Table of Contents

India’s Largest Leopard Safari

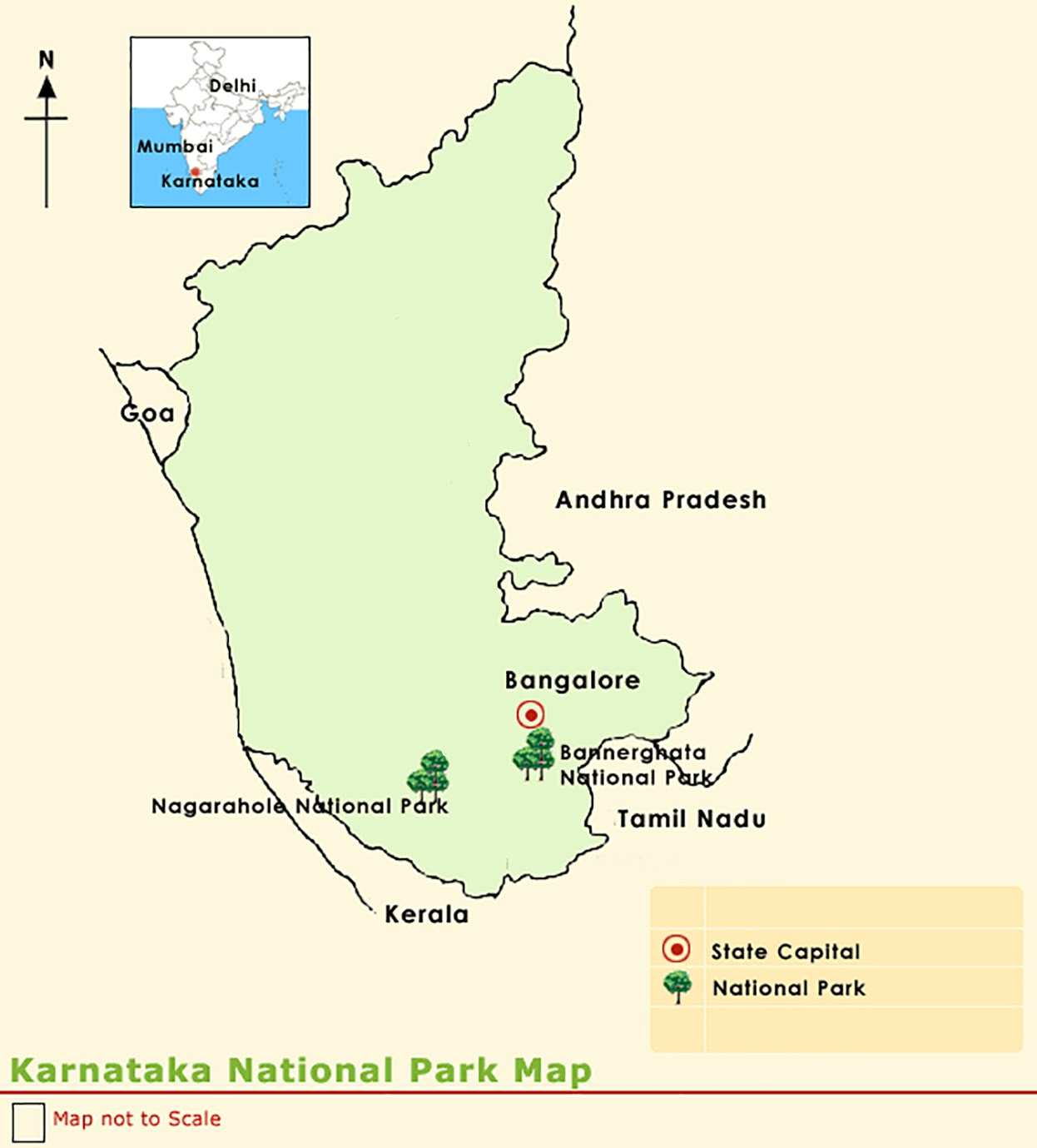

Context: The country’s largest leopard safari (South India’s First) was inaugurated by the Forest, Ecology and Environment Minister at the Bannerghatta Biological Park (BBP), Karnataka.

More in News

- The safari spans 20 hectares with eight leopards released in a natural forest setting.

- Aimed at highlighting leopards and addressing human-animal conflict, the park rescues leopard cubs for educational purposes.

- Additionally, new facilities include a renovated elephant weaning centre, babycare room, children’s play area, and electric buggies.

Bannerghatta Biological Park

- The Bannerghatta Biological Park has been an integral part of Bannerghatta National Park and emerged as an independent establishment during the year 2002.

- The Park is dedicated to supporting national efforts to preserve rich biodiversity and United Nations Sustainable Development Goal 15(Life on Land) in order to fulfil the objective of the National Zoo Policy of 1998.

About Bannerghatta National Park

- Location: It is located near Bangalore, Karnataka, in the hills of the Anekal range.

