Table of Contents

Magnetic Resource Imaging

Context: Magnetic Resonance Imaging (MRI) was developed in the 1970s, and now has become vital in modern medical diagnostics.

Magnetic Resource Imaging (MRI): An Overview

- What is it?

- MRI is a non-invasive imaging technique used to visualise soft tissues within the body (brain, muscles, organs, etc.).

- It’s vital for diagnosing and monitoring cancer, neurological conditions, and more.

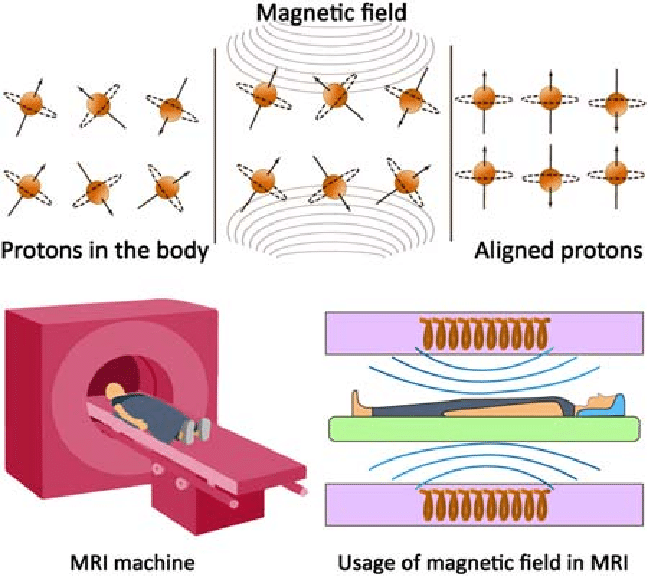

- How does it work?

- MRI utilises the magnetic properties of hydrogen atoms in the body to create detailed images of soft tissues.

- The machine consists of a superconducting magnet, a device emitting radiofrequency pulses, and a detector.

- Hydrogen atoms align with the magnetic field

- Radio pulses excite these atoms, and their energy emission upon returning to a lower energy state is detected to form images.

| Facts |

|

Pros of MRI

- MRI is non-invasive and capable of imaging various body parts including the brain, cardiovascular system, and joints.

- It is particularly useful for diagnosing conditions like cancer and neurological disorders.

- The machine can produce detailed images from multiple angles without requiring patient movement, using gradient magnets.

- MRI exploits differences in T1 relaxation times of hydrogen in water across different tissues, enhanced by contrast agents for clearer imaging.

- It is considered safe as the magnetic fields do not have long-term effects on the body, although effects on pregnant women are less studied.

Cons of MRI

- High costs: MRI machines are expensive, ranging from tens of lakhs to crores of rupees, making scans costly (often over ₹10,000 each in India).

- Physical discomfort and potential issues for claustrophobic patients due to the need to remain still in a confined space during the scan.

- Maintenance and operational costs are high due to the energy-intensive process needed to generate and maintain the strong magnetic fields.

Technical Specifications and Challenges

- MRI scans involve strong magnetic fields (around 1 tesla or more), created by passing a heavy current through superconducting wires cooled with liquid helium.

- The process is noisy due to the switching of currents in the gradient coils.

