Table of Contents

16th Finance Commission

Context

The 16th Finance Commission (FC) of India has commenced its operations.

About the Finance Commission

- Body: It is a constitutional, independent, non-political body.

- Composition: It consists of a chairman and four other members.

- First Constituted: The First Finance Commission was constituted on April 6, 1952

- Constitutional Mandate:

- Article 280(1) of the Constitution mandates the establishment of the Finance Commission every fifth year or sooner.

- Appointed by: The President Of India

- Qualification: As prescribed by the Parliament.

- Chairman: Must have experience in public affairs.

- Other Members (4):

- High Court judge or qualified to become one.

- Specialised knowledge of government finance and accounts.

- Experience in financial matters and administration.

- Special knowledge of economics.

- Purpose: To ensure fair and equitable distribution of tax revenue between the central government (Union) and individual states.

- Functions: Article 280 (3) states that it shall be the duty of the Commission to make recommendations to the President as to:

- Tax Distribution: Recommend fair division of shared tax revenue between Union and states, and among states themselves (every 5 years).

- Grants-in-Aid: Establish principles for the Union government to provide financial assistance to states.

- Local Government Support: Advise on strengthening state finances to benefit local bodies like panchayats and municipalities.

- Financial Consultation: Offer expert advice on any financial matters referred by the President, promoting sound fiscal policies.

- Submission: Report -> President -> Parliament

- Quasi-Judicial Powers: Hold powers similar to a civil court(based on Code of Civil Procedure 1908) for summoning witnesses and accessing documents.

- Article 280(1) of the Constitution mandates the establishment of the Finance Commission every fifth year or sooner.

What are the Challenges Associated?

- Financial Allocation To Urban Areas: Despite their crucial economic role, financial allocation to urban areas remains insufficient.

- Cities are pivotal to India’s economic landscape, contributing approximately 66% of the nation’s Gross Domestic Product (GDP) and about 90% of total government revenues.

- Challenges in Fiscal Devolution to Urban Local Bodies (ULBs): Despite the constitutional mandates and the efforts of previous finance commissions since the 11th FC, the fiscal devolution to cities has been inadequate.

- Urban Local Bodies (ULBs) face a financial shortfall, which impacts city productivity and the quality of life.

- Currently, Intergovernmental Transfers (IGTs) to ULBs are merely about 5% of GDP, significantly lower than in other developing countries like South Africa (2.6%), Mexico (1.6%), the Philippines (2.5%), and Brazil (5.1%).

- Taxation Challenges Post-GST Implementation: The introduction of the Goods and Services Tax (GST) has notably reduced the tax revenues of ULBs, excluding property tax, from about 23% in 2012-13 to roughly 9% in 2017-18.

- The financial support from states to ULBs, recommended by State Finance Commissions, is also notably low, constituting only about 7% of states’ own revenue in 2018-19.

- Impact of Parallel Agencies on Local Governance: The 13th Finance Commission highlighted the detrimental effect of parallel agencies which financially and operationally weaken local governments.

- Notable programs like the Member of Parliament Local Area Development Scheme (MPLADS) and the Member of Legislative Assembly Local Area Development Scheme (MLALADS) further complicate this distortion in the federal structure.

- Outdated 2011 Census Data: The reliance on outdated 2011 Census data for fiscal devolution is increasingly problematic, especially in the absence of the 2021 Census.

- Accurate and current demographic data is crucial for the 16th FC to consider the significant urban migration and the emerging urban centres in Tier-2 and Tier-3 cities.

Recommendations for the 16th Finance Commission

- The previous guiding principles of the 15th FC, including enhancements in property tax collection and other fiscal strategies, need revisiting and updating.

- The 16th FC is encouraged to double the IGTs to urban areas to better align with the dynamic urbanisation of India.

- According to a McKinsey Global Institute report, without substantial investments, urban infrastructure deficits will exacerbate, leading to severe urban issues like water scarcity and untreated sewage problems.

