Table of Contents

Context: Recently, the co-legislators at the European Commission signed the landmark ‘Carbon Border Adjustment Mechanism (CBAM)’.

What is the EU’s Carbon Border Adjustment Mechanism (CBAM)?

- It is a proposed policy that would place a price on the carbon content of certain imported goods.

- Its primary objective is to avert ‘carbon leakage’, which refers to a phenomenon where an EU manufacturer moves carbon-intensive production to countries outside the region with less stringent climate policies in order to avoid carbon pricing or other climate regulations.

- Under the CBAM proposal, importers of certain goods into the EU would be required to purchase emissions allowances at the same cost as EU companies under the EU Emissions Trading System (EU ETS).

- It ensures an equivalent carbon price for domestic and imported production on selected goods. This way, it would also encourage trading partners to reduce their emissions.

- CBAM was legislated as part of the European Green Deal, and CBAM takes effect in 2026, with reporting starting in 2023.

- The European Green Deal, approved in 2020, is a set of policy initiatives by the European Commission with the overarching aim of making the EU climate neutral in 2050.

About the EU Emissions Trading System (EU ETS)

- It is a carbon market based on a system of cap-and-trade of emission allowances for energy-intensive industries and the power generation sector.

- It is the EU’s main tool in addressing emissions reductions.

- Since its introduction in 2005, the EU’s emissions have decreased by 41%.

How will the CBAM work in practice?

- Companies that want to import goods produced outside the EU into the EU will have to purchase certificates corresponding to the amount of emissions generated in the production of those goods.

- The European Commission will calculate the price of CBAM certificates to reflect the average weekly price of ETS auctions.

- This means that CBAM certificates will be pegged to the ETS. This will ensure that the price of CBAM certificates is as close as possible to the price of ETS allowances while also ensuring that the system remains manageable for the administrative authorities.

Which sectors and emissions are covered by CBAM?

- Initially, CBAM will cover direct emissions (scope 1) of selected sectors: iron and steel, cement, aluminum, fertilizers, hydrogen and electricity.

- The greenhouse gas emissions regulated by the CBAM correspond to those emissions covered by Annex I to the EU ETS, namely carbon dioxide (CO2) as well as, where relevant, nitrous oxide (N2O) and perfluorocarbons (PFCs).

- Indirect emissions (scope 2) will not be covered in the initial phase but can be added after the transitional period.

Significance of Carbon Border Adjustment Mechanism (CBAM)

- Achieving Europe’s climate ambitions: CBAM would operate alongside the other policy tools in the ‘Fit for 55’ package.

- Fit for 55 refers to the EU’s target of reducing net greenhouse gas emissions by at least 55% by 2030.

- Generating revenue: The CBAM would generate revenue for the EU, as importers of certain goods would be required to purchase emissions allowances at the same cost as EU ETS.

- Level playing field: The CBAM would create a level playing field for EU companies that are subject to carbon pricing. By placing a price on the carbon content of imported goods, the CBAM would prevent non-EU companies from gaining a competitive advantage by avoiding carbon pricing or other climate regulations.

- Encouraging global action on climate change: The CBAM is expected to encourage non-EU countries to adopt stronger climate policies, as they would face a price on their carbon-intensive exports to the EU.

Challenges associated with the Carbon Border Adjustment Mechanism (CBAM)

- Complexity: The CBAM is a complex policy proposal that involves assessing the carbon content of imported goods, issuing certificates, and ensuring compliance with reporting and payment requirements.

- Trade disputes: The CBAM is likely to face opposition from non-EU countries, who may view the policy as a form of protectionism.

- Complexity of calculating carbon content: It could be challenging to calculate the carbon content of certain products, especially if the production process involves multiple stages or takes place in countries with weaker climate policies.

- Double carbon pricing: There is a risk of double carbon pricing, where companies would be subject to carbon pricing both in the EU and in their home country. This could lead to increased costs for businesses and could undermine the effectiveness of the CBAM.

Why are countries worried?

- In 2021, the United Nations Conference on Trade and Development (UNCTAD) had concluded that Russia, China and Turkey were most exposed to the mechanism.

- Considering the level of exports to the EU, the report stated India, Brazil and South Africa would be most affected among the developing countries.

- Mozambique would be the most exposed least-developing country.

- Why is CBAM a cause of concern for India?

- India is Europe’s third-largest trading partner, and it does not have its own carbon tax or cap. So, CABAM is a cause of concern for India.

- Important to note, countries in the EU combined represent about 14% of India’s export mix for all products, steel and aluminum included.

- Given India’s products have a higher carbon intensity than its European counterparts, the carbon tariffs imposed will be proportionally higher making Indian exports substantially uncompetitive.

- A UNCTAD study predicts that India will lose $ 1-1.7 billion in exports of energy-intensive products such as steel and aluminum.

- And finally, international climate policies (including CBAM) will compel other countries to impose similar regulation eventually translating to “a significant impact” on India’s trading relationships and balance of payments.

What are the other carbon pricing mechanisms available?

SSC CGL Exam 2025 Apply Online Starts Ap...

SSC CGL Exam 2025 Apply Online Starts Ap...

Daily Quiz 19 April 2025

Daily Quiz 19 April 2025

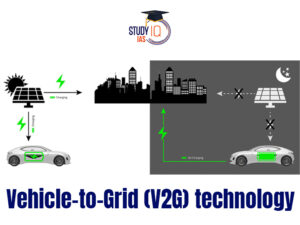

Vehicle-to-Grid (V2G) Technology and its...

Vehicle-to-Grid (V2G) Technology and its...