Table of Contents

Swachh Bharat Mission

Context: Recently Swachh Bharat Mission has completed 10 years of its launch.

About Swachh Bharat Mission

- Launch: on October 2, 2014

- Nodal Ministry: Ministry of Jal Shakti

- Key Objectives:

- Eliminate Open Defecation: Construction of toilets in rural and urban areas to ensure that every citizen has access to sanitation facilities.

- Solid Waste Management: Implementing scientific waste management practices to handle municipal solid waste effectively.

- Behavioural Change: Encouraging community participation through awareness campaigns and promoting cleanliness as a cultural norm.

| Achievements of Swachh Bharat Mission |

|

Swachh Bharat Mission 2.0

- Launch: on October 1, 2021

- Key Objectives:

- Achieving “garbage-free” cities by 2026.

- Ensuring 100% source segregation, door-to-door collection of waste and scientific management of all waste fractions.

- Remediation of legacy dumpsites to convert them into green zones.

| What are Legacy Waste Dumpsites? |

|

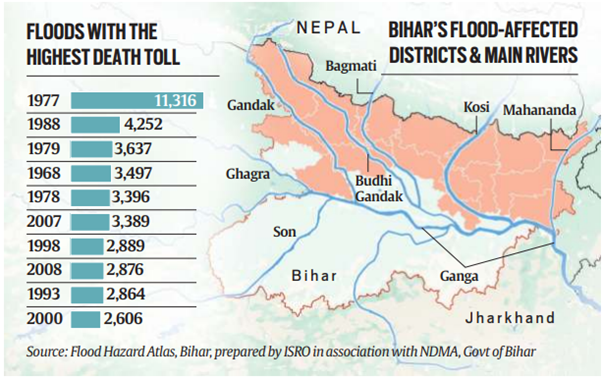

Floods in Northern Bihar

Context: Northern Bihar experienced devastating floods this year due to extremely heavy rainfall. This recurrent flooding is due to both natural geography and man-made interventions.

Why is Northern Bihar prone to floods every year ?

- Flood Management Improvement Support System classifies Bihar as ‘India’s most flood-prone region’.

- Approximately 76% of North Bihar’s population lives under the constant threat of severe floods.

- The reason for these frequent floods lies in the Geography of the region:

- Location: Bihar is located immediately south of Nepal, from where many Himalayan rivers carry a lot of soils and sediment downstream.

- Siltation: Sediment builds up in the riverbeds resulting in siltation causing overflow at the banks easily.

- River Networks: Bihar has many rivers that are fed by snow and rain, making it more vulnerable to different types of flooding.

- North Bihar is at risk of flood from 5 primary rivers during the monsoon season: Mahananda, Kosi, Bagmati, Burhi Gandak & Gandak

- Encroachment on Drainage Channels: Building on or blocking drainage channels restricts the natural flow of water, worsening flooding.

- Chaurs formation: When rivers change their course, they create saucer-shaped depressions called Chaurs, which can hold water and lead to permanent waterlogging.

| Categorisation of Floods |

|

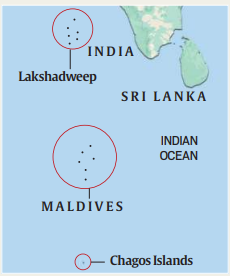

UK- Mauritius Agreement on Chagos Archipelago

Context: The United Kingdom and Mauritius have reached a historic agreement to resolve the dispute over Chagos Archipelago.

About the agreement:

- UK has ceded claims over the islands of Chagos. Now, Mauritius is free to implement the programme of resettlement on the islands of Chagos other than Diego Garcia.

- The military base at Diego Garcia will remain operational on an initial lease of 99 years.

- UK will still have sovereign rights over Diego Garcia.

Chagos Archipelago

- It comprises around 58

- Location: 500 km to the South of Maldives archipelago in the Indian ocean.

- Mauritius, which gained independence from Britain in 1968, has consistently maintained its claim over the Chagos Islands.

- In 2019, the International Court of Justice (ICJ) dismissed the UK’s right to govern the Chagos Islands and called on its government to withdraw from the archipelago.

Significance of Chagos archipelago:

- Strategic location: Britain retained sovereignty over Chagos and signed a strategic agreement with the USA in 1966 for defence purposes.

- Diego Garcia, the largest island in the archipelago became a full time operational military base in 1986.

- USA’s presence in the region: The archipelago maintains US presence in the Indian Ocean which is critical especially in the ongoing situation in West Asia.

