Table of Contents

Criminalization under GST Regime

- The need for criminalization: Since the implementation of GST, there has been a significant increase in tax evasion.

- Hence the GST law establishes stringent penalties and guidelines in order to ensure smooth trade of goods and to combat corruption and maintain an effective tax collection system.

- Provisions:

- In terms of tax compliance, Section 122 of the CGST Act includes 21 offenses that contribute to tax evasion and can result in a penalty equivalent to the amount of tax evaded by the assessee.

- Section 132 lists around 11 offenses that might lead to criminal proceedings. Some of them include: tax evasion, misuse of input tax credits or tax refunds, falsifying financial accounts etc.

- The person committing any of the offences above shall be punished as follows:

| Tax amount involved | 1-2 Crore | 2-5 Crore | Above 5 Crore |

| Bailable or Non-Bailable | Bailable | Bailable | Bailable |

| Jail term | Up to 1 year | Upto 3 years | Upto 5 years |

- Disadvantages

- The stringent penal provisions of the law significantly alter how businesses perceive risk and uncertainty, directly impacting their ability to conduct business.

- Investors may be discouraged by the fear of criminal sanctions in small, trivial, and petty matters, even before their engagement in any business activity or investment.

Recommendations by the 48th GST Council Meeting

- The council has recommended the following measures to decriminalize the GST offences:

- Raising the minimum threshold of tax amount for launching prosecution under GST from one crore to two crore.

- Reducing the compounding amount from the present range of 50 to 150% of the tax amount to the range of 25 to 100%.

What is Compounding of Offences under GST?

- Compounding means payment of monetary compensation / fine, instead of suffering prosecution for an offence committed, which warrants such prosecution.

- In nut-shell, compounding is simply a compromise between the offender and the department to avoid proceedings.

- Section 138 of the CGST Act, 2017 deals with the compounding of offences under GST.

- Decriminalizing certain offences under Section 132 of the CGST Act, 2017, such as obstructing or preventing any officer from doing his duties, deliberate tempering of material evidence and failure to supply information.

- Impact of Decriminalization:

- By creating a clear bifurcation between minor violations and deliberate duty evasion, this initiative is in line with enhancing the ease of doing business for small firms.

- The potential GST decriminalization will treat minor and willful violators differently, reducing instances of hash penalties borne by small enterprises due to minor and unintentional offenses.

Other Important outcomes of the 48th GST Council Meeting

- Refund to unregistered persons: Earlier there was no procedure for claim of refund of tax borne by the unregistered buyers in certain cases. Now, the council recommended the rules to prescribe the procedure for filing application of refund by the unregistered buyers in such cases.

- Facilitate e-commerce for micro enterprises: The council granted in-principle approval for allowing unregistered suppliers and composition taxpayers to make intra-state supply of goods through E-Commerce Operators (ECOs), subject to certain conditions.

GST Council

- Article 279A – GST Council to be formed by the President to administer & govern GST.

- Its Chairman is Union Finance Minister of India with ministers nominated by the state governments as its members.

- The council is devised in such a way that the centre will have 1/3rd voting power and the states have 2/3rd.

- The decisions are taken by 3/4th majority.

Accredited Social Health Activists (ASHA...

Accredited Social Health Activists (ASHA...

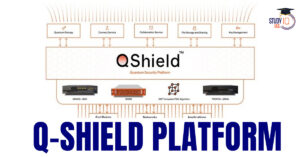

World’s 1st Unique Q-Shield Platform a...

World’s 1st Unique Q-Shield Platform a...

IB ACIO Recruitment Notification 2025 Ex...

IB ACIO Recruitment Notification 2025 Ex...