Project 75I

Context

The Indian Navy’s Project-75I has completed the field evaluation trials (FET) to assess the compliance of bids.

About Project-75I

Background of India’s Submarine Projects

- Project 75 Initiation:

- Conceived in 1997 for the construction of two indigenous SSK submarines, Type 1500.

- Approved by the Cabinet Committee on Security (CCS) of the Ministry of Defence (MoD).

- Scorpene Submarine Adoption:

- In April 2001, collaboration with Thomson-CSF (TCSF) was discontinued when the Indian Navy chose to adopt the Scorpene design.

- Technology Transfer (TOT) was offered by French naval firm Armaris (now Naval Group).

- Implementation Phases:

- Phase I included constructing some submarines at Mazagon Dock Limited (MDL) under Project 75.

- Phase II aimed at additional submarines built later using indigenous capabilities.

- Financial and Operational Challenges:

- In 1999, the MoD approved a 30-year plan for 24 submarines.

- Financial constraints limited operational status to only six Kalvari-class submarines by the mid-2030s.

- Construction delays were caused by technology adoption challenges, industrial infrastructure issues, and procurement delays.

- Escalation of Costs: The project cost rose from Rs 12,609 crore to Rs 23,562 crore between 2002 and 2010 due to inflation and exchange rate variations.

- Exclusion of Indian Shipyards

- In 2013, the Indian Navy excluded Indian shipyards from Project 75 construction due to delays at MDL.

- MDL, Hindustan Shipyard, L&T, and Pipavav were shortlisted but faced reluctance due to delays in the Scorpene project.

- Strategic Partnership Policy

- Strategic Partnerships in the Defence Sector were finalised as a part of the Defense Procurement Policy (DPP) 2016.

- Foreign firms must now partner with Indian companies for major projects.

- The defence ministry has favoured a proposal to build four Project-75I submarines at Mazagon Dock, Mumbai (MDL), and the remaining two through the designated “strategic partner”.

Project-75I: Key Features and Improvements

- Project-75 (India), also known as P-75(I), is a military acquisition initiative by the Ministry of Defence (MoD).

- The initiative aims to procure diesel-electric attack submarines with fuel cells and Air-Independent Propulsion System (AIP) for the Indian Navy to build India’s naval strength and develop indigenous submarine-building capabilities.

- Project 75I succeeded Project 75, under which six Kalvari-class diesel-electric attack submarines, modelled on the Scorpene class, were constructed.

- Six submarines in this project: INS Kalvari, INS Khanderi, INS Karanj, INS Vela, INS Vagir, and INS Vagsheer.

- AIP Technology:

- Allows submarines to stay submerged for up to two weeks without surfacing.

- This greatly enhances their operational capabilities and reduces detection risk.

- Other Features:

- Advanced stealth design, including acoustic absorption.

- Long-range guided torpedoes and anti-ship missiles.

- Sophisticated sonars and sensor suites.

- Cost: In June 2021, the defence ministry issued a tender to build six conventional submarines at about Rs 43,000 crore, making it India’s largest acquisition project.

- TKMS and Spain’s Navantia are the only two bidders in the project.

- Compliance checks and evaluations of both bids are underway, with TKMS passing its field evaluation trials (FET) in March 2024.

- Navantia’s trials are expected to conclude before June.

- TKMS Submarine Design for P-75I:

- TKMS is offering a design based on its successful Class 214 and Class 212CD submarines.

- The proposed submarine will feature an angular design to minimise radar cross-section.

- TKMS’s Indian partner, Mazagon Dock Shipbuilders Limited (MDL), has started the first phase of submarine design.

- Emphasis on Indigenization and Benefits:

- Gradual Increase: The Request for Proposal (RFP) specifies an initial indigenous content (IC) of 45% in the first submarine, increasing to 60% by the sixth.

- The final design is a joint effort of TKMS and MDL.

- India will own the submarine design, including rights for future integration of indigenous equipment.

