Table of Contents

Armed Groups of Myanmar

Context: The Myanmar military’s 2021 coup has led to significant political changes in the country.

Aftermath Of the Coup

- The removal of Aung San Suu Kyi led to violent resistance.

- The military’s indiscriminate use of force has further eroded its legitimacy.

- Ethnic Armed Organizations (EAOs) and resistance groups like the People’s Defence Forces (PDFs) have gained significant territory.

Key Players and Regions

- Brotherhood Alliance: Includes the Arakan Army, Myanmar National Democratic Alliance Army, and Ta’ang National Liberation Army.

- Recent Activities: Captured strategic towns, military losing control in Shan State.

- Kachin Independence Army: Seized about 70 military posts, controlling important trade routes with China.

- Arakan Army: Dominates large parts of Rakhine province and territories on the Bangladesh border, impacting the implementation of infrastructure projects like China’s Belt and Road Initiative and India’s Kaladan project.

- Ethnic Armed Organisations’ (EAOs) Agenda: EAOs refrain from declaring independence or new nation-states, possibly to avoid rallying support for the military or due to complex ethnic geographies.

- Multi-ethnic regions and overlapping homeland claims complicate the creation of new nation-states.

China’s Influence

- Dual Support: China supports both the Myanmar military and EAOs, maintaining leverage in the region.

- Military and Economic Interests: Facilitated ceasefires and supplied arms to both sides. Engages diplomatically with various Myanmar factions to protect its interests.

- Security: Responded to threats from criminal syndicates near the China-Myanmar border.

India’s Potential Role

- Federalism Expertise: India can share its experiences with federalism, institutional frameworks, and peace agreements.

- Infrastructure Initiatives: Despite challenges, India could undertake infrastructure projects in Myanmar to promote regional peace and prosperity.

Conclusion

Sustainable peace in Myanmar requires a new constitutional compact involving all stakeholders, focusing on federalism and democracy.

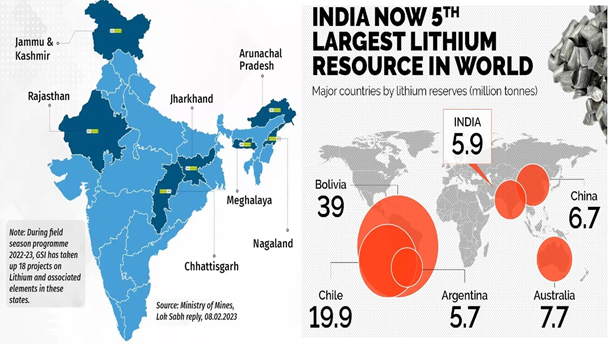

No buyers for J&Ks Lithium

Context: The Ministry of Mines cancelled the auction for the lithium block in J&K’s Reasi district for the second time due to weak investor response.

| Fact |

| In Reasi an inferred deposit of 5.9 million tonnes of lithium ore was discovered (one of the largest in the world). |

| Status of Other Lithium Deposits in India |

|

Investor Concerns

- Mining lithium from hard rock pegmatite deposits, like those in Reasi, is challenging and costly.

- India’s current mineral reporting standards, based on the UNFC, lack clarity on the economic viability of mining operations.

- Prospective bidders cited limited information in the bid documents and questioned the feasibility of extracting lithium from the identified resources.

Need for Improved Reporting Standards

- Most global mining companies use the CRIRSCO template, which requires high geological confidence and economic viability.

- Adopting CRIRSCO-aligned standards to attract private investment.

- The Indian Mineral Industry Code (IMIC), compliant with CRIRSCO, has been maintained by NACRI since 2019.

| About Lithium |

|

Why India Needs Its Own Economic Model?

Why India Needs Its Own Economic Model?

Challenges in India’s Airline Sector: ...

Challenges in India’s Airline Sector: ...

Forest Conservation Act, 1980: Objective...

Forest Conservation Act, 1980: Objective...