Table of Contents

Context: Recently, the Lok Sabha passed amendments to the Finance Bill, 2023, which eliminates the indexation benefits on long-term capital gains (LTCG) for debt mutual funds.

Explaining the News

- What are mutual funds?

- A mutual fund is a professionally managed investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Major types of mutual funds include the following:

- Equity funds: Equity funds primarily invest in stocks, and hence go by the name of stock funds as well.

- Debt funds: Debt funds invest primarily in fixed-income securities such as bonds, securities and treasury bills.

- Money Market Funds: They invest in short-term debt securities such as Treasury bills, commercial paper, and certificates of deposit, etc.

- Hybrid funds: Hybrid funds (Balanced Funds) is an optimum mix of bonds and stocks, thereby bridging the gap between equity funds and debt funds.

- The removal of indexation benefits on debt mutual funds:

| Current tax treatment of debt mutual funds | New Amended Rules |

| Currently, debt mutual funds held for over 3 years are considered long-term investments and taxed at 20% with indexation benefit.

If the investor chooses not to avail of the indexation benefit, the long-term capital gains tax rate is 10%. Investments held for less than 3 years are taxed based on the investor’s income tax slab. |

Amendment to the Finance Bill 2023 will reclassify capital gains from debt mutual funds as short-term capital gains, eliminating long-term capital gains.

Furthermore, debt mutual funds held for over 3 years will no longer qualify for indexation benefits and any gains will be taxed as capital gains tax. |

What is the Meaning of Indexation Benefit?

- It is a tax provision that allows investors to adjust the purchase price of an asset for inflation while calculating long-term capital gains tax on the sale of that asset.

- Indexation reduces the overall tax liability of an investor and helps in realizing higher gains.

- The rate of inflation used for indexation is obtained from the Cost Inflation Index (CII).

- CII notified each year by the CBDT is mandated under Section 48 of the Income Tax Act, 1961.

What are the possible impacts of removal of indexation benefits on debt mutual funds?

- At par with Fixed Deposits (FDs): The amendments will bring debt mutual funds on par with Fixed Deposits (FDs), which currently lack tax advantages compared to debt mutual funds.

- According to experts, these changes could lead to people shifting to safer bank FDs over debt mutual funds.

- FDs are safer than debt mutual funds as they offer guaranteed returns unlike the later which are subject to market conditions.

- Impact on bond markets: According to Industry experts, the removal of the indexation benefit is a major loss for bond markets that are still struggling with liquidity. Mutual funds are the only large active institutional investors that bring liquidity in the bond market.

- Affects the deepening of capital market: The new regulations may impede and create hurdles in deepening the capital market in India.

What are Capital Markets?

- A capital market is a financial market where individuals and institutions buy and sell financial securities, such as stocks, bonds, and other long-term investments.

- It provides a platform for raising long-term funds for companies and governments through the sale of securities.

- Capital markets play an important role in allocating resources efficiently and in facilitating economic growth.

What is Capital Market Deepening?

- Capital market deepening refers to the process of increasing the liquidity, efficiency, and accessibility of a country’s capital markets.

- It involves developing financial systems and institutions that support a wider range of financial instruments, increasing participation of investors, and expanding the range of financial services available to them.

- The need for capital market deepening in India?

- Limited Government Resources: Governments have limited resources to finance their own infrastructure and development projects. Capital market deepening can help bridge this gap by providing an alternative source of long-term financing.

- Economic Growth: A deep and liquid capital market can help spur economic growth by facilitating the allocation of capital to productive investments.

- Attracting Foreign Investment: A deep and liquid capital market can help attract foreign investors by providing them with a range of investment options and ensuring the stability of the financial system.

- Diversification of Financing Options: Capital market deepening can help diversify a country’s financing options beyond traditional bank lending, allowing companies to access a wider range of funding sources.

Hurdles for Capital Market Deepening in India

Accredited Social Health Activists (ASHA...

Accredited Social Health Activists (ASHA...

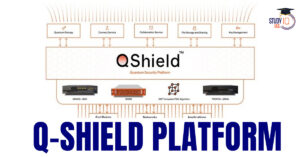

World’s 1st Unique Q-Shield Platform a...

World’s 1st Unique Q-Shield Platform a...

IB ACIO Recruitment Notification 2025 Ex...

IB ACIO Recruitment Notification 2025 Ex...