiscal Space Concerns: The shift to a shared Goods and Services Tax (GST) regime has narrowed fiscal space for States, making the resolution of this case crucial for determining the extent of the Centre’s control over State borrowing and fiscal responsibilities.

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...

New Phase of Operation Chakra to Combat ...

New Phase of Operation Chakra to Combat ...

Soyuz Aircraft: History, Design and Sign...

Soyuz Aircraft: History, Design and Sign...