Boeing Starliner

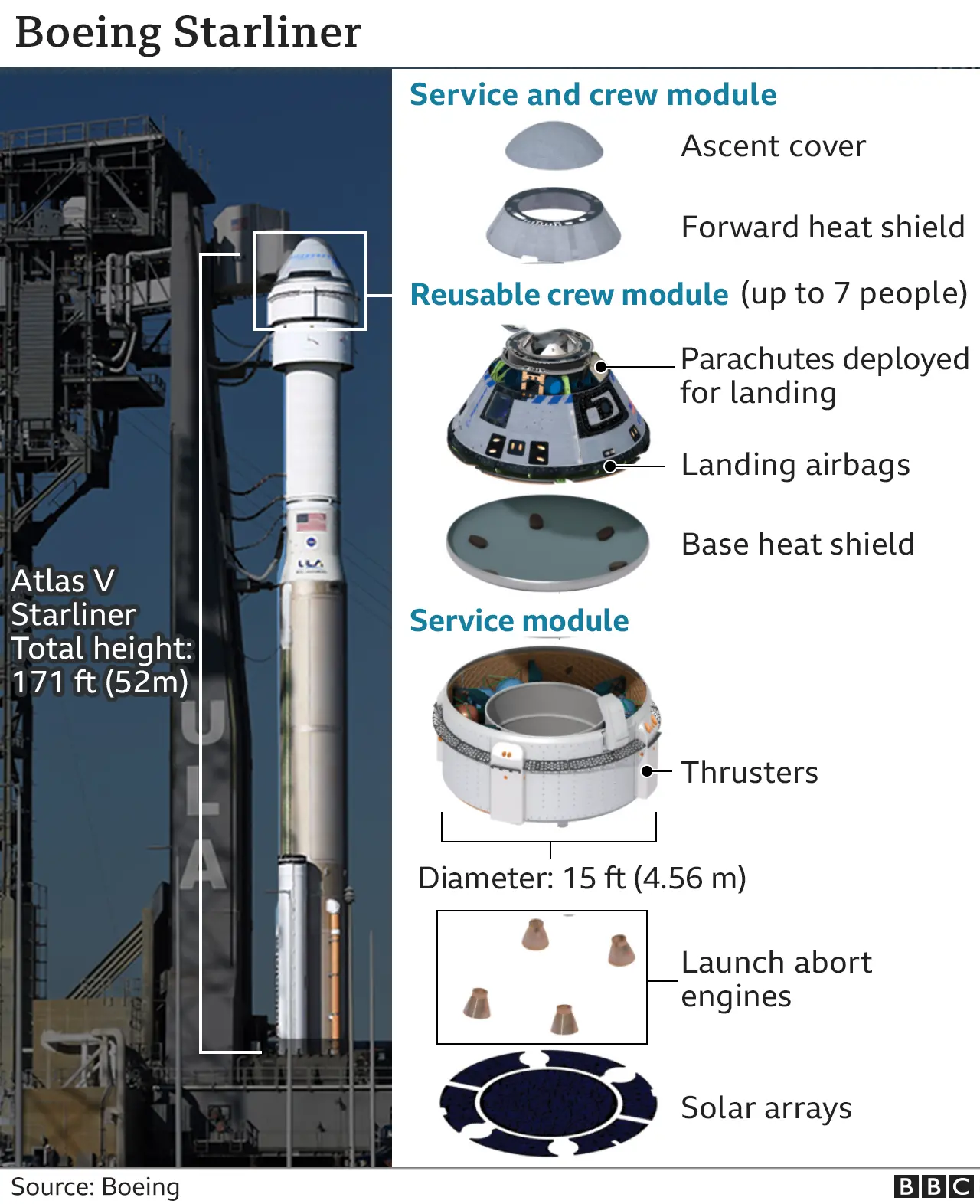

Context: Boeing’s Starliner spacecraft, carrying two NASA astronauts, will be launched by an Atlas V rocket from the Kennedy Space Center in Cape Canaveral, Florida, to the International Space Station (ISS).

About Boeing Starliner

- The Starliner(also known as CST-100 (crew space transportation)) is a partially reusable crew capsule, standing 5 metres tall and 4.6 metres wide.

- It consists of a crew module, which can house 7 astronauts but will be configured for 4 plus cargo for ISS missions.

- This module can be reused up to 10 times with a six-month turnaround.

- The expendable service module provides essential support such as electricity, propulsion, and life support systems.

- Mission Objectives:

- Primary Goal: The mission will assess Starliner’s performance in space with astronauts onboard.

- It involves docking with the ISS a day after launch for about 10 days, during which astronauts will test manual controls and various onboard systems.

- Crew: NASA astronauts Barry “Butch” Wilmore and Sunita Williams will be aboard. They will test various components, including seat functionality, life-support, navigation systems, and the cargo transfer system.

- Space Suits: The astronauts will wear blue space suits that are about 40% lighter than previous versions and feature touchscreen-sensitive gloves.

- Return: Key observations on the return will include monitoring the heat shield and parachutes’ performance, concluding with a land-based touchdown facilitated by airbags.

- Primary Goal: The mission will assess Starliner’s performance in space with astronauts onboard.

Significance of the Mission

- For NASA: Successful integration of Starliner would provide NASA with an alternative to SpaceX for crew and cargo missions to the ISS, enhancing launch flexibility and redundancy.

- For Boeing: This mission is pivotal for restoring Boeing’s tarnished reputation following recent safety and regulation troubles in its airline business. Success in this flight is vital for Boeing to secure its position in the commercial spaceflight market and compete with SpaceX.

Reasons for Delay

- After NASA retired its space shuttle fleet in 2011, it sought commercial partners to transport astronauts, selecting SpaceX and Boeing. While SpaceX has been operational since 2020, Boeing faced numerous setbacks.

- Intended for a 2015 launch, the uncrewed test was postponed to 2019 due to technical issues.

