Table of Contents

Context

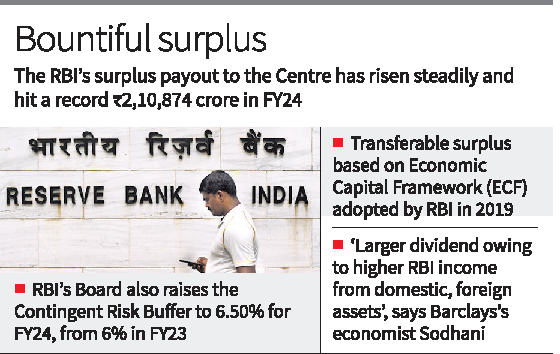

- The Reserve Bank of India (RBI) approved the transfer of a record ₹2,10,874 crore as surplus to the Union government for the accounting year 2023-24.

- This transfer is more than double the ₹87,416 crore transferred in FY23.

More in News

- Contingent Risk Buffer (CRB): The Board decided to increase the CRB to 6.50% for 2023-24, up from 6% in the previous year.

- Economic Capital Framework (ECF): The transferable surplus for 2023-24 was determined based on the Economic Capital Framework (ECF).

Economic Capital Framework

- Adopted: On August 26, 2019.

- Recommended By: The Expert Committee (Chair. former governor Bimal Jalan) to Review the extant Economic Capital Framework of the Reserve Bank of India.

- Objective: To build harmony between the central bank’s need for autonomy and the Government’s objectives of development.

Recommendations of the Bimal Jalan Committee

- Distinction in Economic Capital Components:

- Realised Equity: This should be used for meeting all risks and losses as it is built primarily from retained earnings.

- Revaluation Balances: Should be considered only as risk buffers against market risks since they represent unrealized valuation gains and are not distributable.

- Risk Provisioning for Market Risk: Recommended adopting the Expected Shortfall (ES) methodology under stressed conditions instead of the existing stressed value at Risk.

- Target an ES with a 99.5% confidence level for measuring the RBI’s market risk.

- Size of Realised Equity: Maintain the Contingent Risk Buffer (CRB), primarily from retained earnings, within a range of 5% to 5.5% of the RBI’s balance sheet.

- This includes 5.5% to 4.5% for monetary and financial stability risks.

- 0% for credit and operational risks.

- Surplus Distribution Policy: Recommended a policy targeting the level of realised equity to be maintained by the RBI.

- Only if realised equity is above its requirement, will the entire net income be transferable to the government.

- Periodic Review: Suggested the RBI’s economic capital framework be periodically reviewed every five years.

| Note |

| The RBI has accepted all the recommendations made by the committee. |

Sunrise Sectors in India, Key Characteri...

Sunrise Sectors in India, Key Characteri...

Gold Price Surge in India, Key Drivers a...

Gold Price Surge in India, Key Drivers a...

Fiscal Slippage, Causes and Implications

Fiscal Slippage, Causes and Implications