Table of Contents

Context: The first advance estimates of India’s Gross Domestic Product (GDP) for the fiscal year 2024-25, released by the National Statistics Office (NSO).

What was the Finding?

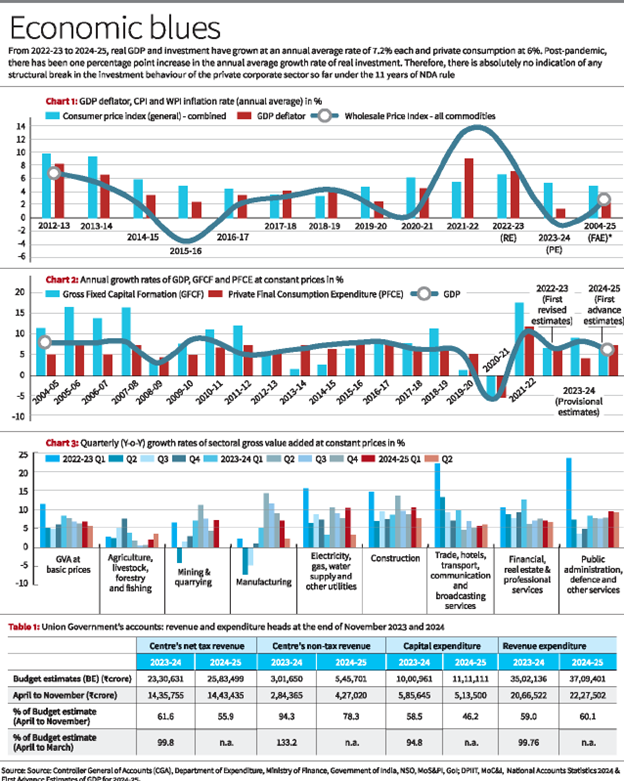

- A decline in the real GDP growth rate to 6.4%, down from 8.2% in 2023-24.

- This figure is below the 6.5% to 7% range projected in the Economic Survey of July 2024.

- The nominal GDP growth rate is estimated at 9.7%, significantly lower than the 10.5% projected in the last Union Budget.

Elusive Private Investment

- Economic Survey Insights: The Economic Survey 2023-24 expressed optimism about private sector investment but raised concerns regarding sluggish corporate investments in machinery and equipment.

- The Union Budget relied heavily on a revival of private corporate capital expenditure (capex) to support initiatives like the ‘Prime Minister’s Package for Employment and Skilling,’ which aimed to benefit 41 million youth over five years.

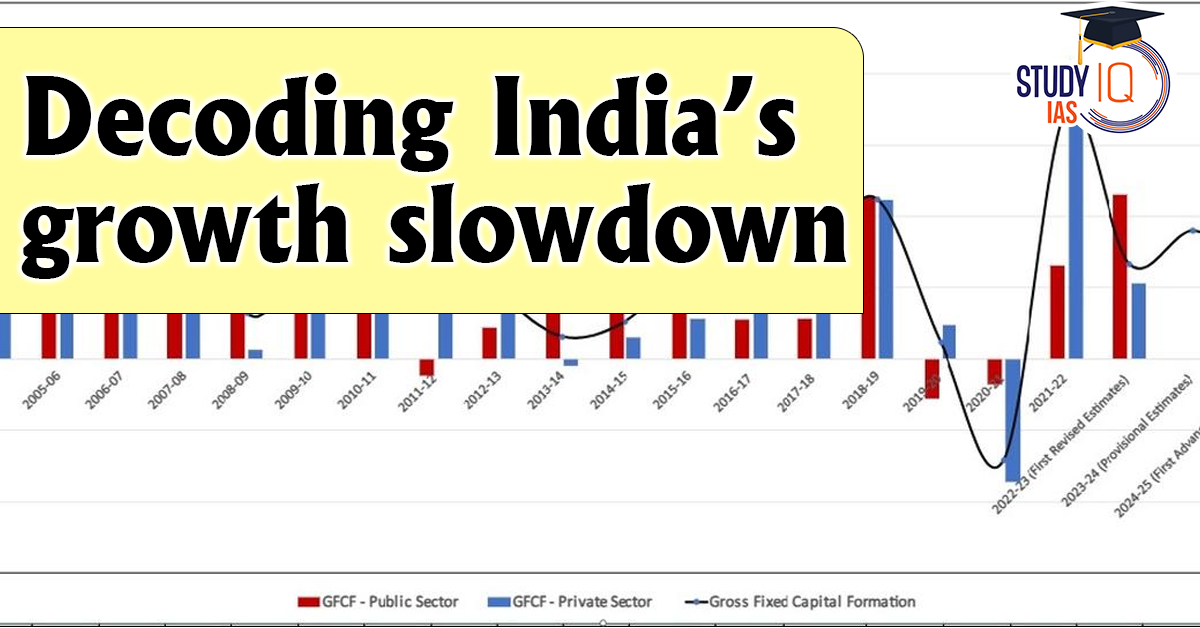

- Declining Growth in Fixed Capital Formation: Recent estimates reveal a decline in real gross fixed capital formation growth from 9% in 2023-24 to 6.4% in 2024-25, suggesting that expectations for private investment-led growth may be overly optimistic.

Sectoral Analysis and Public Spending

- Sector-Wise GVA Trends:

- Declines: Manufacturing, mining, construction, services (retail trade, transport, communications, finance).

- Growth: Public administration, defence, and other services remain strong due to public spending.

- Public Spending’s Role: The only sector projected to grow faster in 2024-25 compared to the previous year is public administration and defense services, highlighting the importance of public spending for sustaining economic growth.

Budgetary Challenges

- Monthly accounts reveal that crucial revenue and expenditure targets set in the last Union Budget are likely unachievable.

- By November 2024, net tax revenues were only 56% of the budgetary target of ₹25.83 trillion.

- This shortfall has resulted in less than half of the budgeted capital expenditure of ₹11.11 trillion being spent by November 2024.

Data Discrepancies in GDP Estimates

- Use of Deflator: The GDP deflator (weighted average of WPI and CPI) is flawed due to the volatility of WPI.

IMF Observations

- Recommended replacing WPI with Producer Price Index (PPI).

- Highlighted discrepancies in GDP by activity and expenditure.

Divergences in Inflation Rates

- WPI inflation dropped to -0.7% in 2023-24 from 4% in 2022-23, while CPI inflation stood at 5.4%.

- Resulted in a GDP deflator of only 4%, contradicting nominal and real GDP trends.

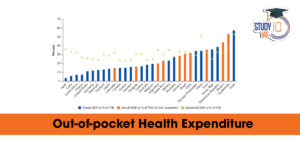

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...

Fisheries Sector in India, Current Statu...

Fisheries Sector in India, Current Statu...