- The first uncrewed flight encountered software and hardware issues preventing it from reaching the correct orbit or docking with the ISS.

- Subsequent inspections required over 80 corrections, addressing concerns like thruster performance and cooling systems.

- Further safety issues with wiring and parachutes extended the delay.

E-rupee

Context: Governor Shaktikanta Das on Monday stated that permanent deletion of transactions can make the e-rupee or central bank digital currency (CBDC) anonymous and make it at par with paper currency.

About E- rupee

- The e-rupee is a digital form of the Indian rupee, with a one-to-one exchange ratio with fiat currency.

- The retail digital rupee will function through a digital wallet provided by participating banks, allowing users to store and manage their digital rupees on their mobile phones and devices.

- Transactions with the digital rupee can be made from person to person (P2P) or from person to merchant (P2M) using QR codes.

- It appears as a liability on the central bank’s balance sheet.

- Medium of Payment: It must be accepted as a medium of payment, legal tender, and a safe store of value by all citizens, enterprises, and government agencies.

- Convertibility: It is freely convertible against commercial bank money and cash.

- Fungibility and Accessibility: The e-rupee is a fungible legal tender that does not require holders to have a bank account.

- Cost Efficiency: It is expected to reduce the cost of money issuance and transactions.

- Issuance Authority: The Reserve Bank of India (RBI) will issue the e-rupee, which cannot be mined like cryptocurrencies such as Bitcoin.

- Interest Policy: The RBI is not in favour of the e-rupee bearing interest.

- Anonymity Levels: The RBI proposes partial anonymity, where small transactions can be anonymous, but not large transactions.

| Note: |

| It is different from cryptocurrencies like Bitcoin as it is centrally issued and regulated by the RBI, providing the stability of the Indian Rupee. |

Versions of Central Bank Digital Currency (CBDC)

- Retail CBDC:

- Accessibility: Available for use by the private sector, non-financial consumers, and businesses.

- Functionality: Acts as safe money for payment and settlement, being a direct liability of the central bank.

- Wholesale CBDC:

- Access: Designed for restricted access to select financial institutions.

- Impact: Could transform interbank settlements.

Forms of CBDC

- Token-based CBDC: Acts like a bearer instrument similar to banknotes. The holder of the tokens is presumed to be the owner.

- Usage: Preferred for retail CBDC as it mimics physical cash.

- Account-based CBDC: Requires the recording of balances and transactions of all holders, clearly indicating ownership of the monetary balances.

- Application: Considered for wholesale CBDC.

CBDC Issuance Models

- Direct Model (Single Tier): The central bank manages all aspects of the CBDC, including issuance, account-keeping, and transaction verification.

- Indirect Model (Two-Tier): The central bank issues the CBDC indirectly through intermediaries; consumers’ claims are managed by these intermediaries.

| Fact |

| The world’s first digital currency was the Sand Dollar by the Bahamas. |

Significance

- Cost Efficiency: Aims to reduce the operational costs associated with managing physical cash.

- Financial Inclusion: Enhances financial inclusion by making banking and payment services more accessible.

- Resilience and Efficiency: Improves resilience, efficiency, and innovation in the payment systems.

- Settlement and Innovation: Increases efficiency in the settlement system and fosters innovation in cross-border payments.

- Risk Mitigation: Offers the benefits of private virtual currencies without the associated risks.

- Crime Prevention: Helps combat money laundering, terror financing, tax evasion, and other illicit activities.

- Transaction Flexibility: Allows for both person-to-person (P2P) and person-to-merchant (P2M) transactions.

- Digital Tokens: Users can withdraw digital tokens from banks, store them in digital wallets, and use them for online or in-person transactions.

Examples, Data and Case Studies

- Indigenisation of Technology (GS 3): Mindgrove Technologies, a semiconductor startup incubated by IIT Madras, has launched India’s first commercial high-performance System on Chip (SoC) named Secure IoT.

- This chip, which utilises the open-source RISC-V instruction set architecture (ISA), is anticipated to enhance cost efficiency for Indian original equipment manufacturers (OEMs) developing devices with rich features.

- Climate Initiatives (GS 3): The UN Development Programme (UNDP) has launched ‘Climate Promise 2025′ – an initiative to support developing countries as they prepare their climate action plans under the Paris Agreement on climate change.

GPS Spoofing and Its Impact in India: A ...

GPS Spoofing and Its Impact in India: A ...

Amrit Gyaan Kosh Portal: A Comprehensive...

Amrit Gyaan Kosh Portal: A Comprehensive...

UpLink Initiative: Launched by World Eco...

UpLink Initiative: Launched by World Eco...