- Establishments:

- National Park Declaration: 1974

- Biological Reserve Establishment: 2002

- Elephant Sanctuary: First in India with a fenced forested area

- Butterfly Enclosure: Inaugurated in 2006, India’s first.

- River: Suvarnamukhi River runs through the park.

- Vegetation Types:

- Dry Deciduous Scrub Forests

- Southern Tropical Dry Deciduous Forests

- Southern Tropical Moist Mixed Forests

- Flora: Narcissus latifolia, Schleichera oleosa, Sandalwood, Neem, Tamarind, Bamboo, Eucalyptus

- Fauna: Endangered Asian Elephant, Indian Gaur, Tiger, Sambar Deer, Spotted Deer, Leopard, Wild Dog, Wild Pig, Sloth Bear, Common Mongoose, Pangolin, Slender Loris, Black-naped Hare.

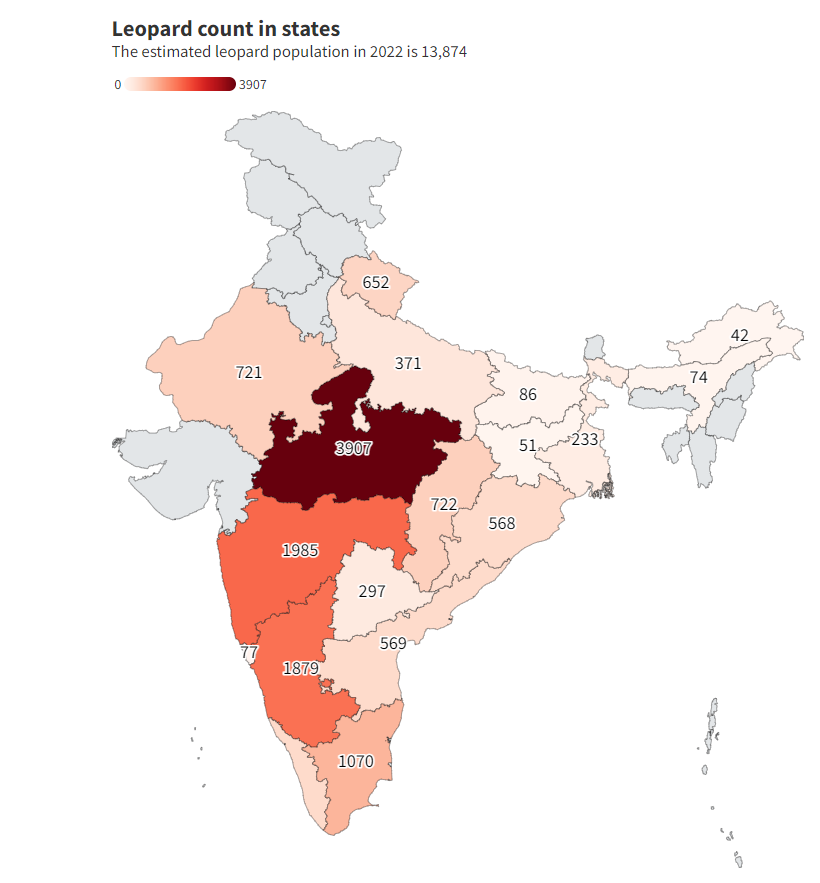

| Status of Leopard In India 2022 |

About the Leopard

|

Government Bonds in JP Morgan Index

Context: Inclusion of Indian Government Bonds (IGBs) in JP Morgan’s emerging markets bond indices will begin shortly.

More in News

- The inclusion process will be spread over 10 months, concluding on March 31, 2025.

- Estimates suggest an inflow of $20-25 billion into India as a result of this inclusion.

- Increased inflows are anticipated to bolster India’s foreign exchange reserves and strengthen the rupee, but may also introduce inflationary pressures.

- 23 IGBs are eligible, all under the Fully Accessible Route (FAR), with a combined notional value of about Rs 27 lakh crore ($330 billion).

Inclusion Criteria and Process

- Criteria for Inclusion: Eligible bonds must have a notional outstanding above $1 billion and at least 2.5 years remaining maturity.

- Eligibility Date: Only FAR-designated IGBs with a maturity date post-December 31, 2026, will be considered starting June 28, 2024.

- Additional Inclusions: Any new FAR-designated IGBs issued during the phase-in will also be included.

India’s Weight in the Index

- Maximum Weight: India is expected to reach a maximum weight of 10% in the GBI-EM Global Diversified Index (GBI-EM GD).

- Implications: A higher weighting in the index is likely to lead global investors to allocate more funds for investment in Indian debt, with projected monthly flows of $2 billion to $2.5 billion.

Economic Implications and Management

- Management of Inflows: The Reserve Bank of India (RBI) will utilize various instruments to manage the potential inflationary pressures due to increased dollar inflows.