- Gradual Increase: The Request for Proposal (RFP) specifies an initial indigenous content (IC) of 45% in the first submarine, increasing to 60% by the sixth.

- Boost for MSMEs: The project will benefit both core submarine manufacturing and smaller industries supplying parts and equipment (MSMEs).

Project Nexus

Context

The Reserve Bank of India (RBI) has joined Project Nexus.

More in News

- This agreement was signed on June 30, 2024, in Basel, Switzerland.

- The Reserve Bank of India (RBI) collaborates with different countries to link India’s Fast Payments System (UPI) with other countries’ FPSs for cross-border Person to Person (P2P) and Person to Merchant (P2M) transactions.

- While bilateral connections offer benefits, a multilateral approach via Project Nexus significantly enhances the global reach of Indian payment systems.

- The Reserve Bank of India (RBI) together with ASEAN countries has decided to develop a platform designed to enable instant cross-border retail payments.

- The platform, expected to go live by 2026, is part of Project Nexus, an initiative aimed at facilitating quick cross-border retail transactions by linking various fast payment systems (FPSs).

About Project Nexus

- Development: Project Nexus is initiated by the Singapore-based Innovation Hub of the Bank for International Settlements (BIS).

- Aim: To facilitate better cross-border payments by interconnecting various national instant payment systems (IPS) across the globe.

- It marks the first BIS Innovation Hub project in the payments sector progressing towards active implementation.

- Participating Countries: Project Nexus aims to connect the FPSs of four Association of Southeast Asian Nations (ASEAN) — Malaysia, Philippines, Singapore, and Thailand and India, who would be the founding members and first mover countries of this platform.

- Recent Developments: An agreement formalising this collaboration was signed by the BIS and the central banks of the founding countries, namely Bank Negara Malaysia (BNM), Bank of Thailand (BOT), Bangko Sentral ng Pilipinas (BSP), Monetary Authority of Singapore (MAS), and the Reserve Bank of India.

- Additionally, Indonesia is slated to join the platform in the future.

- Benefits of Project Nexus:

- Standardisation of Connections: Project Nexus standardised the interconnection process between different IPSs.

- Instead of creating multiple individual links with each country, a payment system operator only needs to establish a single connection to the Nexus platform.

- Network Expansion and Efficiency: This unified connection enables a fast payment system to access all other countries in the network efficiently. Nexus has the potential to significantly expedite the proliferation of instant cross-border payments.

- Standardisation of Connections: Project Nexus standardised the interconnection process between different IPSs.

Top Quark

Context

Researchers have significantly increased the precision of the measured value of the top-quark mass.

About Top Quarks

- Top quarks are one of the six types of quarks, fundamental particles that are constituents of matter within the standard model of particle physics.

- Measuring the mass of the top quark is challenging due to its rapid decay.

- Discovery: The top quark was discovered in 1995 at the Tevatron collider in the U.S., operated by Fermilab.

- Its discovery was significant as it confirmed the three-generation model of quarks predicted by the Standard Model.

Fundamental Properties

- Mass: Heaviest of all observed elementary particles.

- Its mass is about52 GeV/c².

- This is roughly equivalent to the mass of an atom of tungsten, making it extraordinarily heavy for a subatomic particle.

- Charge: Like other quarks, the top quark has a fractional electric charge, specifically +2/3 of the elementary charge.

- Spin: It is a fermion with a spin of 1/2, which classifies it under the category of matter particles with intrinsic angular momentum.

- Stability: The top quark is extremely unstable, with a very short lifetime of about 5 x 10–25

- This instability arises because it can decay through the weak force, one of the four fundamental forces in physics.

- Significance:

- As the most massive of all quarks, the top quark plays a critical role in testing the standard model of particle physics. Its properties affect various aspects of particle physics, including corrections to other particle masses and interactions.

- Due to its unique properties, studying the top quark could lead to discoveries beyond the standard mode Anomalies in its behaviour or unexplained aspects of its interactions could indicate new physics.

- The mass of the top quark, combined with that of the Higgs boson, influences the stability of the universe.