- Global Choke Point: The island is also crucial for the USA as an outpost to monitor Malacca Strait, a global choke point vital to China.

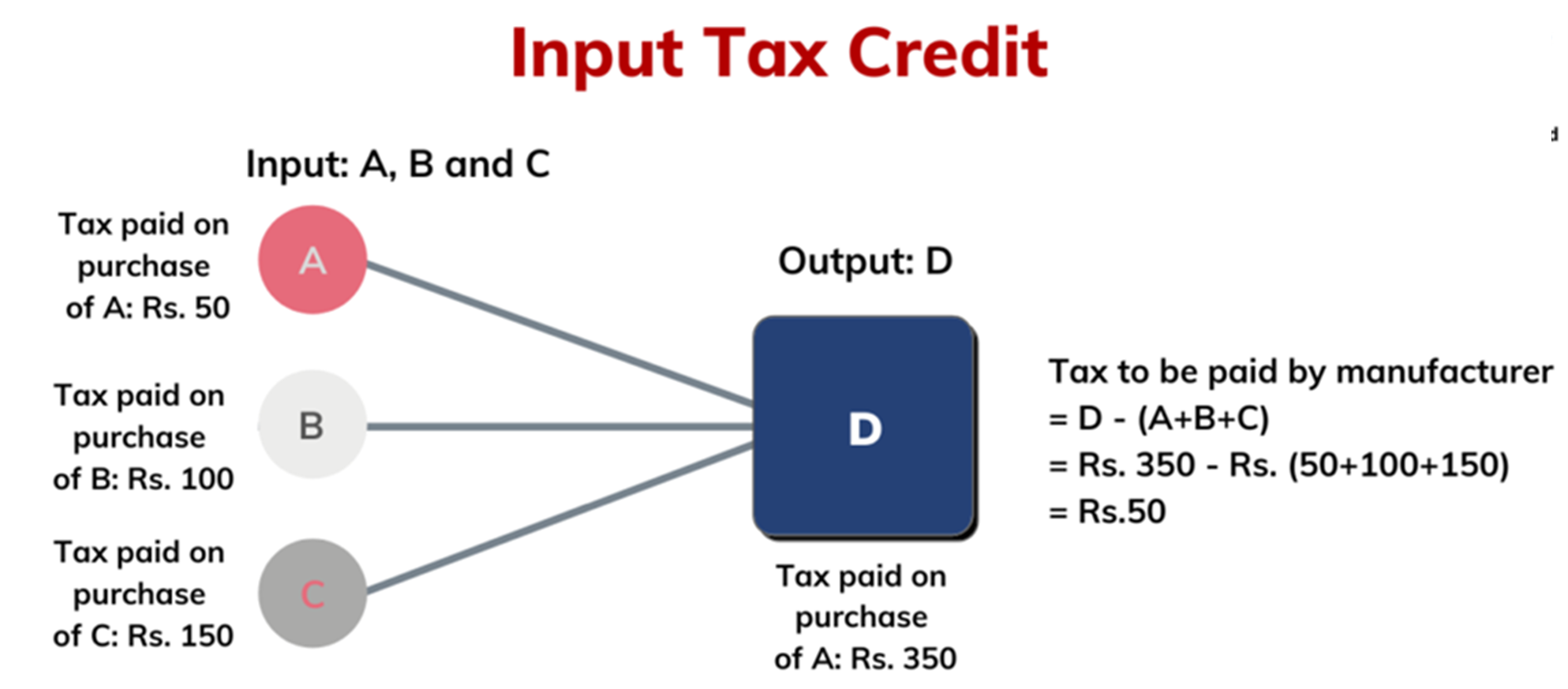

Input Tax Credit Mechanism

Context: In a recent decision Supreme Court has allowed input tax credit (ITC) on construction expenses for buildings intended for leasing.

What is Input Tax Credit Mechanism (ITC) ?

- It is a mechanism designed to prevent the cascading effect of taxes (tax on tax).

- It allows a person to deduct the tax they have already paid on the purchase of goods or services from the total tax payable on their sales.

- Exceptions:

- A business under composition scheme cannot avail of input tax credit.

- ITC cannot be claimed for personal use or for goods that are exempt.

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...

New Phase of Operation Chakra to Combat ...

New Phase of Operation Chakra to Combat ...

Soyuz Aircraft: History, Design and Sign...

Soyuz Aircraft: History, Design and Sign...