Table of Contents

Financial Stability Report & its key takeaways

Context: Recently, the Reserve Bank of India (RBI) released its biannual Financial Stability Report.

Key Highlights Of The Financial Stability Report

| Financial Sector Component | Details and Current Status |

| Gross NPA (GNPA) | GNPA ratio declined to a seven-year low of 5% in September 2022. |

| Capital to Risk (Weighted) Assets Ratio (CRAR) | The CRAR of 46 major banks is at 15.8%, significantly higher than the minimum requirement of 9%. |

| Performance of NBFCs | Post the second wave of Covid, the NBFC sector has shown strong recovery and continuous improvement in asset quality. |

| Financial Markets | Experiencing tightened financial conditions and heightened volatility due to multiple shocks. |

| Insurance Sector | Both life and non-life insurance companies have maintained a consolidated solvency ratio above the prescribed minimum level. |

We’re now on WhatsApp. Click to Join

Synthetic Diamonds

Context: The Directorate of Revenue Intelligence and Hong Kong Customs have uncovered a money laundering network involving diamond traders importing synthetic diamonds to India.

About Synthetic Diamond

| Aspect | Details |

| About | Diamonds created using technology that replicates the natural diamond-forming geological processes. |

| Comparison with Simulants | Diamond simulants like Moissanite, Cubic Zirconia (CZ), White Sapphire, YAG are used to mimic natural diamonds’ appearance. |

| Production Methods |

|

| Usage | Industrial Application: Widely used in machines and tools due to their hardness and strength. Ideal for use as cutters in various industries. |

| Use in Electronics: Pure synthetic diamonds are employed as heat spreaders in high-power laser diodes, laser arrays, and transistors. |

XPoSat

Context: The Indian Space Research Organisation (ISRO) put its first polarimetry mission X-ray Polarimeter Satellite (XPoSat) in a precise circular orbit of 650 km after a 21-minute flight.

What is XPoSat?

- India’s first mission dedicated to studying the polarisation of X-rays from celestial sources.

- Operates: In the medium frequency band and is designed to observe polarised X-rays from various astronomical sources.

- Aim: The mission aims to observe and study polarised X-rays from various celestial sources, including magnetars, black holes, and neutron stars, helping scientists to better understand the nature of these radiations and the processes involved in their generation.

- Duration: XPoSat has an estimated mission life of approximately five years, during which it will conduct observations from a low earth orbit of about 650 km.

Payloads Used in XPoSat

- Indian X-ray Polarimeter (POLIX): The world’s first instrument for medium X-ray band (8 to 30 keV) observations.

- It includes a collimator and a scatterer with four X-ray proportional counter detectors, primarily observing tens of astronomical sources.

- X-ray Spectroscopy and Timing (XSPECT): Designed for fast timing and high spectroscopic resolution in the soft X-ray band (0.8-15 keV), observing a variety of sources such as X-ray pulsars, black hole binaries, neutron stars, AGNs, and magnetars.

Significance of XPoSat

- XPoSat represents a significant advancement in astronomical studies by enabling X-ray polarisation measurements in the medium energy band (8-30 keV), a range not extensively explored before.

- This capability allows for a more detailed and nuanced understanding of celestial X-ray sources.

What is Polarisation of X-rays?

- Polarisation of X-rays refers to the orientation of X-ray waves in a particular direction, which occurs when X-rays interact with strong magnetic fields or material around black holes.

- Studying polarisation provides insights into the nature and processes of X-ray emitting sources.

XPoSat Compared with Global X-ray Experiments or Missions

- While there have been a few X-ray polarisation missions globally, such as NASA’s HX-POL and XL-Calibur, and the Imaging X-ray Polarimetry Explorer (IXPE), XPoSat stands out by offering expanded observational capabilities in the medium X-ray band (8 to 30 keV).

- It complements IXPE’s observations in the soft X-ray band (2 to 8 keV) and fills a gap in the global understanding of X-ray polarimetry.

Maulana Azad Scholarship

Context: Research students have raised concerns about the disparity in scholarship amounts under the Maulana Azad National Fellowship (MANF) compared to other research fellowships.