- RBI’s Preparedness: RBI Governor Shaktikanta Das has indicated that the central bank is prepared to handle the surge in flows, similar to past instances.

Additional Global Index Inclusion

- Bloomberg’s Announcement: In March, Bloomberg announced the inclusion of Indian government bonds in the Bloomberg Emerging Market (EM) Local Currency Government Index from January 31, 2025.

- Scope of Inclusion: The inclusion will extend to related indices, such as the Bloomberg EM Local Currency Government Index 10% Country Capped Index and its sub-indices.

- Initial Weight in Bloomberg Indices: Indian FAR bonds will initially weigh 10% of their full market value in these indices.

Broader Economic Context

- Current Account Balance: As of the January-March 2024 quarter, India recorded a current account surplus of $5.7 billion, or 0.6% of GDP, a significant improvement from a deficit of $1.3 billion in the same quarter the previous year.

- Rating Agency’s View: Fitch Ratings noted that the inclusion of Indian sovereign bonds in key indices would diversify the investor base for Indian securities, potentially lower funding costs, and support the development of domestic capital markets, though immediate effects on India’s credit profile are expected to be marginal.

Case for a Food Buffer Policy

Context

- In May, the consumer price index (CPI) revealed inflation rates of 8.69% for cereals and a significantly higher 17.14% for pulses.

- These rates might have been higher without the intervention from buffer stocks, particularly wheat and chana, which government agencies built up during years of surplus production.

Role of Buffer Stocks

- Buffer stocks played a crucial role in mitigating the inflation rates.

- For instance, in the fiscal year 2022-23, the Food Corporation of India (FCI) released 34.82 lakh tonnes (lt) of wheat from its stocks to the open market.

- This amount increased to a record 100.88 lt in the following fiscal year.

- These sales included flour processed and sold under the ‘Bharat Atta’ brand at a maximum retail price of Rs 27.5/kg.

- This intervention helped bring down retail inflation in cereals and wheat from their peaks of 16.73% and 25.37% respectively in February 2023 to 8.69% and 6.53% in May 2024.

Chana Buffer Stock Role

- Price Stabilisation: Buffer stocks of chana were crucial in moderating the sharp rise in pulse prices, which have been in double digits since June 2023.

- Market Prices vs. MSP: The National Agricultural Cooperative Marketing Federation of India (NAFED) purchased large quantities of chana at the government’s minimum support price (MSP) during the 2021-22 and 2022-23 bumper crop years. These purchases were made when market prices were significantly lower than the MSP.

- Current Stock and Usage: As of July 1, 2023, NAFED held 37.21 lakh tonnes of chana, utilising these stocks to stabilise prices amid poor crop yields influenced by an El Niño-induced patchy monsoon.

Challenges and Solutions in Food Price Management

- Current Government Measures: To control food prices, the government often restricts exports or imposes stock limits on traders and processors.

- Proposed Sustainable Solution: Creating a buffer stock of all essential food items could provide a more sustainable solution.

- Mechanism of Buffer Stocks: Procure food items during years of surplus and release them during shortages to help stabilise market prices.

Potential Expansion of Buffer Stocks

- Current Procurement Focus: Government agencies primarily procure rice, wheat, a few pulses, and oilseeds.

- Expansion Opportunities: There is potential to expand procurement to staple vegetables and skimmed milk powder (SMP).

- Storage and Sales Strategy: Vegetables like onions, potatoes, and tomatoes could be stored in dehydrated or processed forms and sold to institutional buyers, preventing price spikes during shortages.

Fiscal Implications and Benefits

- Cost Effectiveness: The fiscal cost of maintaining buffer stocks is manageable since these commodities are intended to be sold at near-market prices during periods of inflation, not given out for free.

- Price Stability Role: This strategy could help curb excessive volatility in food prices, akin to how the RBI uses foreign exchange reserves to stabilise the currency market.

- Necessity Due to Climate Impacts: With increasing climate-driven price volatility, establishing a robust food buffer policy is increasingly vital to protect both consumers and producers.

| About National Agricultural Cooperative Marketing Federation of India Ltd.(NAFED) |

About the Food Corporation of India (FCI)

|

Examples, Case Studies and Data

- Cases related to Freedom Of Religion (GS 2): The Bombay High Court recently rejected a petition from nine students of NGAcharya & DK Marathe College in Chembur, who were contesting the college’s dress code that prohibits wearing the hijab.

- The court maintained the college’s policy, stating it was in the “larger academic interest.” This decision is consistent with a 2022 Karnataka High Court ruling that upheld the hijab ban in state-run colleges.

Bihar Assembly Election 2025 Dates, Poli...

Bihar Assembly Election 2025 Dates, Poli...

Bharat Bandh 9 July 2025: Over 25 Crore ...

Bharat Bandh 9 July 2025: Over 25 Crore ...

Sukhoi Su-57: Will India Choose Russia�...

Sukhoi Su-57: Will India Choose Russia�...