Table of Contents

Context: India’s merchandise exports shrunk by 12.7% year-on-year basis in April as a result of slowing economy, inflationary setting and tighter monetary controls across the world.

More on the News

- India’s merchandise export numbers fell to $34.66 billion in April, which is a six-month low. During the same period, imports fell by 14% to $49.90 billion.

- The trend of the fall in imports and exports is not just limited to India as other countries have also recorded similar declines, indicating a slowing global demand.

Major reasons for slowdown of Global Economy

- Covid-19 pandemic: The covid-19 pandemic affected economic growth, widened fiscal deficit, disrupted supply chains and reduced manufacturing output. The aftermath of pandemic was decline in household income, increase in inflation and weak consumer sentiments.

- The Ukraine war: The crisis in Ukraine increased energy and food prices. The supply chain of vital products such as gems, fertilizers, defence, rare earth minerals etc was affected.

- Climate emergency: The existing conditions were exacerbated through climate-induced crisis, including floods, droughts, marine heatwaves, cyclones etc.

- Economic crisis in China: Recession in China has been a result of zero-Covid policy. Stringent rules have affected the nation’s real estate, manufacturing and services. This also affected global economy.

Current trends in Global Trade

- Economic slowdown: The observed trends across the world include weaker economic activities, inflation and tightening of monetary policies, disrupted supply chains due to Russia-Ukraine conflict and financial instability due to failure of financial institutions in advanced economies.

- Rise in food and energy prices: The conflict in Eastern Europe has a bearing on the prices of energy, food and commodities. Even though food and energy prices receded from their peaks, they still remain high by historical standards.

- The impact was strongest during the winter months in Europe as Russia was among the largest suppliers of energy to Europe.

- To compensate for the loss of gas shipments from Russia, Europe shifted to other suppliers, including the U.S., Qatar, Norway and Algeria.

- This led to increase in LNG prices in other countries such as Japan, where prices doubled.

- Collapse of financial institutions: Financial institutions such as Silicon Valley Bank, Signature Bank and First Republic Bank witnessed collapse. This has worsened the already precarious situation.

What could be the future economic trends?

- Recession fear in EU: The European Economic Forecast says that the region would narrowly escape the recession that had begun around September.

- Inflationary pressure in US: Even though inflation pressure in the US has moderated, it continues to run high with expectations of it receding to 2% soon looking bleak.

- Business conditions: The Global Manufacturing Purchasing Managers’ Index (PMI) indicates a marginal deterioration of business conditions, especially in manufacturing.

- International trade: In current state, the international trade (imports and exports) have fallen sharply as overall demand for goods and services stand reduced.

- The decision to postpone spending on some postponable expenditures have led to fall in exports of engineering goods, gems and jewellery, chemicals, and readymade garments and plastics.

- Low economic growth: Inflation of food and energy erodes the purchasing power of an individual. It also will affect the flow of capital to developing countries, thereby causing reduced growth.

Impact of adverse economic conditions on India

- Reduced trade with major markets: Demand from markets like the EU and the US looks bleak. To sustain the exports momentum, the government will be looking to initiate inter-ministerial talks.

- Even though merchandise exports will be affected, services exports will hold the fort.

- Imports may remain low as commodity prices and rupee value stabilizes. However, the growth in non-crude non-jewellery segment imports indicates robust domestic demand.

- Decline in investments: Weakened economic sentiments are likely to reduce the inflow of investments in India. This could have a bearing on foreign exchange.

- Inflation: Imported inflation may impact domestic economy, especially in sectors dependent on raw materials. The rise in prices of imported goods can adversely affect economic growth.

SSC CGL Exam 2025 Apply Online Starts Ap...

SSC CGL Exam 2025 Apply Online Starts Ap...

Daily Quiz 19 April 2025

Daily Quiz 19 April 2025

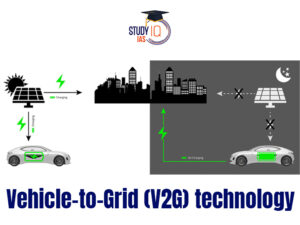

Vehicle-to-Grid (V2G) Technology and its...

Vehicle-to-Grid (V2G) Technology and its...