- The parameters of these particles suggest that the universe is in a metastable state, which could theoretically decay to a more stable state with catastrophic implications, although such an event is highly unlikely within the foreseeable future.

World’s First Brain Implant for Epilepsy

Context

Oran Knowlson, a teenager from the UK, became the world’s first individual to receive a brain implant designed to manage his epileptic seizures.

About Epilepsy

- Epilepsy is a neurological condition characterised by recurrent seizures, which can manifest as jerking movements, temporary confusion, staring spells, or stiff muscles.

- These seizures are caused by abnormal electrical activity in the brain.

- In half of the cases, the cause of epilepsy remains unidentified, but it can be triggered by factors like head trauma, brain tumours, certain infections, and genetics.

- The prevalence of epilepsy in India is between 3 and 11.9 per 1,000 people, with about 30% of patients resistant to available anti-seizure medications.

First Brain Implant for Epilepsy

- The device, which utilises deep brain stimulation (DBS), has successfully reduced Knowlson’s daytime seizures by 80%.

- The neurostimulator was surgically implanted in his skull and connected to electrodes that target the thalamus, a critical area for relaying motor and sensory information in the brain.

- The device functions by delivering continuous electrical impulses to disrupt the abnormal seizure-causing signals.

- It is notable that this device is the first to be implanted in the brain rather than the chest, marking a significant advancement in DBS technology.

What is DBS?

- DBS is a medical procedure that delivers electrical impulses to specific parts of the brain to treat neurological disorders.

- Traditionally used for conditions like Parkinson’s disease, DBS has also been applied to epilepsy but typically involved placing the neurostimulator in the chest with leads extending to the brain.

- The innovation with Knowlson’s treatment is the placement of the neurostimulator directly in the skull, enhancing its effectiveness and direct impact.

Treatment Protocols and Alternatives

- The primary treatments for epilepsy include anti-seizure medications and a ketogenic diet, which is high in fats and low in carbohydrates and known to reduce seizure frequency in resistant cases.

- When these methods fail, surgical options like removing a part of the brain where seizures originate or corpus callosotomy (severing the connection between the two brain hemispheres) are considered.

- These surgeries can reduce seizure frequency by up to 90%, making them more effective than DBS, which has been shown to reduce seizures by about 40%.

Cost and Accessibility of DBS

- The cost of a neurostimulator for DBS therapy is approximately Rs 12 lakh, with total costs including surgery reaching up to Rs 17 lakh in private hospitals.

- In comparison, brain surgery costs between Rs 20,000 and Rs 30,000. Given the high cost and specific applicability, DBS is recommended primarily for patients whose epilepsy does not have a single focal point and where other treatments have failed.

Implementation at AIIMS

- At AIIMS, New Delhi, only seven out of thousands of epilepsy patients have undergone DBS therapy, approximately one per year.

- This indicates the selective use of this treatment, emphasising its role as a secondary or tertiary option after other treatments have proven ineffective.

Examples, Case Studies and Data

- Industrial Pollution (GS 3): In Kolhapur, over the last five years, there has been a 26% increase in large, medium, and small industries classified under the red category for causing significant pollution, as indicated by the Economic Survey Report presented in the state legislature of Maharashtra.

- Red category industries generate hazardous waste, which emits particulate matter, dioxides, effluents, with high pH levels, less biological oxygen demand, phenol, ammonia and its variants.

UDAN Scheme, Objectives, Funding and Ach...

UDAN Scheme, Objectives, Funding and Ach...

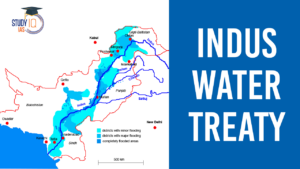

Indus Water Treaty 1960 Suspended by Ind...

Indus Water Treaty 1960 Suspended by Ind...

5 Years of SVAMITVA Scheme and Its Benef...

5 Years of SVAMITVA Scheme and Its Benef...