About Maulana Azad Scholarship

| Aspect | Details about Maulana Azad National Fellowship (MANF) |

| Objective | To support students from minority communities in pursuing M.Phil. and Ph.D. |

| Launch | Launched by the Ministry of Minority Affairs, Government of India |

| Eligibility | Students from minority communities (Muslims, Sikhs, Christians, Buddhists, Zoroastrians, Jains) who have cleared CBSE/NTA-UGC NET or CSIR NET |

| Financial Assistance | Covers university fee, maintenance allowance, and other necessary expenses; granted for up to 5 years |

| Administration | Managed by the Ministry of Minority Affairs with the University Grants Commission (UGC) as the nodal agency |

| Selection Process | Based on the JRF-NET (Junior Research Fellow- National Eligibility Test) examination |

| Purpose and Impact | Aims to promote higher studies and research in various fields for the educational and socio-economic development of minority communities |

Donkey Route

Context: Recently a Bollywood movie “Dunki” highlights the prevalence of illegal migration through the “donkey route”.

About Donkey Route

- The “donkey route” is a term for the journey migrants take through Latin American countries to reach the US border.

- This journey often begins in countries such as Ecuador, Bolivia, or Guyana, known for their relatively easier visa processes for Indian citizens.

- Travellers face the treacherous Darién Gap, a forested region between Colombia and Panama, known for its challenges including scarce clean water, dangerous wildlife, and criminal gangs.

- After Panama, the route typically passes through Guatemala and into Mexico, with migrants confronting obstacles like fence jumping and river crossings, including the Rio Grande.

- The journey can cost between Rs 15 lakh to Rs 70 lakh, involving dealings with human trafficking rings.

- Indian agents work in conjunction with traffickers throughout the route to facilitate the journey to the US.

- Despite the inherent risks and dangers, many migrants undertake this hazardous journey driven by the hope of achieving the American Dream.

Growth in Property Tax

Context: Over the past three years, about 70% of India’s 4,900 urban local bodies (ULBs) have reported an increase in property tax collection.

Recent Developments in Urban Local Bodies’ Property Tax Collections and Reforms

- Central Funding and Tax Reform: Over Rs 1 lakh crore in Central funding is tied to property tax reform, with 3,086 ULBs across 22 states showing increased property tax collection in 2022-23 in line with their state’s five-year GSDP growth rate.

- Finance Commission Recommendations: The 15th Finance Commission recommended Rs 1,21,055 crore for ULBs over five years (up to 2025-26).

- So far, Rs 21,791 crore has been allocated for this financial year, with Rs 5,705 crore already disbursed.

- Annual Increase in Tax Collection: In 2022-2023, 3,417 out of 4,771 ULBs reported an increase in property tax collection over the previous year.

- Major Cities Reporting Increases: 40 out of the 50 cities with a population over 1 million, such as Mumbai, Chennai, and Hyderabad, have reported increased property tax collection.

- Overall Impact of Reforms: Significant changes in property tax reforms since 2020, with over Rs 1 lakh crore at stake under various schemes and incentives.

- RBI Report on Municipal Corporations: From 2017-2018 to 2019-2020, municipal corporations’ own revenue, including property tax, comprised 31-34% of their total revenue.

- However, several issues like poor enforcement and outdated exemptions have led to under-recoveries.

- MoHUA-Jaanagraha Toolkit: A 2021 toolkit released by MoHUA and Jaanagraha highlighted that while property tax is a major revenue source, collections are far below potential, aiming to reach Rs. 40,000 crores in 2024 from approximately Rs. 20,000 crores.

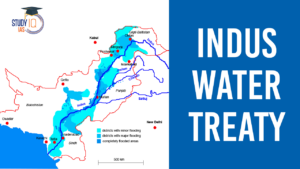

Indus Water Treaty 1960 Suspended by Ind...

Indus Water Treaty 1960 Suspended by Ind...

5 Years of SVAMITVA Scheme and Its Benef...

5 Years of SVAMITVA Scheme and Its Benef...

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...